Government Expenditure Multiplier With Tax, The Concept Of Balanced Budget Multiplier Bbm

Government expenditure multiplier with tax Indeed lately has been sought by users around us, maybe one of you. People are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of this article I will discuss about Government Expenditure Multiplier With Tax.

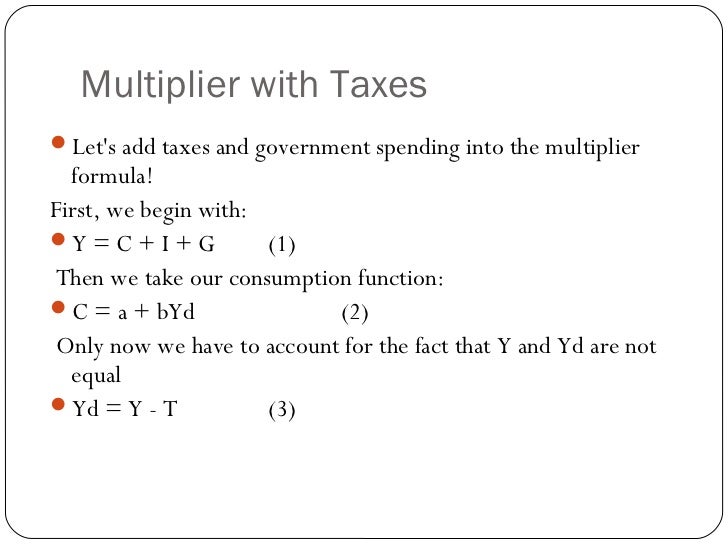

- Eco 200 Principles Of Macroeconomics Ppt Download

- The Multiplier Effect And The Simple Spending Multiplier Definition And Examples Video Lesson Transcript Study Com

- Https Apcentral Collegeboard Org Pdf Teaching Spending Multipliers Pdf Course Ap Macroeconomics

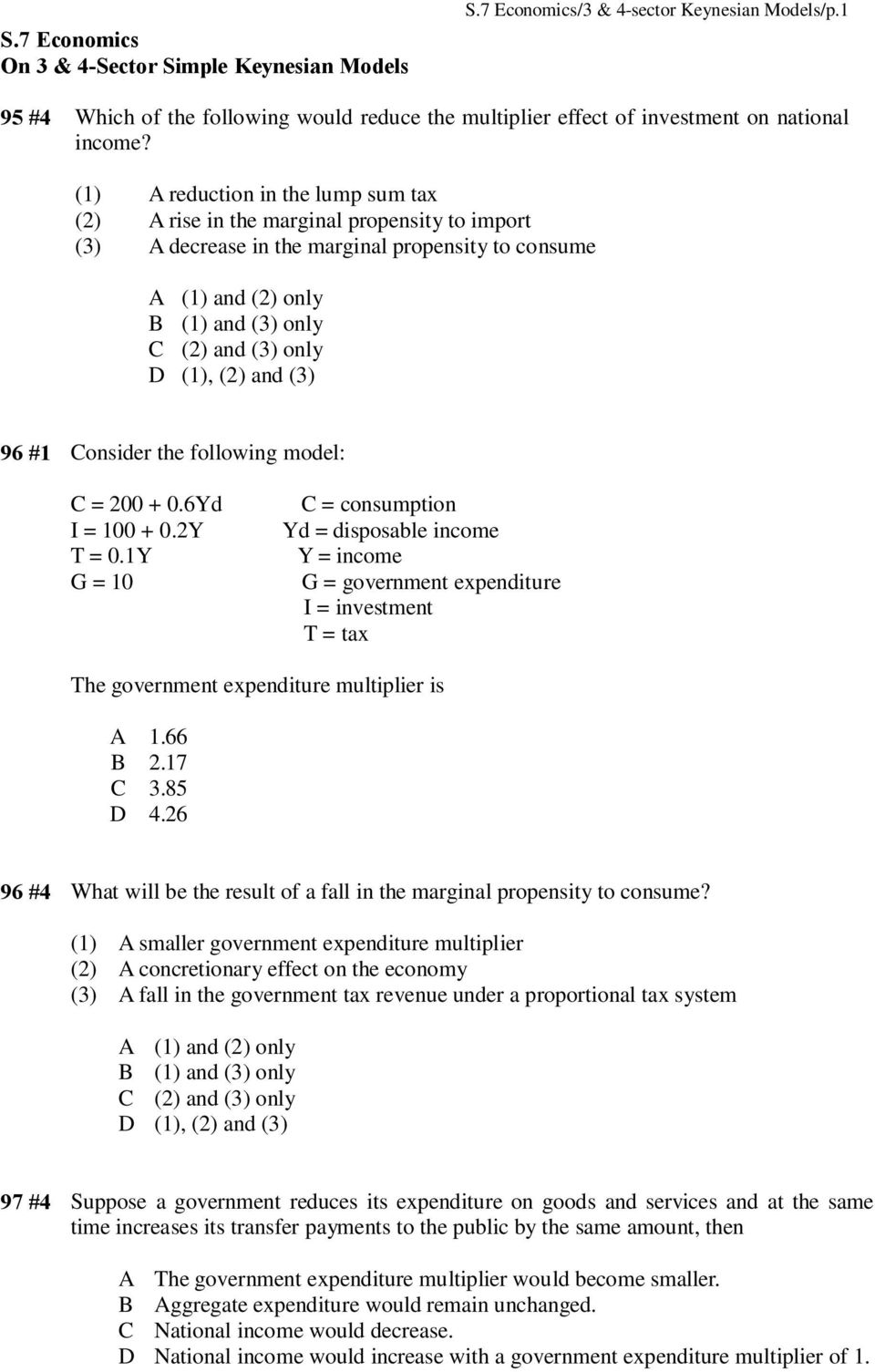

- 1 A Reduction In The Lump Sum Tax 2 A Rise In The Marginal Propensity To Import 3 A Decrease In The Marginal Propensity To Consume Pdf Free Download

- Fiscal Policy The Tax Multiplier Youtube

- Calculating Change In Spending Or Taxes To Close Output Gaps Video Khan Academy

Find, Read, And Discover Government Expenditure Multiplier With Tax, Such Us:

- Pdf Government Spending An Economic Boost

- Consumption Savings Mpc Mps Multiplier Analysis Ppt Download

- Reading The Multiplier Effect Macroeconomics

- Https Apcentral Collegeboard Org Pdf Teaching Spending Multipliers Pdf Course Ap Macroeconomics

- Consumption Savings Mpc Mps Multiplier Analysis Ppt Download

If you are looking for Government Of Canada you've arrived at the right place. We have 104 images about government of canada including images, photos, photographs, backgrounds, and much more. In such page, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

The balanced budget multiplier is based on the combined operation of the tax multiplier and the government expenditure multiplier.

Government of canada. Pajak tax dan pengeluaran pemerintah government spending. Save 10 of income. Thus tax multiplier is negative and in absolute terms one less than government spending multiplier.

Interestingly the tax multiplier is always smaller than the expenditure multiplier by exactly 1 1. 81 of income to people through the economy. The government spending multiplier and the tax multiplier.

Fiscal policy is more effective in countries with greater mpc because these countries tend to have a greater g m all else equal. Dalam tulisan ini kebijakan fiskal yang penulis bahas hanya terbatas pada dua cara yakni. Save 10 of income.

Spend 90 of income. In the balanced budget multiplier the tax multiplier is smaller than the government expenditure multiplier. Mekanisme kerja dari fiscal policy ini ternyata sangat dipengaruhi oleh angka penggandanya multiplier.

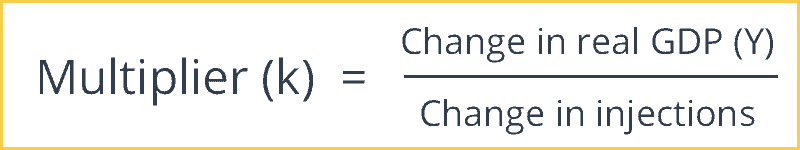

Save 10 of income. Change in rgdp 1 1mpc x change in g implication. How much income would expand depends on the value of mpc or its reciprocal mps.

Tax multiplier for the economy is calculated using the formula given below tax multiplier mpc 1 mpc tax multiplier 077 1 077 tax multiplier 333. In other words an autonomous increase in government spending generates a multiple expansion of income. The following formula gives the impact on rgdp of a change in g.

Thus k g yg and y k g. The government expenditure multiplier is thus the ratio of change in income y to a change in government spending g. It shows how gdp increases or decreases in response to the changes in government spending.

The formula for k t is. Given the same value of marginal propensity to consume simple tax multiplier will be lower than the spending multiplier. 90 of income to people through the economy.

This is because in the first round of increase in government expenditures consumption increases by 100 while in case of a decrease in taxes of the same amount consumption increase by a factor of mpc. The tax multiplier tells us the final increase in real gdp that will occur as the result of a change in taxes. The spending multiplier measures fiscal policy effects on the economy.

This number is related mainly to how much consumers save. Spend 90 of income. Second round increase of 100 10 90.

Third round increase of 90 9 81. Again how much national income would decline following an increase in tax receipt depends on the value of mpc.

More From Government Of Canada

- Us Government Agency Logos

- What Is Being Furloughed From Your Job Mean

- Government Meaning In Tagalog

- No Furlough For Scotland

- Self Employed Womens Association Lucknow

Incoming Search Terms:

- Calculating Change In Spending Or Taxes To Close Output Gaps Video Khan Academy Self Employed Womens Association Lucknow,

- Keynesian Multiplier Ubc Wiki Self Employed Womens Association Lucknow,

- Government Expenditure Multiplier Youtube Self Employed Womens Association Lucknow,

- Calculating The Spending Multiplier Macroeconomics Youtube Self Employed Womens Association Lucknow,

- Topic 3 Fiscal Policy Circular Flow Keynesian Economics Taxes And Government Spending Ppt Download Self Employed Womens Association Lucknow,

- The Mpc The Mps And The Keynesian Spending Multiplier Youtube Self Employed Womens Association Lucknow,