Indian Government Bonds Interest Rates, How To Buy Government Bonds In India Getmoneyrich

Indian government bonds interest rates Indeed recently is being sought by consumers around us, perhaps one of you. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of this post I will talk about about Indian Government Bonds Interest Rates.

- Interest Rates Government Securities Government Bonds For India Intgsbinm193n Fred St Louis Fed

- Rbi S New Boss Shaktikanta Das Is Stuck Between A Rock And A Hard Place

- Managing The Interest Rate Risk Of Indian Banks Government Securities Holdings Managing The Interest Rate Risk Of Indian Banks Government Securities Holdings

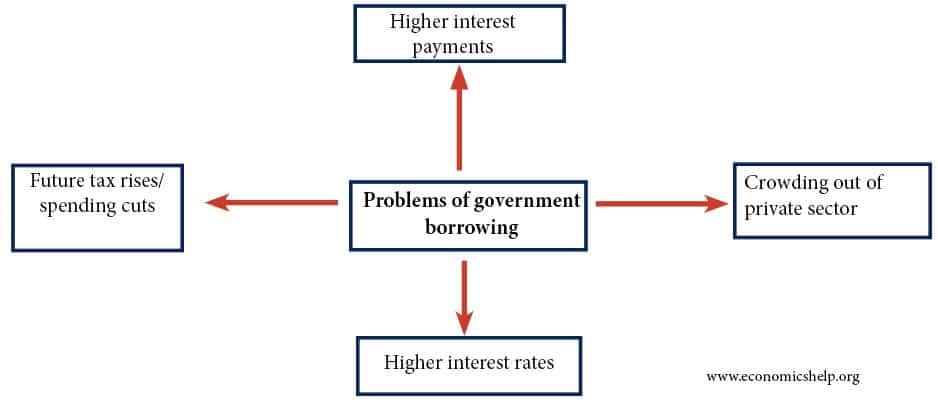

- Problems Of Government Borrowing Economics Help

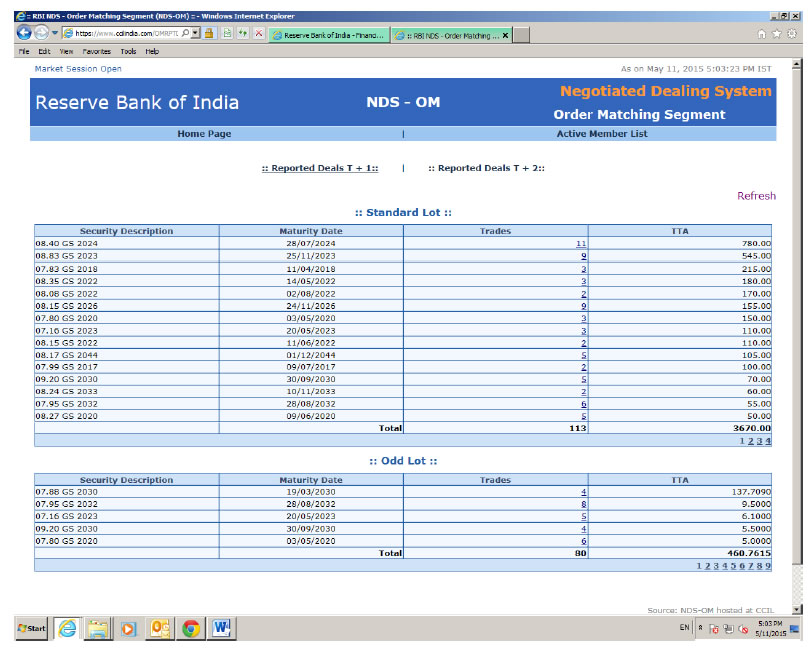

- Reserve Bank Of India Rbi Bulletin

- Nse Launches Interest Rate Options On Government Of India Bonds

Find, Read, And Discover Indian Government Bonds Interest Rates, Such Us:

- National Savings Certificates India Wikipedia

- How The Reserve Bank Of India S Policy Might Finally Be Paying Off Wsj

- Falling Interest Rates Ppt Download

- Tax Free Bonds Is Rbi Taxable Bond At 7 75 A Better Option The Financial Express

- 7 75 Government Of India Savings Bonds Should You Invest Basunivesh

If you re searching for Government College University Lahore Fee Structure you've come to the right location. We ve got 104 images about government college university lahore fee structure including images, pictures, photos, wallpapers, and much more. In these webpage, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

What Rising Bond Yields Tell Us About The Economy The Hindu Government College University Lahore Fee Structure

Central bank rate is 400 last modification in may 2020.

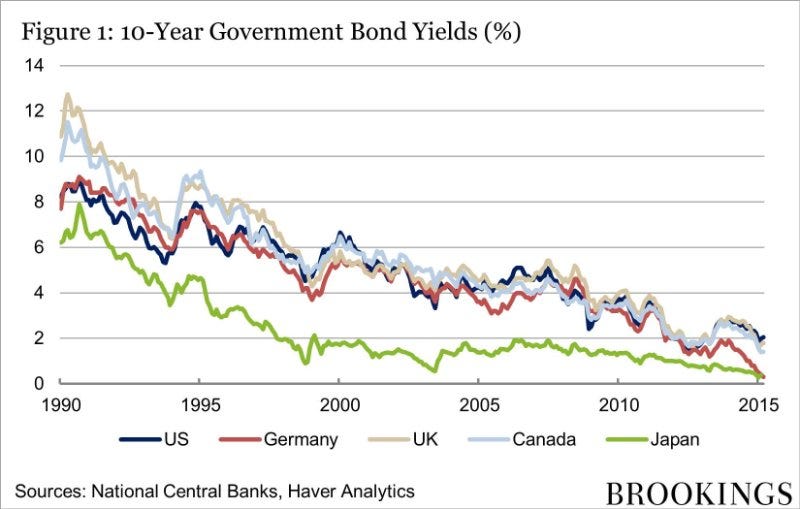

Government college university lahore fee structure. Normal convexity in long term vs short term maturities. The bonds are available for subscription july 1 2020 onwards. India 10y bond yield was 589 percent on wednesday november 4 according to over the counter interbank yield quotes for this government bond maturity.

Current 5 years credit default swap quotation is 10714 and implied. The india 10y government bond has a 5886 yield. The government has announced the launch of floating rate savings bonds 2020 taxable with an interest rate of 715 per cent.

The issuer is the borrower debtor the holder is the lender creditor and the coupon is the interest. As per the reserve bank of india rbi press release the interest rate on these bonds will be reset every six months the first reset being on january 01. Bonds market in india.

Despite my skepticism a number of short term technical indicators. 10 years vs 2 years bond spread is 1715 bp. Date sp moodys fitch dbrs.

In near term bond market will remain volatile. Rbi is the major player in bond market whose policies will decide the direction of interest rate. Thus a bond is like a loan.

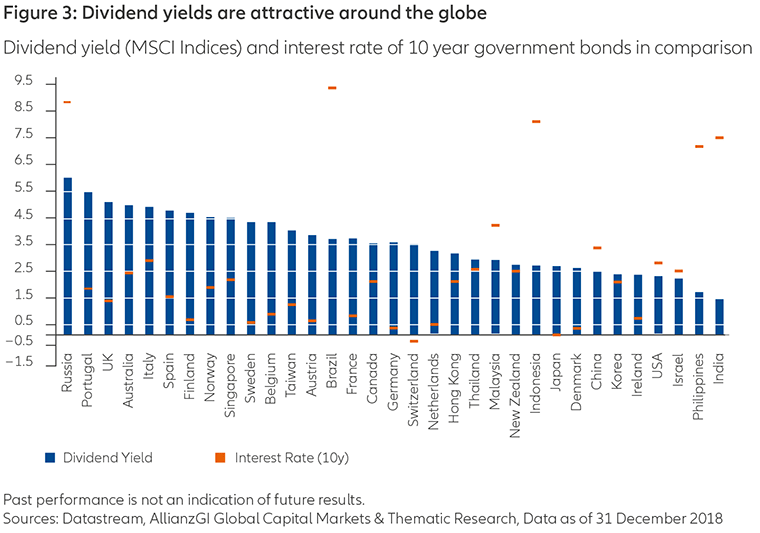

As interest rates rise nav of debt funds fall especially long term bonds. Historically the india government bond 10y reached an all time high of 1476 in april of 1996. The india credit rating is bbb according to standard poors agency.

Bonds provide the borrower with external funds to finance long term investments or in the case of government bonds to finance current expenditure. Get the latest updates on bonds issue returns government bonds infrastructure bonds non convertible debentures bondsncd bonds tax free bonds indiaissue 2020. 4 nov 2020 1315 gmt0.

Rbi sold long term bonds at 675 thats why interest rates are rising rapidly. Government bond interest rate. Bbb low 26 sep 2014.

7 75 Government Of India Savings Bonds Should You Invest Basunivesh Government College University Lahore Fee Structure

More From Government College University Lahore Fee Structure

- Government Of Canada Hierarchy Chart

- Furlough Vs Leave Without Pay

- New Furlough Scheme After October

- Tamil Nadu Government Symbol Png

- Lenovo B490 Government Laptop Price

Incoming Search Terms:

- An Overview History Bond Market Bonds Finance Lenovo B490 Government Laptop Price,

- Tax Free Bonds Is Rbi Taxable Bond At 7 75 A Better Option The Financial Express Lenovo B490 Government Laptop Price,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqmvaug Cwldmigijgvqbengt6ppjnqdmbvkw Usqp Cau Lenovo B490 Government Laptop Price,

- Bonds Bond Traders See India Raising Second Half Debt Sales By A Fifth The Economic Times Lenovo B490 Government Laptop Price,

- Term Structure Changes Using Pca Indian Markets Principal Component Analysis Yield Curve Lenovo B490 Government Laptop Price,

- How Does Rise Fall In Repo Rates Impact Bond Yields Lenovo B490 Government Laptop Price,