Self Employed Sss Monthly Contribution, Guide For Sss Self Employed Membership Moneygment

Self employed sss monthly contribution Indeed lately is being hunted by consumers around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the article I will discuss about Self Employed Sss Monthly Contribution.

- New Sss Contribution Table 2020

- Updated Sss Contribution Table And Schedule Of Payment For 2019 Sss Guides

- 2019 New And Updated Sss Contribution Table For Ofw S And Other Sss Member

- Guide For Sss Self Employed Membership Moneygment

- Sss 2017 Updated Contribution Table Pinoy Helpdesk

- 2019 Sss Contribution Table And Sss Benefits That Every Filipino Should Know Filipino Guide

Find, Read, And Discover Self Employed Sss Monthly Contribution, Such Us:

- Sss Contribution Table And Payment Schedule For 2020 Tech Pilipinas

- Sss Contribution Table 2016 Mastercitizen S Blog

- Sss 2017 Updated Contribution Table Pinoy Helpdesk

- New Sss Contribution Table 2020

- Sss Contribution For 2019 Jsl Co

If you are searching for Local Government Functions In The Philippines you've come to the perfect location. We ve got 104 images about local government functions in the philippines including pictures, photos, photographs, wallpapers, and more. In these page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Sss Contributions For Employed Self Employed Kasamabahays 2019 Local Government Functions In The Philippines

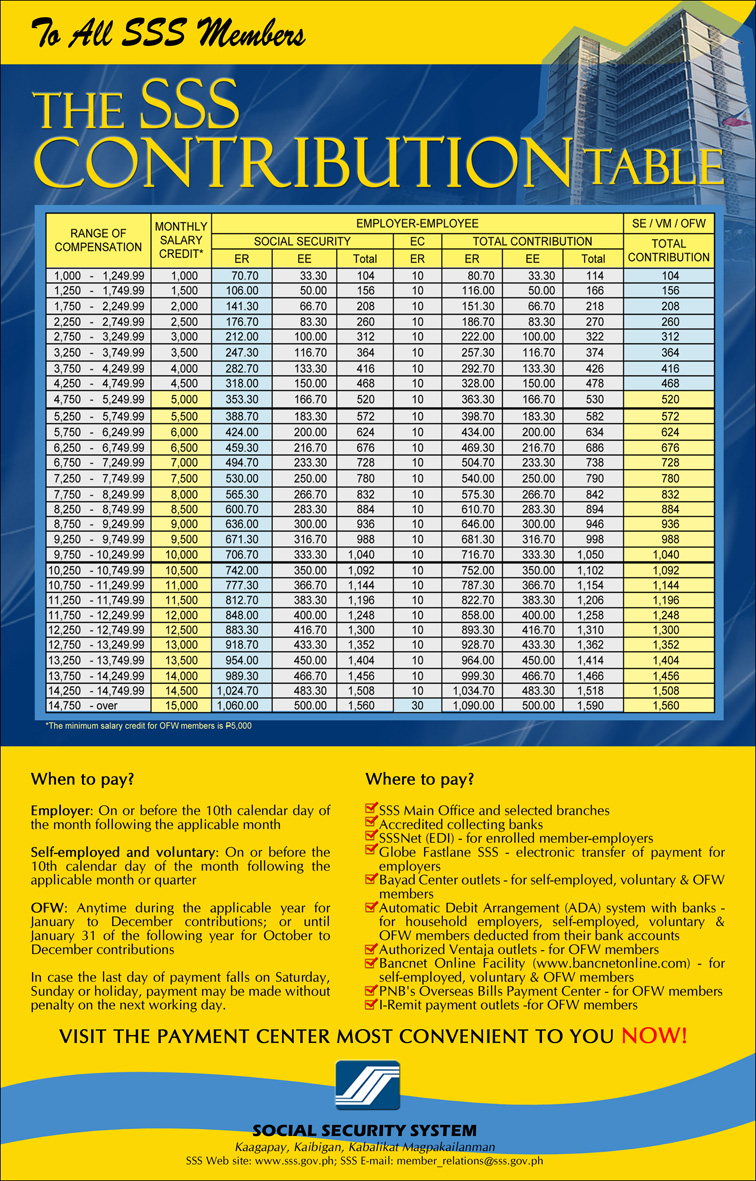

For employed members the minimum monthly salary credit is php 2000 with a total contribution of php 250 while the maximum monthly salary credit is php 20000 with a total contribution of php 2430.

Local government functions in the philippines. The current sss contribution rate is 11 of the monthly salary credit not exceeding p16000 and this is being shared by the employer 737 and the employee 363. There are 37 monthly salary credits beginning from 2000 pesos and increasing in increments of 500 pesos up to the maximum of 20000 pesos as of the latest sss contribution table effective april 2019. Meaning if you were previously employed your employer mustve remitted your sss contributions and it must have been posted in your sss account.

If you want to download the sss contributions table 2020 then you may double click this image and save on your phone for your handy reference here is the new sss contributions table for employed self employed voluntary and non working spouse sss members for ofw members. For quarterly sss remittances any payment for 1 2 or 3 months are accepted. Here is the new sss contributions table for employed self employed voluntary and non working spouse ofw and household members.

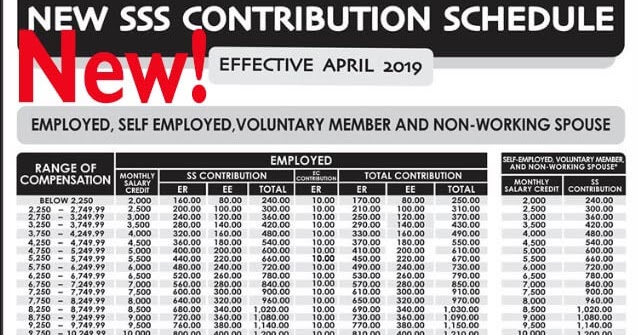

Effective april 2019 below is the new sss contribution table for employed self employed voluntary members and non working spouses. Paid at least three 3 monthly contributions within the 12 month period preceding the semester of sickness. Salary credit is the amount used by sss to compute your salary loan amount sickness benefit amount maternity benefit amount and pension amount.

Self employed and voluntary members pay the 11 of the monthly salary credit msc based on the monthly earnings declared at the time of registration. The new contribution schedule will be implemented for the applicable month of april and payable in may 2019. All existing ec benefits shall be enjoyed by self employed members in accordance with the implementing guidelines of sss and ecc.

Starting applicable month of september 2020 payment reference number prn issued to sss self employed members will include ec contributions. The sss contribution table below is for self employed individuals voluntary members and overseas filipino workers. Sss benefits for self employed members.

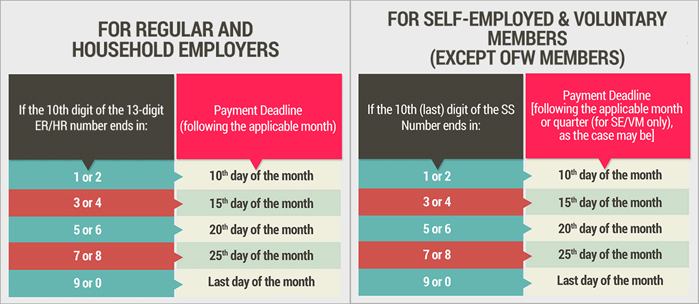

For ofws the minimum monthly salary credit is p5000. Sss contribution for self employed and voluntary members can be monthly or quarterly basis every 3 months which ends on the last day of march june september and december. Confined for at least four 4 days.

Sickness benefit daily cash allowance paid to a member for the number of days heshe is unable to work due to sickness or injury.

More From Local Government Functions In The Philippines

- Government To Government E Commerce Examples

- Government Furlough Scheme End Date

- Furlough And Unemployment Benefits Washington State

- Sri Lankan Government Logo Png

- Furlough Scheme Uk July

Incoming Search Terms:

- Sss Monthly Contribution Table Schedule Of Payment 2020 The Pinoy Ofw Furlough Scheme Uk July,

- News And Technology New Sss Contribution Table 2017 Furlough Scheme Uk July,

- Sss Payment Schedule For Contributions And Loans 2017 Sss Guides Furlough Scheme Uk July,

- Latest 2014 2015 Sss Contribution Table For Employers And Employees Onlinefilipinoworkers Com Furlough Scheme Uk July,

- Voluntary Contribution Guide For Pag Ibig Philhealth And Sss Members Furlough Scheme Uk July,

- The Payment Deadline For Sss Monthly Philippine Social Security System Facebook Furlough Scheme Uk July,