1099 Self Employed Form, Turbotax Self Employed Online 2019 File Self Employment Taxes

1099 self employed form Indeed lately has been sought by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of the post I will talk about about 1099 Self Employed Form.

- Your Complete Guide To Self Employment Taxes In 2020 Ridester Com

- Pesonal Income Taxes

- 1099 Misc Form And Other Tax Forms Online Only At Stubcreator

- 1099 Misc Form Fillable Printable Download Free 2019 Instructions

- How To Fill Out Schedule Se Irs Form 1040 Youtube

- Irs Form 1099 Reporting For Small Business Owners In 2020

Find, Read, And Discover 1099 Self Employed Form, Such Us:

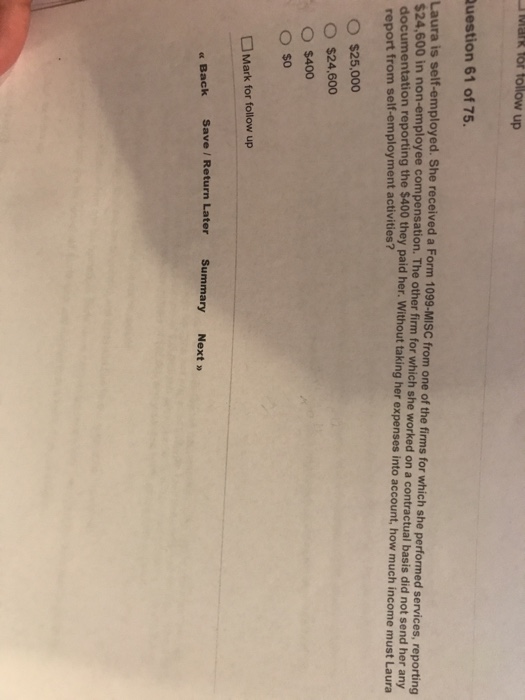

- Solved How Much Income Must Lura Report From Self Employm Chegg Com

- 4 Tax Programs To File Self Employed Taxes Online For Less Than 100 Careful Cents

- Form 1099 K Decoded For The Self Employed Turbotax Tax Tips Videos

- Help How Do I Report Self Employment Income For Medicaid Or The Marketplace Healthcare Counts

- Turbotax Self Employed Online 2019 File Self Employment Taxes

If you re searching for Government Budget Surplus Equals you've arrived at the right location. We have 104 images about government budget surplus equals adding images, pictures, photos, backgrounds, and much more. In these webpage, we additionally provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Filing Taxes 1099 Form As An Independent Contractor Walk Through Everlance Government Budget Surplus Equals

You dont necessarily have to have a business for payments for your services to be reported on form 1099 misc.

Government budget surplus equals. If payment for services you provided is listed in box 7 of form 1099 misc miscellaneous income the payer is treating you as a self employed worker also referred to as an independent contractor. The social security administration shares the information with the internal revenue service. The 1099 form 2019 is used by business owners and freelancers to document and report their outside employment paymentsearnings.

Employers furnish the form w 2 to the employee and the social security administration. The self employment tax applies evenly to everyone regardless of your income bracket. If youre certainly one of over 44 million retired americans theres a good probability youve come throughout tax form 1099 r.

The biggest reason why filing a 1099 misc can catch people off guard is because of the 153 self employment tax. The wage and tax statement for the self employed form 1099 proves your wages and taxes as a self employed person. You dont necessarily have to have a business for payments for your services to be reported on form 1099 misc.

If payment for services you provided is listed in box 7 of form 1099 misc miscellaneous income the payer is treating you as a self employed worker also referred to as an independent contractor. Report payments made in the course of a trade or business to a person whos not an employee. 1099 misc 1099 misc form is used for self employed or independent conductors.

The form may be filed by either the business or the worker. Paying taxes on your self employment income. You must also send a copy of this form to the irs by january 31.

It must be filled for every income of 600 or more during the tax year. Form 1099 nec is used by payers to report payments made in the course of a trade or business to others for services. Along with completing your customary irs form 1040 and1099 s form instructions are attached youre required to complete type form 1099 r instructions are included if youve acquired any distributions from revenue sharing or retirement plans iras annuities pensions and extra.

If you paid someone who is not your employee such as a subcontractor attorney or accountant 600 or more for services provided during the year a form 1099 nec needs to be completed and a copy of 1099 nec must be provided to the independent contractor by january 31 of the year following payment. Payers use form 1099 misc miscellaneous income to. The 1099 tax rate consists of two parts.

If after reviewing the three categories of evidence it is still unclear whether a worker is an employee or an independent contractor form ss 8 determination of worker status for purposes of federal employment taxes and income tax withholding pdf can be filed with the irs. Its very important to report to irs by 1099 misc about every job made.

More From Government Budget Surplus Equals

- Government Surplus Cheese Underground Cave

- Small Government Building Minecraft

- Government Guidelines Covid

- Is Furlough Extension For Self Employed

- How Does New Furlough Scheme Work

Incoming Search Terms:

- 4 Important Things To Know About Form 1099 Taxact Blog How Does New Furlough Scheme Work,

- Taxes For Tutors Part 1 First Steps 1099s How Does New Furlough Scheme Work,

- The Difference Between A W2 Employee And A 1099 Employee Ips Payroll How Does New Furlough Scheme Work,

- What Is A 1099 Form And How To File It Fileunemployment Org How Does New Furlough Scheme Work,

- How To Fill Out Form 1099 Misc Youtube How Does New Furlough Scheme Work,

- How To Report 1099 Misc Box 3 Payments On Your 1040 How Does New Furlough Scheme Work,

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png)