Self Employed Claiming Expenses Working Home, 12 Self Assessment Expenses You Didn T Know You Could Claim

Self employed claiming expenses working home Indeed recently has been sought by users around us, maybe one of you. People now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the post I will talk about about Self Employed Claiming Expenses Working Home.

- Simplified Expenses A Guide For The Self Employed

- Expenses You Can Claim Working From Home Workingmums Co Uk

- Working From Home Tax What You Can And Can T Claim H R Block Australia

- Expenses You Can Claim If You Re Self Employed In Ireland

- Self Employed And Working From Home Expenses Guide Pillow May

- Claiming Business Expenses A Guide For The Self Employed Citywire

Find, Read, And Discover Self Employed Claiming Expenses Working Home, Such Us:

- 2020 Income Tax What You Can T And Can Claim For Your Work From Home Office During The Covid 19 Pandemic Moneysense

- Stuck Working From Home It Won T Save You Much On Your Taxes

- How Much Can You Really Claim For Your Home Office

- Working From Home How To Cut Your Tax Bill Bbc News

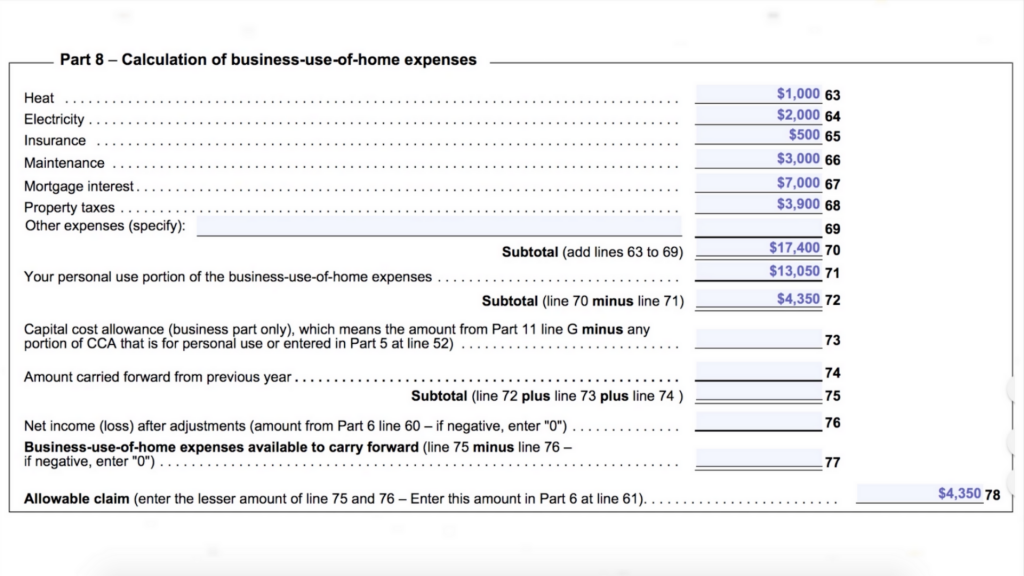

- Part 2 How To Prepare Business Taxes For Self Employed Individuals Madanca

If you are searching for What Is The Furlough Percentage For August you've arrived at the ideal place. We ve got 100 graphics about what is the furlough percentage for august including images, pictures, photos, backgrounds, and more. In such web page, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

.jpg)

Expenses You Can Claim If You Re Self Employed In Ireland What Is The Furlough Percentage For August

If youre self employed in ireland then youre obliged to file a self assessed tax return usually by the deadline of october 31 or by the pay and file deadline of nov 10.

What is the furlough percentage for august. Any amount higher than 320 per workday must have tax. From 6 april you may be able to claim up to 6 a week up from 4 a week in the 201920 tax year to cover your employment expenses. If you are self employed and working from home for at least 25 hours per month then you can claim a flat rate allowance on your taxes.

Your employee is required to work for substantial periods at home. Your employees costs might be higher than 320 per workday and you may repay these expenses. I know it sounds odd because youre technically claiming tax on a tax but it the proportion you use your home as an office is a completely allowable expense by hmrc.

How to claim back job expenses. Hours of business use. Your employee is required to perform essential duties of the employment at home.

The first step towards claiming allowable business expenses is to keep a detailed track of them. There are quite a number of expenses you can claim a proportion of whilst working from home. Expenses higher than 320 per workday.

Utility bills including gas electricity not water unless you can show you use water for business purposes household insurance. Simplified expenses method for claiming use of home. For example if your work from home area is 400 square feet and your total home is 2000 square feet you would be able to claim 20 4002000 of your home related expenses internet fees.

Claiming council tax as an. Working from home you may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. The amount you can claim depends on how many hours you use your home for work.

Over the years ive come to realise that not many self employed people are aware of this but you can actually claim a proportion of your council tax as an allowable expense if you work from home. The working from home flat rate allowance for the 202021 tax year are. Mortgage interest or rent on your home.

You can only use simplified expenses if you work for 25 hours or more a month from home. Employees who are required to work from home have always been able to claim tax relief or expenses incurred as part of their employment so this isnt something new introduced due to the coronavirus crisis.

Part 2 How To Prepare Business Taxes For Self Employed Individuals Madanca What Is The Furlough Percentage For August

More From What Is The Furlough Percentage For August

- Self Employed Vat Registered

- Government Vacation Rewards Star Card

- Us Government Accountability Office Gao

- 2020 September Government Gazette 2020

- Indonesian Government Website

Incoming Search Terms:

- Work From Home Tax Deduction Only Applies To Self Employed Workers Business Insider Indonesian Government Website,

- Stuck Working From Home It Won T Save You Much On Your Taxes Indonesian Government Website,

- Another Six Months Working From Home Expenses Benefits And Insurance Must Knows Your Money Indonesian Government Website,

- How To Claim Back The Expense Of Working From Home Your Money Indonesian Government Website,

- Stuck Working From Home Again Here S What You Can Claim Back This Is Money Indonesian Government Website,

- Working From Home How To Get A Tax Rebate Lovemoney Com Indonesian Government Website,