Self Employed Mortgage Requirements Uk, A Guide To Mortgages For The Self Employed Without Accounts Niche

Self employed mortgage requirements uk Indeed recently is being hunted by consumers around us, perhaps one of you. People now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of this article I will talk about about Self Employed Mortgage Requirements Uk.

- Mortgage Saver Review May 2019 Trussle

- Self Employed Borrowers Are Safer To Lend To Than First Time Buyers

- Self Employed You Can Still Get A Mortgage

- Self Employed

- Top Tips For Self Employed Workers Applying For A Mortgage Mortgage Advice Uk

- Can You Get A Mortgage If You Re Self Employed Gough Mortgages Bristol

Find, Read, And Discover Self Employed Mortgage Requirements Uk, Such Us:

- Mortgages For Self Employed Uk Mortgage Broker Fox Davidson

- Self Employed Invited To Get Ready To Make Their Claims For Coronavirus Covid 19 Support Gov Uk

- Getting A Mortgage When You Re Self Employed Ad

- Self Employed Mortgage With 2 Years Accounts Expert Mortgage Advisor

- Mortgages For Self Employed Or Fixed Term Contractors Equifax Uk

If you are searching for Government Departments Ireland you've arrived at the perfect place. We ve got 104 images about government departments ireland adding images, pictures, photos, wallpapers, and more. In such page, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

They will usually ask to see your sa302 form from hmrc.

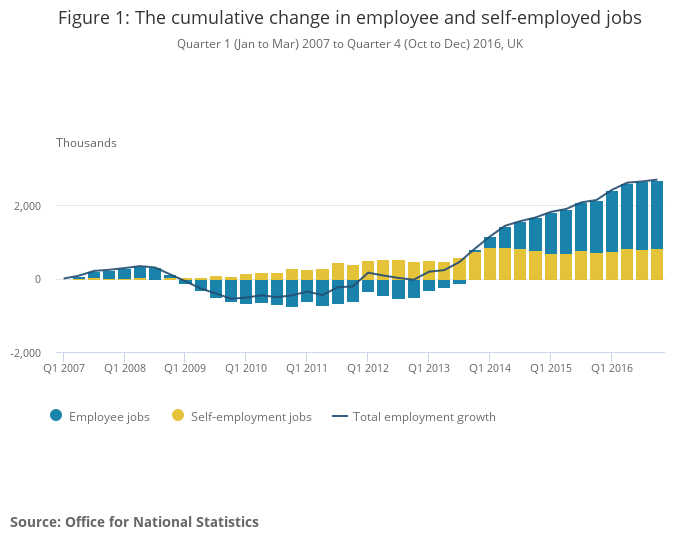

Government departments ireland. Most lenders require three years trading history before they will consider the applicants income stable enough to lend on. You have two years of accounts or self assessment tax returns available. Common problems with self employed mortgages the most common problem for a self employed person applying for a mortgage is only having one year of accounts.

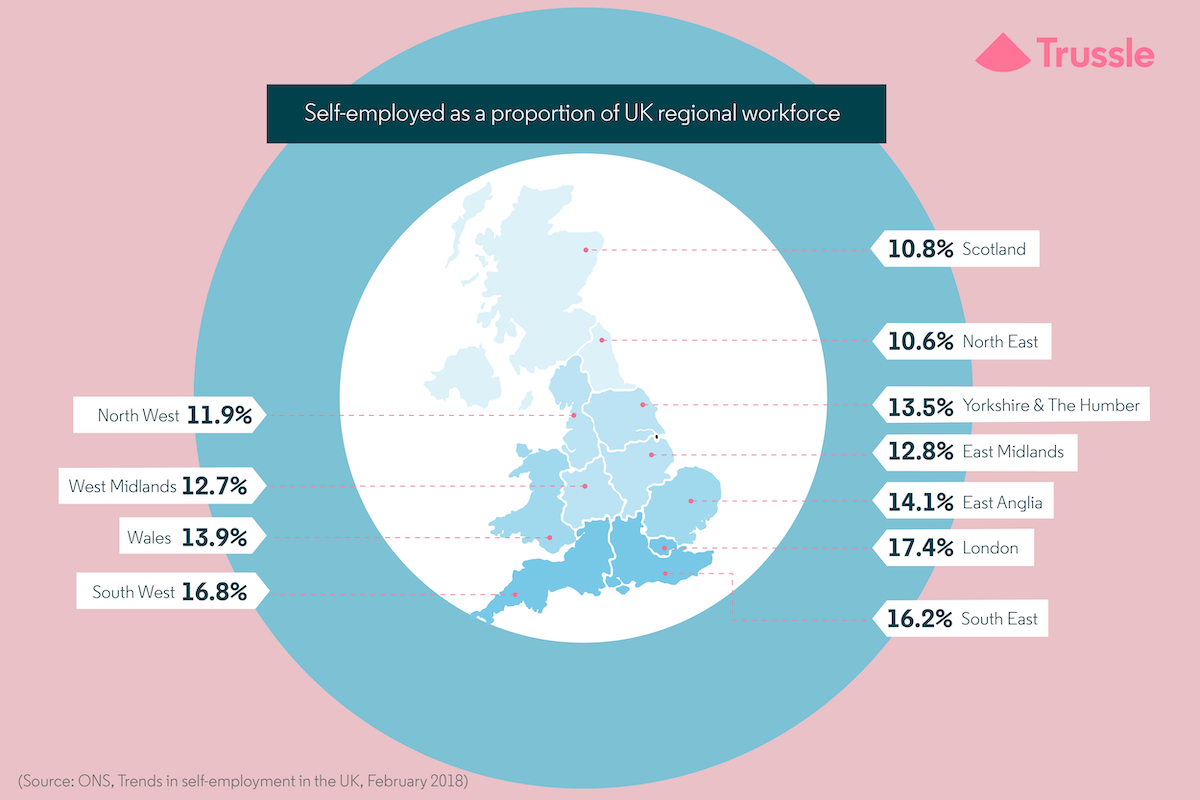

A self assessment tax calculation can be obtained from hm revenue customs which is a form sa302. Some of the requirements when applying for a self employed mortgage include proof of income as discussed above deposit credit history and age. For a lender to establish a self employed borrowers annual income a proven and well documented history of trading is required.

With a little preparation now you could be ready to take steps towards being a homeowner in the new year. If youre self employed and want to get on the property ladder in 2020 now is the time to start preparing. You could be a sole trader a partner or director or a contractor who has set up a limited company.

Lenders will often average out the last two or three years. At least 2 years of personal tax returns including form w2 if you pay yourself a salary. Most lenders are happy to give mortgages for self employed people if.

If business accounts are requested the latest accounts must be provided and be no more than 18 months prior to the mortgage application. Deposit requirements for sole trader mortgages are not different from those of other types of mortgages. Many lenders require two or three years.

Self employed mortgage requirements whether or not you choose to incorporate stay solo or run a partnership lenders will probably ask you for most of the following some of which youll need your accountants help to prepare. A big increase in your income or uneven income over recent years can also prove problematic. When considering your income mortgage lenders will usually want to see at least 2 years worth of accounts.

As a general rule well need to see proof of your income for the past two complete tax. There may be some discretion around the deposit thats required or your credit rating. When you apply for a mortgage well consider you to be self employed if you have more than a 20 share of the business from which you get your main income.

The form will display the information required which covers a specified period typically two years. If you set up your self employed business as a sole trader then calculating your income will be much easier as all company profit is yours to keep.

More From Government Departments Ireland

- Self Employed Electrician

- Uk Furlough Scheme To Be Extended

- Government Tyranny Memes

- Self Employed Sss Contribution 2018

- Government Covid Meme Generator

Incoming Search Terms:

- Self Employed Mortgage Broker Mortgageable Government Covid Meme Generator,

- The Self Employed Mortgage Guide The Key To Buying Any Property Amazon Co Uk Das Gary 9781781334034 Books Government Covid Meme Generator,

- Wiunv6vhoav7km Government Covid Meme Generator,

- Self Employed Mortgage Advice Right Mortgage Uk Government Covid Meme Generator,

- Self Employed Mortgage Checklist Springtide Government Covid Meme Generator,

- Mortgages For Self Employed Buyers Which Government Covid Meme Generator,