Self Employed Wage Subsidy Tax, Employment Wage Subsidy Scheme Ewss Documentation Thesaurus Payroll Manager Ireland 2020

Self employed wage subsidy tax Indeed lately has been sought by users around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of this post I will discuss about Self Employed Wage Subsidy Tax.

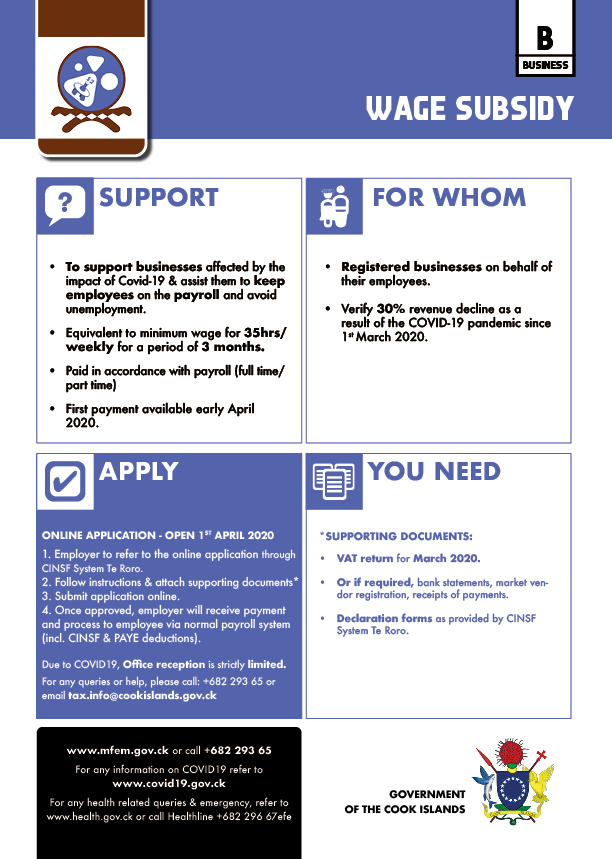

- Wage Subsidy Wikipedia

- Prime Minister S Update On Covid 19 Joint Economic Development Initiative Facebook

- Coronavirus Crisis Your Financial Rights Financial Times

- Job Seeker To Job Keeper Australia S Wage Subsidy Pagetitlesuffix

- Government Help For Sole Traders Business Govt Nz

- Tax Treatment Of The Wage Subsidy Employers Bdo Nz

Find, Read, And Discover Self Employed Wage Subsidy Tax, Such Us:

- Covid 19 Wage Subsidy Jobkeeper Payments Myob Essentials Accounting Myob Help Centre

- Subsidy Wikipedia

- Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

- Accounting Treatment Of The Wage Subsidy Bdo Nz

- Eugenie Sage On Twitter We Know People On The Lowest Incomes Will Be Among Those Worse Affected By Covid 19 Changes To Benefits And Doubling Winter Energy Payments Will Give Those That Need

If you re looking for Self Employed Electrician Jobs you've come to the right location. We ve got 104 images about self employed electrician jobs adding images, pictures, photos, backgrounds, and more. In these page, we also have number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Business owners could be shareholder employees or self employed.

Self employed electrician jobs. The number of people who now file a self assessed tax return has shot up by 112000 in the last five years. In accordance with item 5 of paragraph 1 of article 17 of the law on personal income tax the subsidy granted by the employment service to self employed persons shall be considered as non taxable income and the subsidy to persons with individual activity certificates shall be considered as non taxable income too. There is an issue about whether the wage subsidy received by a self employed person is taxable in the year it is received or spread over the 12 week period.

Many self employed people will receive the wage subsidy in the 2020 tax year but in most cases only 1 or 2 weeks of it relates to the 2020 tax year. There are no gst implications in relation to the wage subsidy it is exempt from gst. Some 730000 were expected to file a tax return last year according to taxback.

Under ita a self employed person who is unincorporated is not an employee and it would appear that such a person cannot qualify for this subsidy. On wage subsidies being exempt from taxes for employers under the jobs support scheme and for people who received payouts under the self employed person income relief scheme. From a tax perspective the wage and leave subsidy are not subject to income tax or gst how do i code this to ensure i do not pay gst or income tax in error.

Covid 19 wage subsidy issues for self employed if youre self employed and get the covid 19 wage subsidy find out about the tax you may have to pay. The payment is also a taxable receipt for the self employed shareholder employees partners in a partnership and sole traders. Does this result in different accounting coding.

More will also be. The wage subsidy when received by a self employed person is not liable for acc under section 14 of the acc act 2001. While the receipt of the wage subsidy is exempt income to an employer if the recipient of the wage subsidy is a self employed person then this should be treated as a payment for loss of income and this amount should be included as taxable income in the relevant tax return.

The subsidy is applied to eligible remuneration which is defined as salary or commissions from which income tax withholdings were taken during the baseline period from january 1 to march 15.

More From Self Employed Electrician Jobs

- Self Employed Sick Pay Covid

- Self Employed Professional Meaning In Malayalam

- Types Of Government Anarchy

- Furlough Extension Uk Gov

- China Government Debt To Gdp 2019

Incoming Search Terms:

- Tax And The Pandemic Unemployment Payment Your Questions Answered China Government Debt To Gdp 2019,

- Pdf Coping With Crises Policies To Protect Employment And Earnings Semantic Scholar China Government Debt To Gdp 2019,

- Does The Temporary Wage Subsidy Affect Me 2020 Turbotax Canada Tips China Government Debt To Gdp 2019,

- Https Ec Europa Eu Social Blobservlet Docid 20431 Langid En China Government Debt To Gdp 2019,

- 1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary China Government Debt To Gdp 2019,

- Coronavirus Covid 19 Sme Policy Responses China Government Debt To Gdp 2019,

/Articles/Tax-Treatment-of-the-Wage-Subsidy-%E2%80%93-Self-Employed/1-tax.jpg.aspx?lang=en-NZ)

/Articles/Accounting-Treatment-of-the-Wage-Subsidy-%E2%80%93-Self-Em/1.png.aspx?lang=en-NZ)