Government Guaranteed Loans For Businesses, Improving Your Chance Of Securing Government Backed Loans Uk Xero Blog

Government guaranteed loans for businesses Indeed lately has been sought by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of this article I will discuss about Government Guaranteed Loans For Businesses.

- Intelligence Memos David Losier Government Guaranteed Ready For Business Cash Flow Loans C D Howe Institute

- Non Msmes To Get Cheap Govt Guaranteed Loans Too Times Of India

- Coronavirus Government Backed Small Business Loans Hit 4bn

- Ed Conway On Twitter Blimey Nearly 700 000 Bounce Back Loans Have Now Been Issued In The Space Of A Month These Remember Are The 100 Government Guaranteed Loans To Small Businesses Meanwhile

- Government Guarantees Of Loans To Small Businesses Effects On Banks Risk Taking And Non Guaranteed Lending Sciencedirect

- Government Guaranteed Loans Chickasaw Community Bank

Find, Read, And Discover Government Guaranteed Loans For Businesses, Such Us:

- Parliament Urges Banking Sector To Help Small Business

- Will The Bounce Back Loan Scheme Help Small Businesses Survive Business Comparison

- Coronavirus Government Backed Small Business Loans Hit 4bn

- Expansion Of Government Backed Loans A Timely Lifeline For Businesses Rnz News

- Government Guaranteed Loans Chickasaw Community Bank

If you re looking for Self Employed Free Profit And Loss Statement Pdf you've arrived at the right location. We have 104 images about self employed free profit and loss statement pdf including pictures, photos, photographs, backgrounds, and more. In such webpage, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

How To Access Government Financial Support If You Or Your Business Has Been Affected By Covid 19 Robert Courts Mp Self Employed Free Profit And Loss Statement Pdf

Small to medium sized businesses will be able to access government guaranteed loans worth up to 1 million under a plan to drive investment.

Self employed free profit and loss statement pdf. Access to the scheme is available to active businesses with either. Roy mctaggart is pleased to inform the public that the government of the cayman islands and five 5 local financial institutions the banks have agreed in principle to a government guaranteed loan scheme to assist medium and large sized. 550000 companies have applied for a state guaranteed loan.

A turnover of less than 50 million in the previous financial year. Applications are open until 31 december 2020 and can be made through myir. These are high risk loans he said.

Raising the cap from 250000 to 1 million could. An expected turnover of less than 50 million in the current financial loan. The terms of the new loans will include.

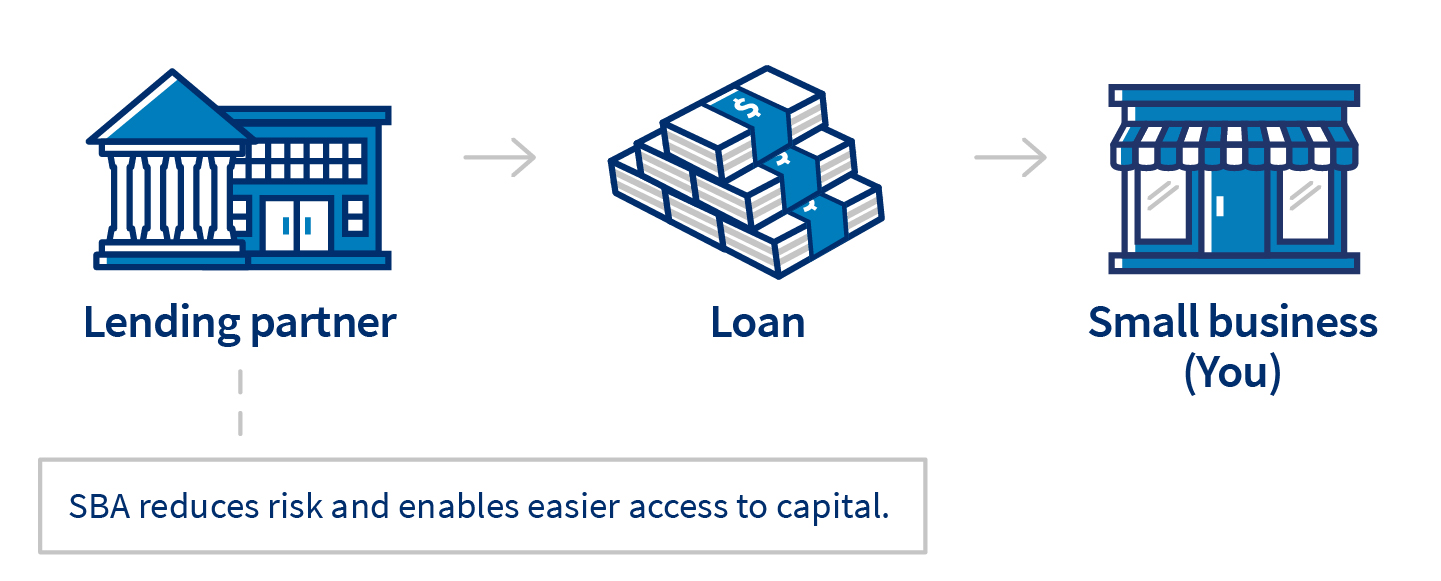

Get competitive rates on a business government guaranteed loan. A government backed business loan is a loan that the government provides a guarantee to the lender on. The governments covid 19 loan guarantee scheme aimed at helping businesses battered by the pandemic fallout has gone live.

Terms of the new loans. Government will provide one off loans to small businesses including sole traders and the self employed impacted by covid 19 to support their cash flow needs. George town grand cayman.

Neither the government nor the banks want to guarantee loans to entities that are already in a state of default. Maximum loan of 250000 per borrower. How will businesses survive.

Government guaranteed loans for medium large sized businesses. These loans will be delivered as part of the coronavirus sme guarantee scheme with the government guaranteeing 100 per cent of loan amounts. In the current environment businesses.

This will support concessional loans to assist creative economy businesses to fund new productions and events to be delivered through commercial lenders and supported by terms and conditions tailored to. The minister for finance and economic development hon.

More From Self Employed Free Profit And Loss Statement Pdf

- New Government Accounting System Manual For Local Government Units

- Government Types Worksheet

- Government Spending Formula

- Federal Government Icon Png

- 2020 Calendar Tamil Nadu Government Holidays

Incoming Search Terms:

- Small Businesses Finally Received Government Backed Loans Now They Re Afraid To Spend Them Mother Jones 2020 Calendar Tamil Nadu Government Holidays,

- The Pros And Cons Of Using Government Business Loans For Your Startup 2020 Calendar Tamil Nadu Government Holidays,

- Government Backed Business Loans Liberis 2020 Calendar Tamil Nadu Government Holidays,

- Government Guaranteed Business Loans Australia Small Business Startups And Funding 2020 Calendar Tamil Nadu Government Holidays,

- Intelligence Memos David Losier Government Guaranteed Ready For Business Cash Flow Loans C D Howe Institute 2020 Calendar Tamil Nadu Government Holidays,

- Lending To Small Business Inside Small Business 2020 Calendar Tamil Nadu Government Holidays,