Self Employed Vs Business Owner Taxes, Pin By Wan On Investment With Images Marketing Strategy Business Business Growth Plan Business Growth Strategies

Self employed vs business owner taxes Indeed lately has been sought by users around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of this post I will talk about about Self Employed Vs Business Owner Taxes.

- Quickbooks Online Vs Quickbooks Self Employed 5 Minute Bookkeeping

- Self Employed Business Owner S Guide To Claiming Jobkeeper Payments Tax Return Perth

- Small Business Hra Strategy Guide

- Do Llc Owners Pay Self Employment Tax Corpnet

- Differences Between Self Employed Individuals And Business Owners Request Pdf

- New Tax Cost And Employment Audit Services Teo Jorda Business Advisor

Find, Read, And Discover Self Employed Vs Business Owner Taxes, Such Us:

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse

- Tax Instagram Posts Photos And Videos Picuki Com

- Solo Roth 401 K Gives Self Employed Business Owners A Tax And Retirement Boost

- 50 Online Business Tax Tools Ideas Business Tax Online Business Small Business Tax

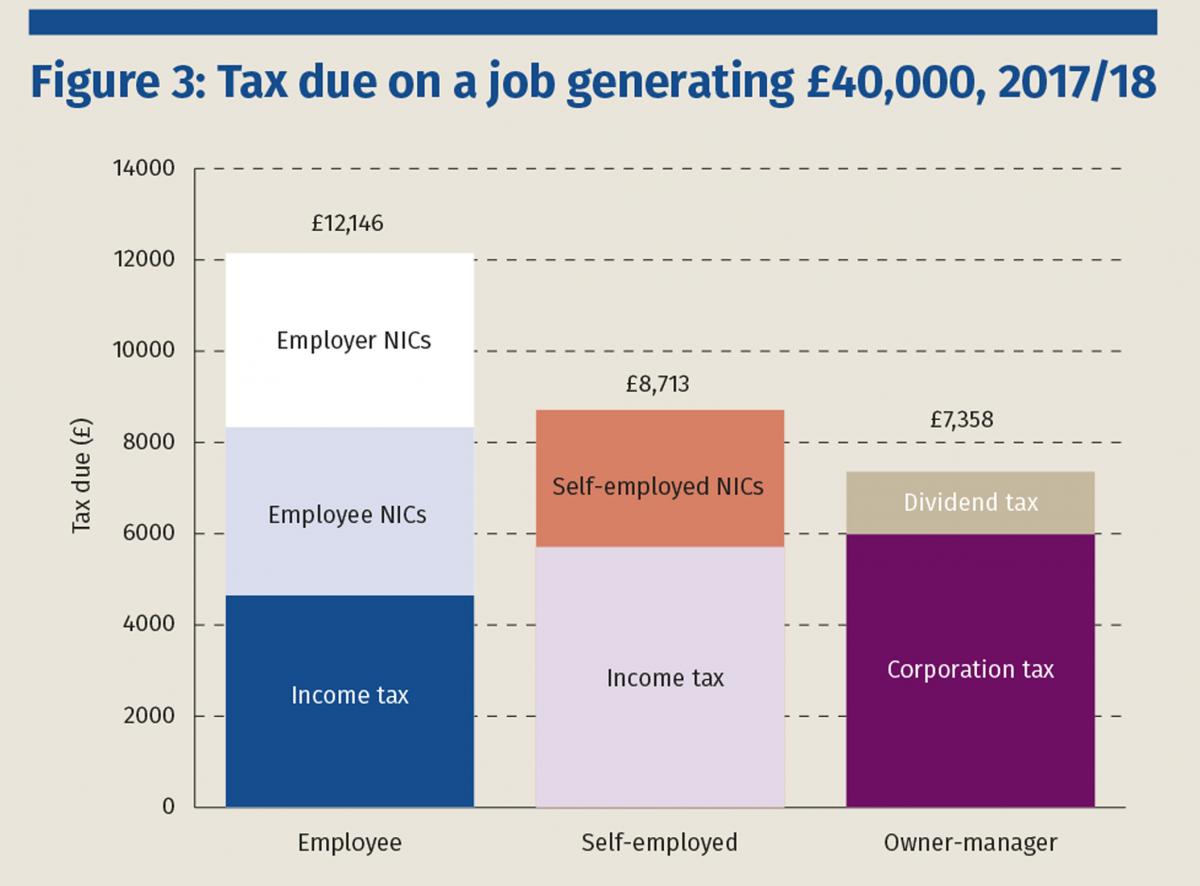

- Tax In A Changing World Of Work

If you re searching for Government Laptop 2019 Model you've come to the perfect location. We ve got 104 images about government laptop 2019 model including images, photos, pictures, backgrounds, and more. In such web page, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

So he himself is an employer.

Government laptop 2019 model. My client hires someone to work for him. Someone who is self employed generally works for themselves as a business owner freelancer or as an independent contractor for another company. They so much need to rely on the income to live.

The self employed works in the business whilst the business owner works on it. As a business owner except for corporate shareholders you arent taxed on the money you take out of the business. When you buy a business you generally pay a set amount for the entire business.

When you are considering becoming a business owner you have the option of buying an existing business or starting a new one. This is because they see this as an avenue to reinvest both in their business and in other places. Self employed are small businesses but they are usually 1 person show self employed are independent contractors and they can have one or multiple clients ie.

Whether youre self employed a freelancer a solopreneur or a business owner youll be required to pay self employment tax. For legal and taxation purposes the term self employed is expressed as opposed to employed but a business owner is not an official term. But whether you consider yourself to be self employed or a small business owner there are certain things you need in place to make sure your work and finances are protected.

The basic difference between these two terms is that self employment tax is paid by self employed individuals while employment taxes are paid by employees and their employers. Uber driver vs real estate agent vs taskrabbit vs sole tax practitioner self employed are creative entrepreneurs and usually not accountants but they really need one. Anyone who owns a business is a business owner so you can be self employed as well as a business owner.

If you identify as a small business owner then that makes you a small business owner. The only tax difference you might face is if youre a business owner with things like employees and a storefront. The bottom line is this.

Shareholders of a corporation are taxed on the dividends they receive. You are taxed on the net income profits of your business. Self employment taxes self employment taxes are taxes paid by self employed business owners t o the social security administration for social security and medicare based on earnings from a business you own not a corporation.

Your classification will impact taxes unemployment compensation taxes health insurance coverage and other benefits.

4 Types Of Commonly Overlooked Self Employed Tax Deductions Toughnickel Money Government Laptop 2019 Model

More From Government Laptop 2019 Model

- World Government Types Map

- Government Clipart Free

- Government Newsletter Templates

- Us Government Forms

- Government Help To Buy A House In Scotland

Incoming Search Terms:

- Limited Company Vs Sole Trader 2019 20 Jf Financial Government Help To Buy A House In Scotland,

- Labour S Tax Raid On The Self Employed Capx Government Help To Buy A House In Scotland,

- 9 Tax Tips For The Self Employed That Make Paying Taxes Way Easier Government Help To Buy A House In Scotland,

- Self Employment Taxes 2020 Uk In 2020 Self Employment Finance Blog National Insurance Government Help To Buy A House In Scotland,

- The Small Business Schedule C Guide Pages 1 27 Text Version Anyflip Government Help To Buy A House In Scotland,

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse Government Help To Buy A House In Scotland,