Government Revenue Tax Supply Demand, How To Calculate Excise Tax And The Impact On Consumer And Producer Surplus Youtube

Government revenue tax supply demand Indeed lately is being sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of this article I will talk about about Government Revenue Tax Supply Demand.

- 1 3 Government Intervention Indirect Tax By Ibeconomist Com

- Deadweight Loss Examples How To Calculate Deadweight Loss

- Worthwhile Canadian Initiative The Impact Of Tax Cuts On Government Revenues

- Taxation Our World In Data

- Effects Of Taxes

- 4 7 Taxes And Subsidies Principles Of Microeconomics

Find, Read, And Discover Government Revenue Tax Supply Demand, Such Us:

- Solved 3 Relationship Between Tax Revenues Deadweight L Chegg Com

- Https Www Ssc Wisc Edu Ekelly Econ101 Answerstohomework3fall2016 Pdf

- Cigarette Tax

- Excise Tax

- Answered The Government Is Considering Levying A Bartleby

If you re searching for Self Employed Kiwisaver Calculator you've reached the right location. We have 104 graphics about self employed kiwisaver calculator including pictures, pictures, photos, backgrounds, and more. In these web page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

1 show supply demand with an equilibrium price a.

Self employed kiwisaver calculator. On the following graph use the green rectangle triangle symbols to shade the area that represents tax revenue for concert. A higher tax on a good shifts supply to the left causing higher price and less demand. However if the government spend the tax revenue overall aggregate demand ad will not be affected.

Ap is owned by the college board which does not endorse this site or the above review. Price multiplied by quantity at this point is equal to revenue. Updated september 26 2017 a firms revenue is where its supply and demand curve intersect producing an equilibrium level of price and quantity.

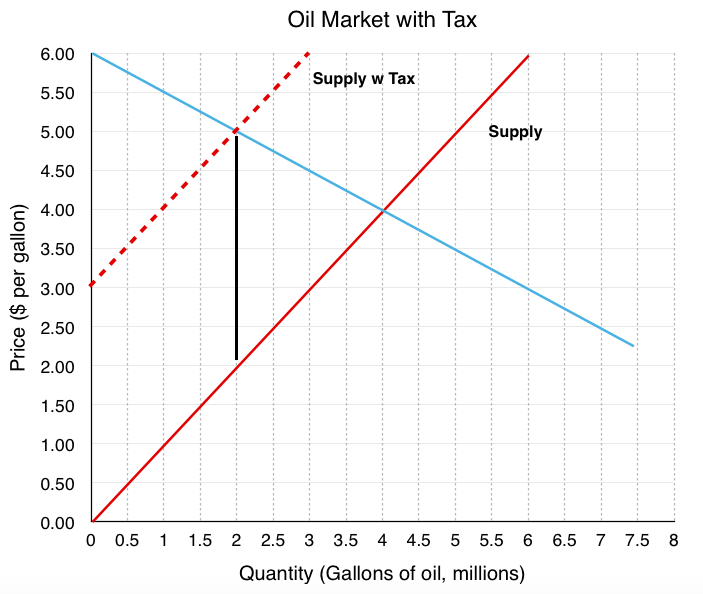

The government decides to levy a tax of 2 per unit on the good to be paid by the seller. And i must find the equilibrium quantity of the curves after the 2 tax has been taken into account for. The following graph shows the annual supply and demand for this good.

Assume that the tax on beer is 20 per unit a unit is a carton of drinks assume the demand and supply functions for cartons of beers per week are. It also shows the supply curve s taz shifted up by the amount of the proposed tax 60 per ticket. Suppose the government taxes concert tickets.

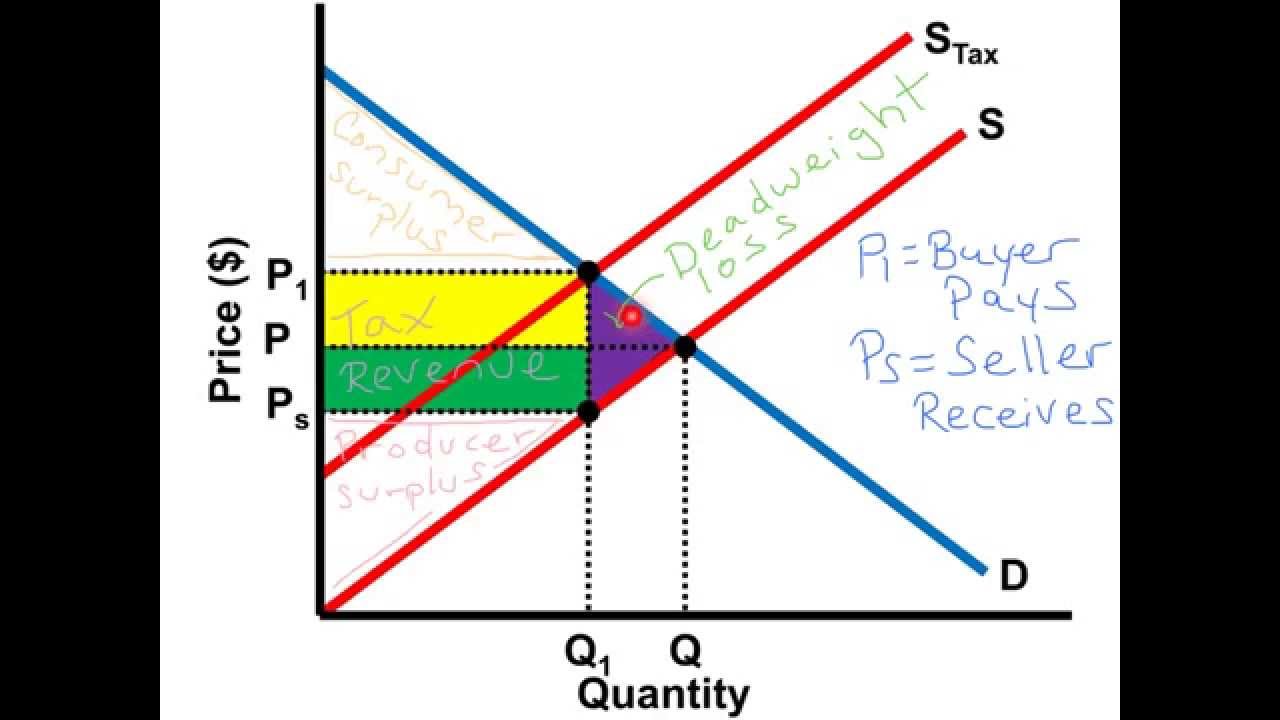

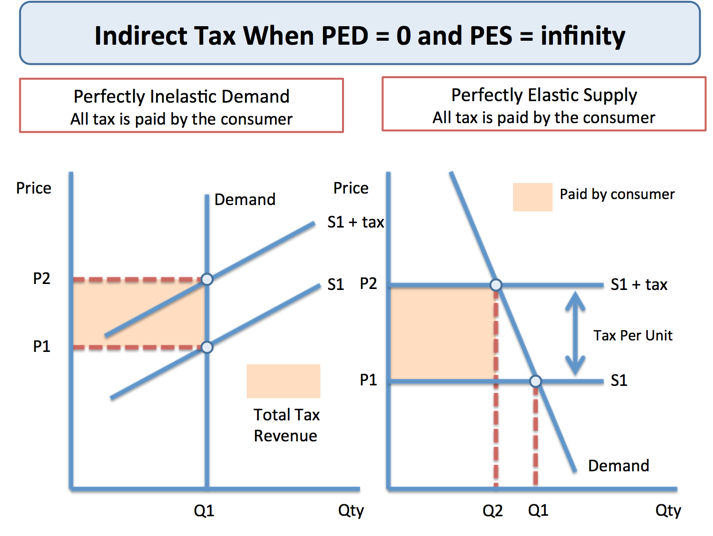

Australian government has imposed a tax on beer. The government would rather place indirect taxes on commodities where demand is inelastic because the tax causes only a small fall in the quantity consumed and as a result the total revenue from taxes will be greateran example of this is the high level of duty on cigarettes and petrol. The impact of an indirect tax will depend on the elasticity of demand.

P200 05q and p05q. One form of government intervention is the introduction of taxes. The effect of taxes on supply and demand.

Taxes are typically introduced to increase government revenue but they also have the effect of raising the cost of goods and services to the consumer. A graph showing the impact of an ad valorem tax 20 on a good. Calculate the amount of tax revenue collected by the government and the distribution of tax payments between buyers and.

This video shows the mathematics behind the supply and demand model with taxes. If the government taxes a good that is inelastic the demand does not change even though the price has increased due to the additional tax. This video shows the mathematics behind the supply and demand model with taxes.

More From Self Employed Kiwisaver Calculator

- Self Employed Sss Payment Center

- Mra Self Employed Form June 2020

- Government Clipart Transparent Background

- Self Employed Womens Association Was Established By

- Government Name Meaning

Incoming Search Terms:

- Deadweight Loss Of Taxation Government Name Meaning,

- Reading Tax Incidence Macroeconomics Government Name Meaning,

- Effect Of Tariffs Economics Help Government Name Meaning,

- Excise Tax Government Name Meaning,

- Solved The Table Below Shows Supply And Demand In The Mar Chegg Com Government Name Meaning,

- Answered The Graph Shows The Demand And Supply Bartleby Government Name Meaning,