Self Employed Ppp Loan Forgiveness 24 Weeks, Sba Finally Clarifies Ppp Loan Forgiveness Rules Full Forgiveness For Self Employed Borrowers

Self employed ppp loan forgiveness 24 weeks Indeed lately has been sought by users around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of this article I will discuss about Self Employed Ppp Loan Forgiveness 24 Weeks.

- Paycheck Protection Program Flexibility Act Of 2020 Stein Sperling

- Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

- Guide To Ppp Loan Forgiveness Honest Buck Accounting

- Self Employed Guide To The Ppp Forgiveness Application Form 3508ez Bench Accounting

- Pppguides Maximize Your Ppp Forgiveness Blog By Pppguides

- Ppp Loan Guide Startup Junkie

Find, Read, And Discover Self Employed Ppp Loan Forgiveness 24 Weeks, Such Us:

- 15 Questions About The Ppp Loan Forgiveness Application Process

- Frequently Asked Questions Ppp Loan Forgiveness Merchants Bank Blog

- Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

- Ppp Loan Forgiveness New Ez Application Released

- Ppp Self Employed 60 Or 8 Weeks Or 24 Weeks Affect From Ppp Flexibility Act All Calculated Youtube

If you re searching for Self Employed Limited Company you've arrived at the right location. We have 102 images about self employed limited company adding images, photos, photographs, backgrounds, and more. In such web page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Why New Ppp Loan Rules For Owner Employees Of S And C Corporations Are Bad News Self Employed Limited Company

Sba Finally Clarifies Ppp Loan Forgiveness Rules Full Forgiveness For Self Employed Borrowers Self Employed Limited Company

However borrowers whose loans were made before june 5 have the option of using a covered period of either 8 weeks or 24 weeks.

Self employed limited company. Self employed with no employees can spend the full 20833 as owner compensation replacement and it will be eligible for 100 forgiveness if proper documentation is provided with ppp forgiveness application. Use the 2512 method of 2019 net profit up to 20833 which is 100 forgiven. Full 100 loan forgiveness.

This is everything we know based on information directly from the sba and the 19th interim final rule ifr filed on june 19th 2020. The 24 week window based on an individual reporting 50000 of self employment income on their 2019 tax return with no overhead expenses. New easy road to 100 percent forgiveness.

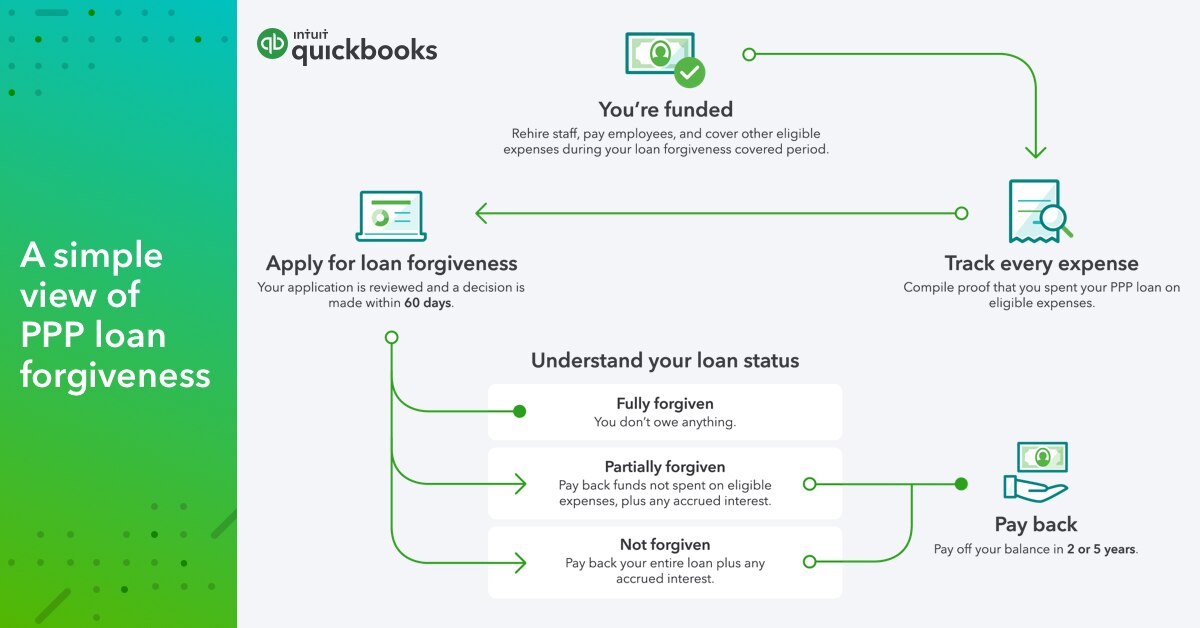

If you dont have any eligible business expenses you can use the ppp funds for the remaining balance of the loan will need to be repaid according to the ppp loan terms. On june 7 the payroll protection program flexibility act was passed into law extending the covered period in which borrowers can use payroll protection program ppp loan proceeds from eight weeks to 24 weeks. The unpublished version of the update ensures full forgiveness for self employed freelancers and independent contractors who took the maximum loan amount based on 25 times their 2019 monthly income.

One of the biggest changes was to the eight week forgiveness period. Here is an example of the potential difference in ppp loan forgiveness using the eight week window vs. Say thanks to the paycheck protection program flexibility act of 2020.

I dont have any other business expenses i can claim for forgiveness. We now have both the new clarity and an easy road to paycheck protection program ppp loan forgiveness for the self employed with no employees. This applies to ppp loans using a 24 week covered period.

Can i still apply for forgiveness after 8 weeks 56 days and apply for the full 25 months forgiveness or. The ppp loan forgiveness extension may help the self employed. This new law creates a 24 week period for you to spend your ppp loan proceeds.

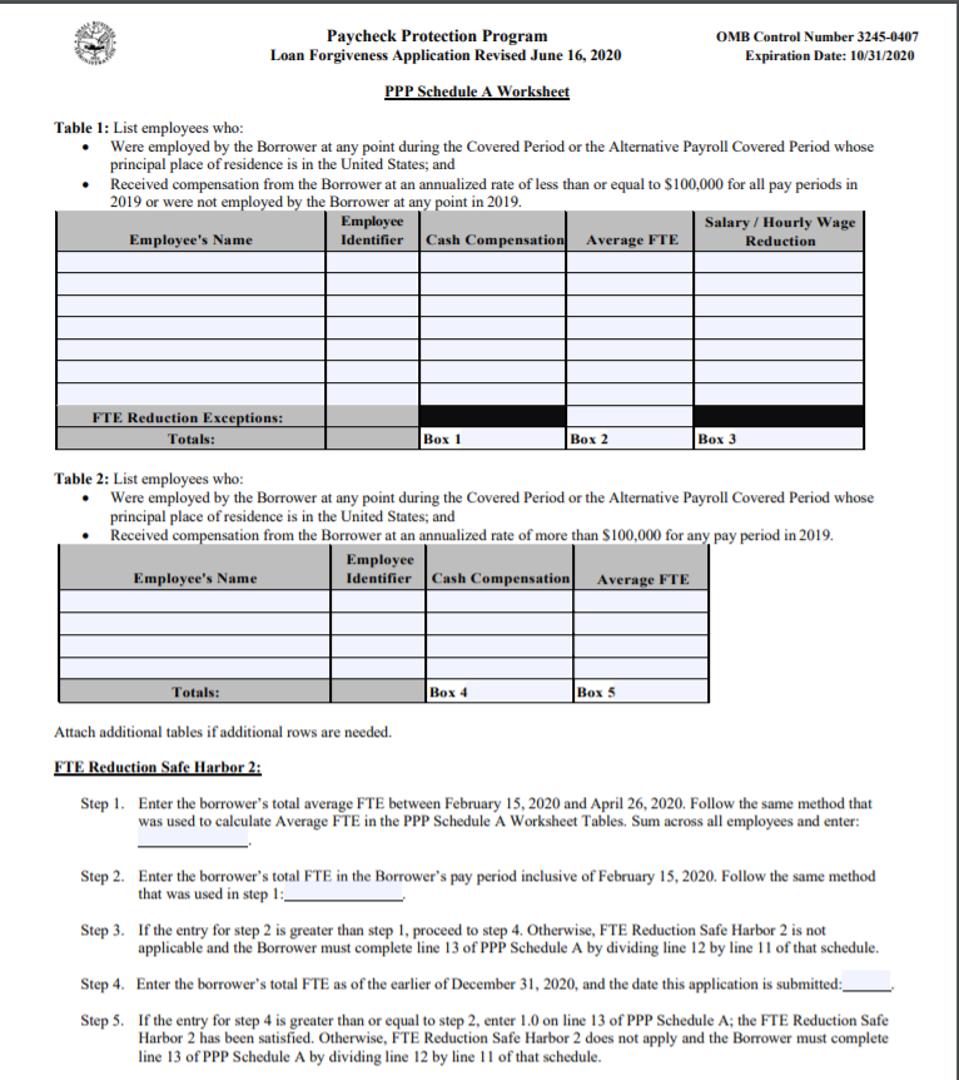

Loan forgiveness is also subject to a reduction if average fte levels during the covered period are less than average fte levels of the comparative period selected by the borrower either february 15. If you were assigned a ppp loan number on or before june 5 2020 you now have the option of taking 24 weeks to spend the funds instead of eight weeks.

Ppp Loan Forgiveness Application How To Track Ppp Loan Expenses Updated Template Included Youtube Self Employed Limited Company

More From Self Employed Limited Company

- Government Jobs People Over 50

- Upcoming Government Exams 2020 Application Form

- Government Relations Strategy Template

- Self Employed Furlough Third Grant

- Self Employed Limited Company Tax Calculator

Incoming Search Terms:

- Paycheck Protection Program Covid 19 Forgivable Loans Self Employed Limited Company Tax Calculator,

- How To Fill Out Your Ppp Forgiveness Application Form Simplifi Payroll And Hr Self Employed Limited Company Tax Calculator,

- 15 Questions About The Ppp Loan Forgiveness Application Process Self Employed Limited Company Tax Calculator,

- How To Fill Out Your Ppp Forgiveness Application Form Cannabis News Culture Heady Vermont Self Employed Limited Company Tax Calculator,

- Gswwncugv38cbm Self Employed Limited Company Tax Calculator,

- Ppp Forgiveness Owner Ees Self Employed Have New Special Calculation Select 24 Week Option Youtube Self Employed Limited Company Tax Calculator,