Self Employed 1099 Form 2020, How To File Taxes As A Freelancer Chime

Self employed 1099 form 2020 Indeed lately is being hunted by users around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the post I will discuss about Self Employed 1099 Form 2020.

- W 2 Form Fillable Printable Download Free 2020 Instructions Formswift

- Self Employment Statement Fill Out And Sign Printable Pdf Template Signnow

- What Is Self Employment Tax Rate Calculations More

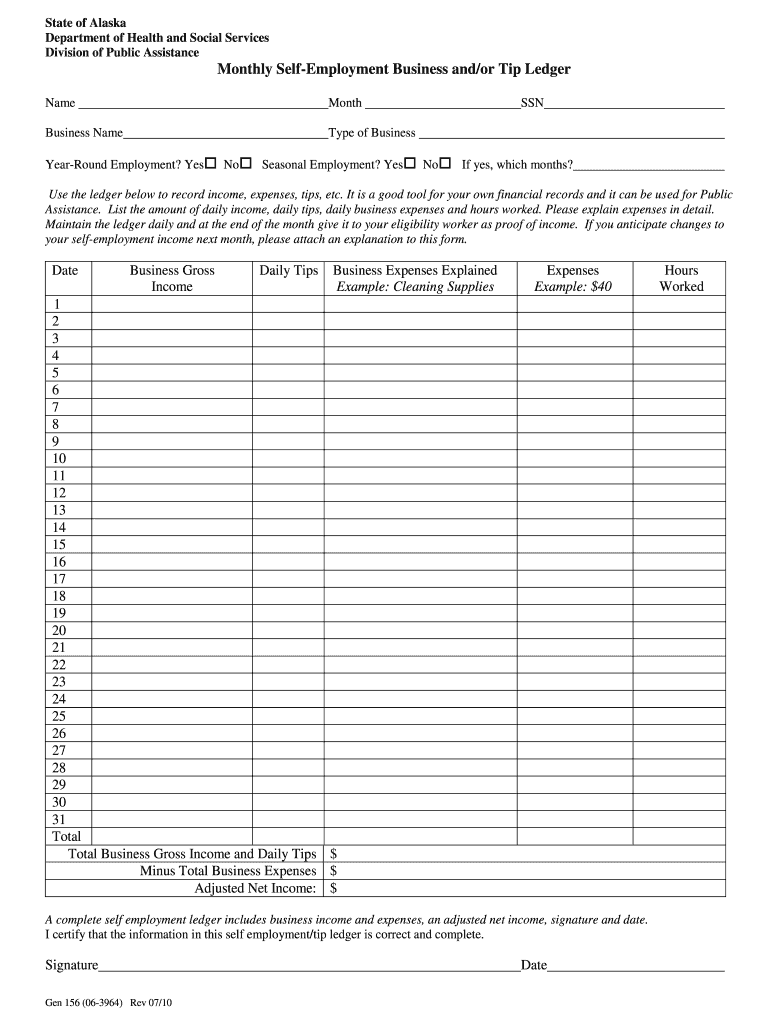

- Self Employment Ledger Fill Out And Sign Printable Pdf Template Signnow

- Form 1099 Nec What Is It

- Instructions For 1099s 2018 Fill Out And Sign Printable Pdf Template Signnow

Find, Read, And Discover Self Employed 1099 Form 2020, Such Us:

- 1099 Form 2020 1099 Forms

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcs8xg4ki9ggqodzdlwisvrx3ilzzyeurlyzys U9ylky Infv3d Usqp Cau

- Understanding Your Instacart 1099

- Answers To Frequently Asked Questions About The Uaw Fca Ford General Motors Legal Services Plan S 1099 Misc Form

- What Are Irs 1099 Forms

If you are searching for Government Student Loans Interest Rate you've come to the right place. We have 104 images about government student loans interest rate including pictures, photos, photographs, wallpapers, and more. In such webpage, we also have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Form 1099 step by step instructions on how to e file the form.

/w2-9ca13523f4d74e958b821aab63af2e60.png)

Government student loans interest rate. What is 1099 form. The separate instructions for filersissuers for form 1099 nec are available in the 2020 instructions for forms 1099 misc and 1099 nec. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits.

On monday may 11 self employed individuals can apply for relief. For example if you are a freelance writer. Unemployment assistance is available for self employed 1099 workers in our area.

The social security administration uses the information from schedule se to figure your benefits under the social security program. Whether you have your own business are. Your net earnings from self employment excluding church employee income were 400 or more.

If payment for services you provided is listed in box 7 of form 1099 misc miscellaneous income the payer is treating you as a self employed worker also referred to as an independent contractor. Unemployment assistance available for self employed 1099 workers may 9 2020. In common words a 1099 form reports all income earnings dividends payments and other personal income.

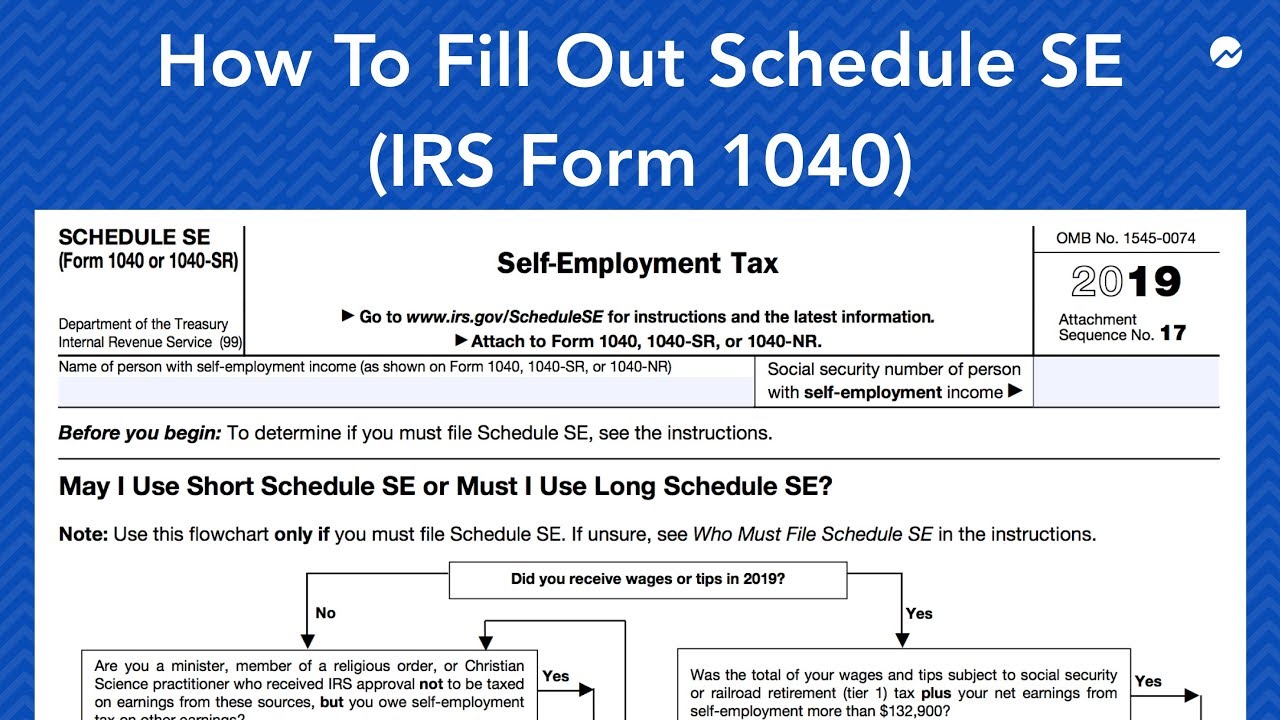

Beginning with tax year 2020 you must use form 1099 nec nonemployee compensation to report payments of nonemployee compensation nec previously reported in box 7 on form 1099 misc. Use schedule se form 1040 or 1040 sr to figure the tax due on net earnings from self employment. Aside from reporting self employed earnings the 1099 2019 tax forms also register such revenue types as government benefits various types of awards rental payments etc.

E file form 1099 with your 2020 2021 online tax return. You must pay self employment tax and file schedule se form 1040 or 1040 sr if either of the following applies. From the illinois department of employment security.

While many employees are finishing up filing w 2s or 1099 forms for taxes some may find themselves in a unique situation that is being self employed. Do you have independent contractor self employed income as reported on a form 1099 and not sure how to prepare and efile your taxes. Generally your net earnings from self employment are subject to self employment tax.

April 15 is due date. Printable versions for 1099 form for the 2020 year in pdf doc jpg and other popular file formats. If you are a worker earning a salary or wage your employer reports your annual earnings at year end on form w 2however if you are an independent contractor or self employed you should receive a form 1099 nec 1099 misc in prior years from each business client that pays you at least 600 during the tax year.

You dont necessarily have to have a business for payments for your services to be reported on form 1099 misc. 1099 is taxable income on your 2020 or 2021 tax return. The most popular type is a 1099 misc form.

More From Government Student Loans Interest Rate

- Government And Public Administration Career Cluster Activities

- Self Employed Resume Sample

- Self Employed Claiming Universal Credit

- Self Employed Furlough Scheme How Much

- Self Employed Furlough Contact Number

Incoming Search Terms:

- Michigan Unemployment Self Employed 1099 Contractors Gig Workers Can Apply Today Self Employed Furlough Contact Number,

- Other Income On Form 1040 What Is It Self Employed Furlough Contact Number,

- Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service Self Employed Furlough Contact Number,

- Https Home Treasury Gov System Files 136 How To Calculate Loan Amounts Pdf Self Employed Furlough Contact Number,

- Form 1099 K Definition Self Employed Furlough Contact Number,

- W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch Self Employed Furlough Contact Number,

/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)