Government Help To Buy Scheme Explained, Help To Buy Help To Buy Scheme Berkeley Group

Government help to buy scheme explained Indeed recently is being hunted by consumers around us, perhaps one of you. People are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the article I will talk about about Government Help To Buy Scheme Explained.

- Equity Loan Help To Buy Scheme Homeowners Alliance

- What Is The Treasury S Help To Buy Scheme Itv News

- Fueukdjfzo4vgm

- Help To Buy Vs 95 Mortgage Which Is Best Which News

- Everything You Need To Know About Shared Ownership

- Help To Buy Authority To Exchange Contracts Sam Conveyancing

Find, Read, And Discover Government Help To Buy Scheme Explained, Such Us:

- What Is The Treasury S Help To Buy Scheme Itv News

- How Does Help To Buy Work Money Co Uk

- Help To Buy England Bellway Homes Bellway

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcscdogxrvxocj2mxjldp1zcxzecrhfhr5ygabzvrwiyoje457cc Usqp Cau

- What Are The Central Bank S Mortgage Lending Rules Mortgages Guide Bonkers Ie

If you are searching for Self Employed Working From Home Ideas you've come to the right location. We ve got 104 images about self employed working from home ideas including images, photos, photographs, wallpapers, and more. In such web page, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

The help to buy equity loan is offered as part of the help to buy scheme for first time buyers or those looking to move with savings equivalent to 5 of the property they are looking to buy.

Self employed working from home ideas. Government help to buy scheme explained. In january of 2013 we released an infographic about the government help to buy scheme. There are two main elements of the help to buy scheme which we explain below.

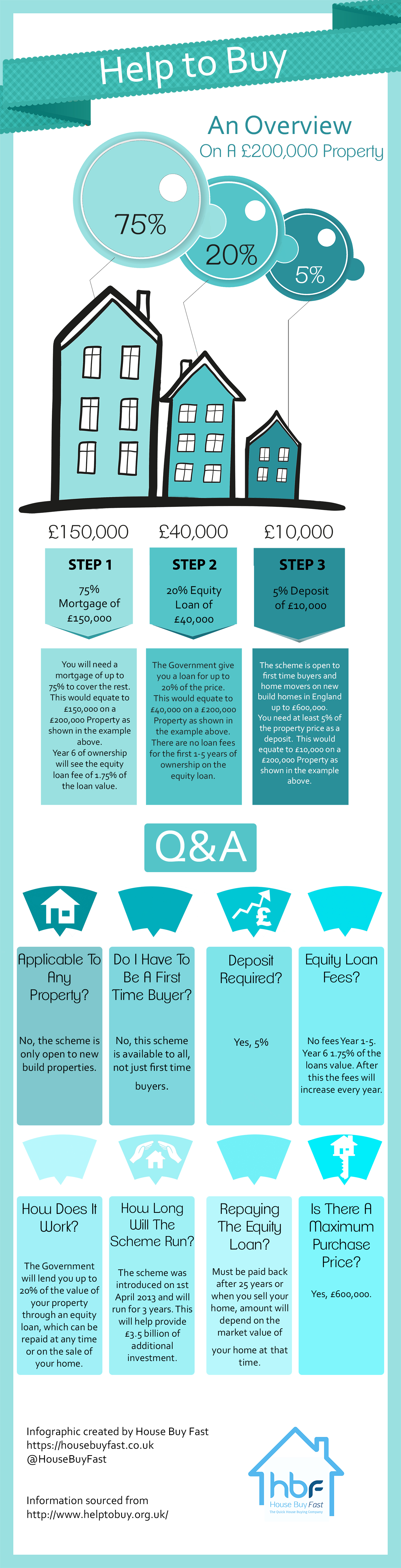

Help to buy an overview on a 200000 property 75 20 5 150000 40000 10000 step 1 step 2 step 3 75 mortgage of 20 equity 5 deposit of 10000 loan of 150000 40000 you will need a mortgage of up to 75 to cover the rest. February 12 2015 real estate leave a comment help to buy is a massive topic of discussion in the uk but its also a confusing topic if youre not up to date on all the relevant information. Under this scheme you can borrow 20 of the purchase price interest free for the first five years as long as you have at least a 5 deposit.

In england the governments help to buy scheme has four main parts. The help to buy scheme offers an equity loan where the government lends first time buyers and existing homeowners money to buy a newly built home. With the governments help to buy.

However this extension will be restricted to first time buyers purchasing newly built homes. The purchase price must be no more than 600000. It is designed to help anyone struggling to save a deposit for their first home or move up the property ladder as they have limited equity.

It can only be used for new build properties. You could be closer to saving your deposit than you think the government has created the help to buy schemes including help to buy. Shared ownership scheme you can buy as little as 25 or as much as 75 of a home and pay rent on the rest.

Weve now updated our infographic and added some further information abo. Help to buy is a government scheme first announced in the march 2013 budget. Help to buy equity loan is the only arm of help to buy that is still available.

Based on this the government lends you a further 20 of the property price and the rest is covered by your mortgage. The scheme requires you put down a minimum 5 deposit of the property value with the government offering an interest free loan of a further 20. From 2021 there will also be new regional price caps which could reduce the maximum value of home that can be bought through the equity loan scheme.

It can only be used for new build properties. Government help to buy scheme explained. Help to buy is the name given to a number of government schemes aimed at helping first time buyers and home movers buy homes.

Equity loan to help hard working.

More From Self Employed Working From Home Ideas

- Self Employed Jobs For Ladies

- Self Employed Furlough Login

- Government Contractor Sample Capability Statement

- Government Guaranteed Loans For Businesses

- Does Furlough Extension Apply To Self Employed

Incoming Search Terms:

- Who Is Eligible Help To Buy Does Furlough Extension Apply To Self Employed,

- Help To Buy Isa In London Help To Buy London Map Area Does Furlough Extension Apply To Self Employed,

- Government Help To Buy Scheme Explained Does Furlough Extension Apply To Self Employed,

- What Is Help To Buy All About Monevator Does Furlough Extension Apply To Self Employed,

- Help To Buy Wales Gov Wales Does Furlough Extension Apply To Self Employed,

- How Does It Work Help To Buy Does Furlough Extension Apply To Self Employed,

.jpeg)