Self Employed Tax Rates Australia, Australian Tax Return Tax Returns Are Easy At Etax Etax Com Au

Self employed tax rates australia Indeed recently is being sought by users around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of the post I will talk about about Self Employed Tax Rates Australia.

- What S The Difference Between Australian And Foreign Tax Residents Nestegg

- Taxes In Japan

- Here S Everything You Need To Know About The Crb Including How It Will Affect Your Taxes Financial Post

- Opening A Bank Account And The Tax System In Australia Internations Go

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctb1s5h4sh4bsp8hp6gxxia5eiavlie9 Hx352v8mxg3rc55pxv Usqp Cau

- Australian Government Small Business Stimulus Relief Package Small Business

Find, Read, And Discover Self Employed Tax Rates Australia, Such Us:

- Freelance Tax In Spain For Self Employed Expats Expatica

- Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

- New Zealand Outstrips Australia Uk And Us With 12 Billion Coronavirus Package For Business And People In Isolation

- Your Budget For Businesses Budget 2019 20

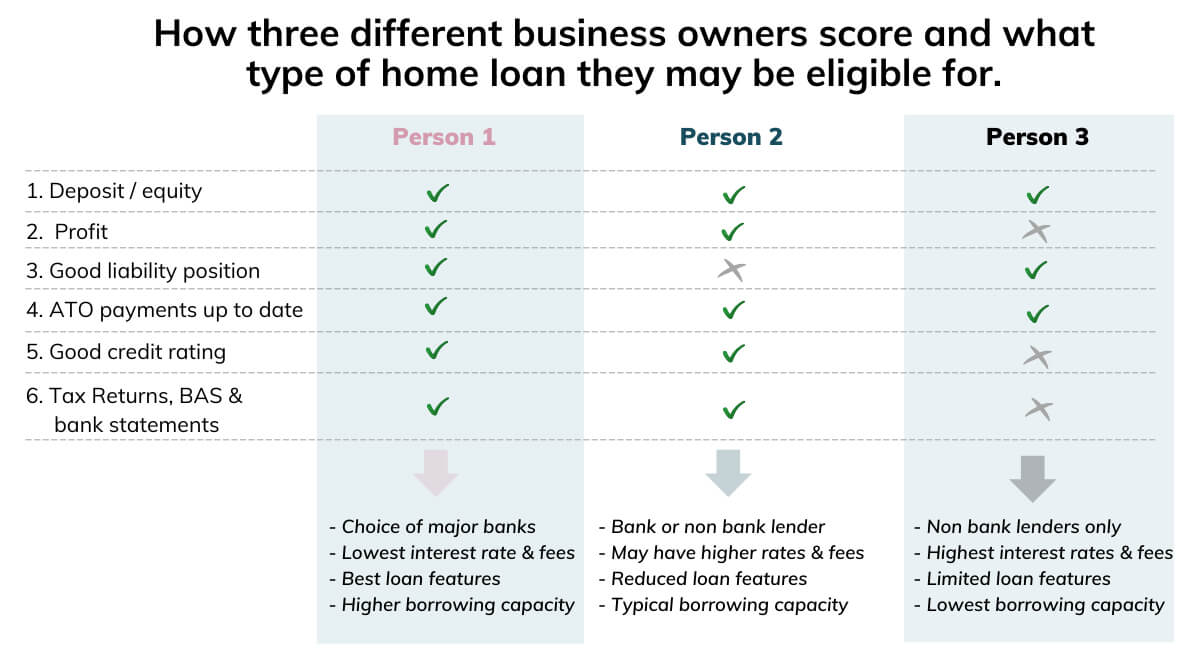

- Self Employed Home Loans Eligibility Application Guide 2020

If you are searching for Government Spending Definition you've come to the perfect location. We have 104 graphics about government spending definition adding images, pictures, photos, wallpapers, and more. In such page, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Tax free threshold the tax free threshold is applied to the first 18200 of income for australian residents.

Government spending definition. If you need help applying this information to your personal situation phone us on 13 28 61. If youre self employed that is a sole trader or a partner in a partnership you dont have to make super contributions to a super fund for yourself. Who we are campaign successes current campaigns.

Self employed australia does not provide tax financial legal or other professional advice. Its important to obtain expert legal advice before establishing a business or starting work as a self employed person in australia. Gst is 10 tax placed on most goods and services sold in australia.

There is no tax free threshold for companies you pay tax on every dollar the company earns. You may be paid cash in hand directly into your bank account or in another way. As a sole trader you.

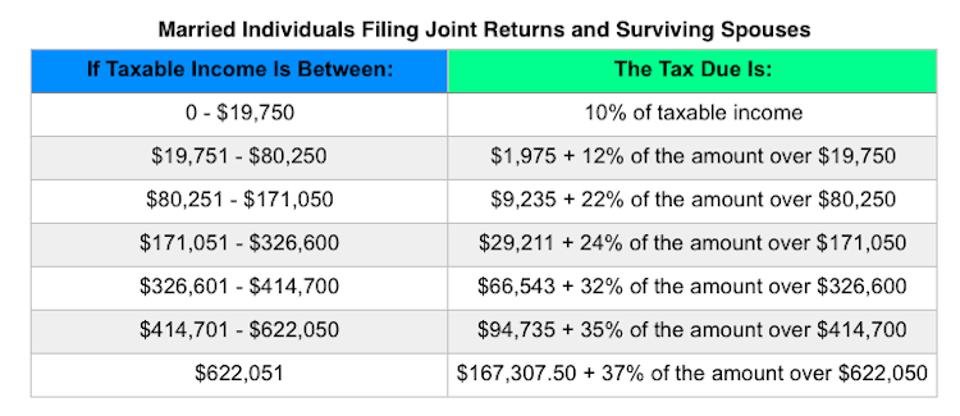

A sole trader business structure is taxed as part of your own personal income. Report all your income in your individual tax return using the section for business items to show your business income and expenses there is no separate business tax return for sole traders. These rates show the amount of tax payable in every dollar for each income bracket for individual taxpayers.

Not all sole traders need to register for and pay gst but in general if you earn over 75000 per financial year or drive taxis its mandatory. The full company tax rate. Even if you make 200000 or more the first 18200 is tax free.

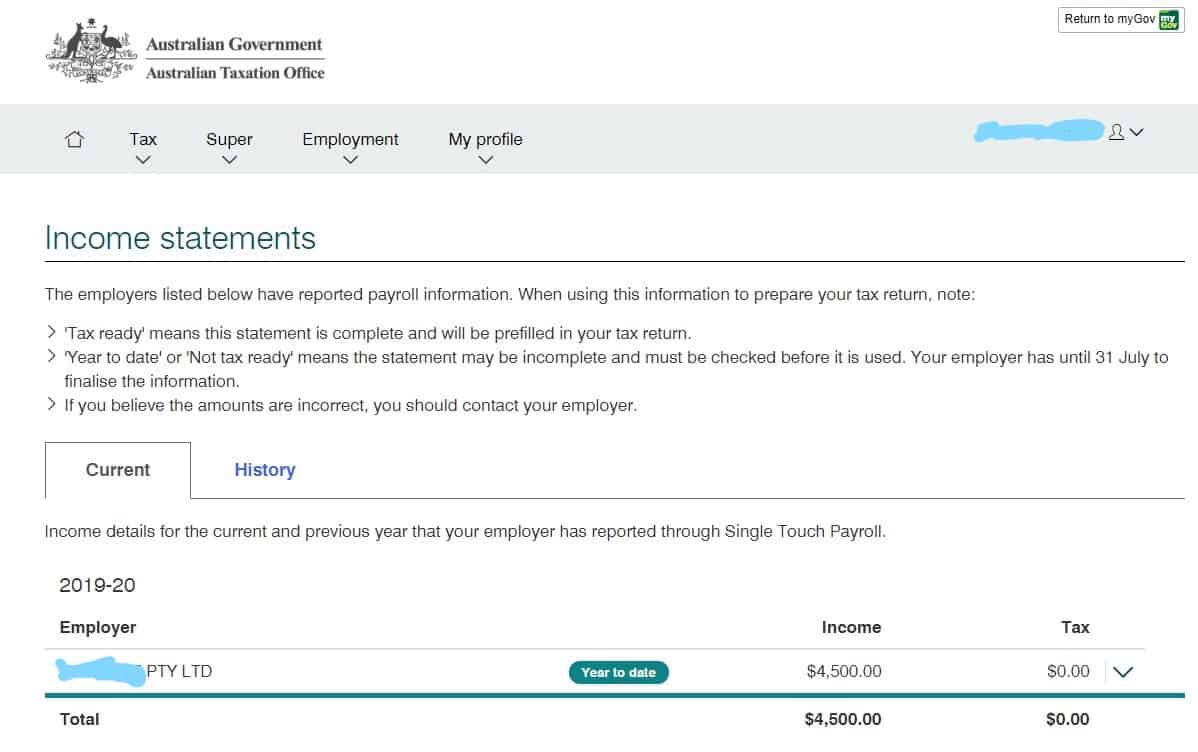

Use your individual tax file number when lodging your income tax return. Your fund can only accept personal contributions from you if it has your tax file number. 15 oct 2020 qc 16218.

Not surprisingly some 90 percent of. Employment income is money you receive from working. Video tax tips on atotv external link.

You need to make sure you include all your employment income on your tax return regardless of whether you have one job or more are full time part time or casual. If you earn over 75000 or drive a taxi you will need to register for gst. Like everything to do with tax law the regulations applying to the self employed are complicated and time consuming and are estimated to cost some 7bn a year in lost time.

In australia businesses are required to charge a 10 tax on most goods and services sold in australia to australian companies or individuals. We seek to understand members situations and make referrals to our partner outsourced self employed specialist lawyers accountants insurance brokers and other. Individual income tax rates for prior years.

When calculating your taxable income as a sole trader you will exclude any gst charged on your earnings as these will be reported in your regular business activity statement bas.

More From Government Spending Definition

- Uk Furlough Scheme Basics

- Supreme Student Government Ssg Logo Design

- Government Decree Definition

- Difference Between Similarities Of Government And Governance Venn Diagram

- Up Government Job Vacancy 2020 In Hindi

Incoming Search Terms:

- How Much Should You Budget For Taxes As A Freelancer Up Government Job Vacancy 2020 In Hindi,

- Your Budget For Businesses Budget 2019 20 Up Government Job Vacancy 2020 In Hindi,

- Https Www Ato Gov Au Uploadedfiles Content Spr Downloads Spr38466factsheet Pdf Up Government Job Vacancy 2020 In Hindi,

- 2 Up Government Job Vacancy 2020 In Hindi,

- At A Glance Treasury Gov Au Up Government Job Vacancy 2020 In Hindi,

- Taxation Our World In Data Up Government Job Vacancy 2020 In Hindi,