Furlough Scheme Pay Rules, Coronavirus Flexible Furloughing What Are The Details

Furlough scheme pay rules Indeed recently is being sought by users around us, maybe one of you personally. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the post I will discuss about Furlough Scheme Pay Rules.

- Https Www Britishchambers Org Uk Media Get Furlough 20agreement 20letter 20v3 Pdf

- United Kingdom Further Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C

- What Is Furlough Definition Pros Cons More

- Job Retention Schemes During The Covid 19 Lockdown And Beyond

- All You Need To Know About The Flexible Furlough Scheme Paris Smith

- Job Support Scheme What Do The October Furlough Changes Mean

Find, Read, And Discover Furlough Scheme Pay Rules, Such Us:

- J4pepq7uqzglwm

- Furlough Scheme Replacement Extended Sunak The Independent

- The Coronavirus Job Retention Scheme Qandas For Employers Ashurst

- Lewis Silkin Wind Down Of Furlough Scheme Timeline And Key Questions For Employers

- Furlough Scheme Still Shutting Out New Starters Not Paid Before 19 March Personnel Today

If you re looking for Self Employed Vs Freelance you've come to the perfect location. We ve got 100 graphics about self employed vs freelance including images, photos, pictures, backgrounds, and more. In such webpage, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Furloughed workers are entitled to pre furlough rates of pay and therefore this will have to be topped up by the employer if workers are receiving 80 of their pay up to a.

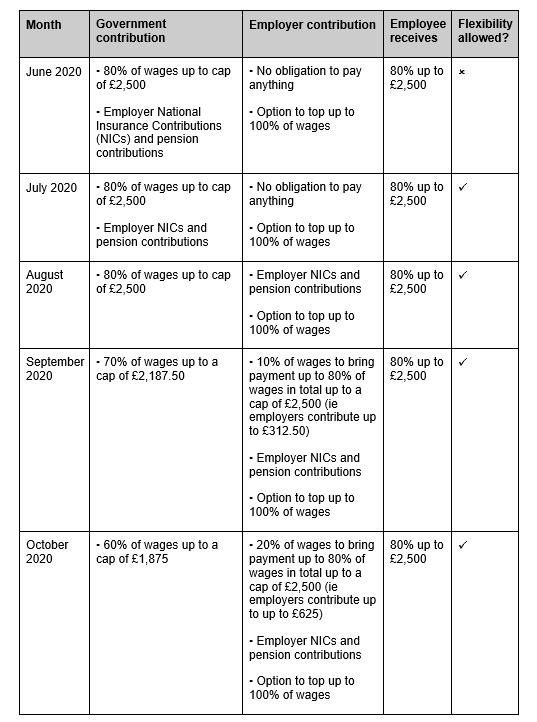

Self employed vs freelance. The coronavirus job retention scheme will pay furloughed employees 80 of their current salary for hours not worked up to a maximum of 2500. Flexible furlough must last for at least 7 days in a calendar month for an employer to make a claim. In view of the two extensions to the furlough scheme the issue of what happens to holidays is important.

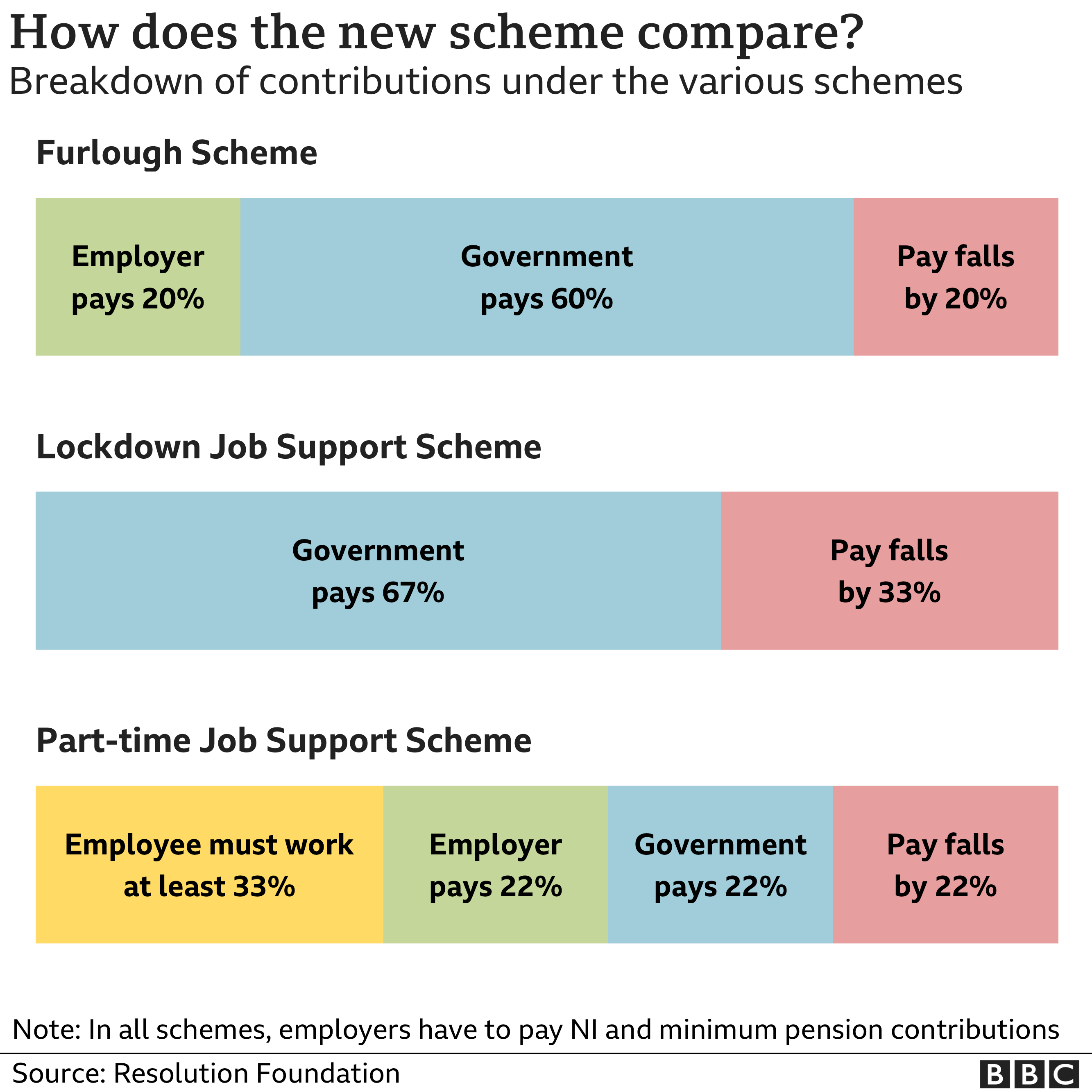

Pay during furlough is taxable in the same way as someones usual pay would be. This scheme will be slightly different from the furlough scheme and is designed to support jobs. When the scheme was first announced the government said it would be open to those who had started or joined a paye payroll scheme by 28 february 2020.

The coronavirus job retention scheme cjrs better known as the furlough scheme will be extended for another month following the announcement of a new national lockdown. Here are the new furlough changes from today october 1. New furlough rules from today how your pay will be affected image.

The furlough scheme will effectively close on october 31 when it will be replaced by a new job support scheme for. Holiday and the furlough scheme what are the rules. New furlough rules from thursday how your pay is changing on october 1.

Getty imagesistockphoto read more related articles. The rules are changing. Under the coronavirus jobs retention scheme to give furlough its official title employees placed on leave receive 80 of their pay up to a maximum of 2500 a month.

The rules say that employers must claim for a. And while the furlough scheme is still going the government is scaling back its contributions for the second time since march. The employer and employee must agree any reduction in pay at the outset in accordance with the furlough process.

Between march and july the government paid for 80 of furloughed workers wages up to 2500 a month and it also. The furlough scheme has been extended until december 2020. Who is entitled to furlough pay.

Pay entitlement under the furlough scheme.

More From Self Employed Vs Freelance

- Market Failure And Government Intervention Ppt

- Government Expenditure Multiplier With Tax

- Furlough Rules In September

- Self Employed Furlough Scheme And Universal Credit

- Self Employed Tax Allowance 1920

Incoming Search Terms:

- Kllsf53i7ni2fm Self Employed Tax Allowance 1920,

- Furlough Scheme Extended To The End Of March 2021 Which News Self Employed Tax Allowance 1920,

- Furlough Hmrc Clarifies Tupe Rules And Warns Against Fraud Personnel Today Self Employed Tax Allowance 1920,

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk Self Employed Tax Allowance 1920,

- Rishi Sunak To End New Applications To Uk Furlough Scheme Financial Times Self Employed Tax Allowance 1920,

- United Kingdom Further Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C Self Employed Tax Allowance 1920,