Self Employed Furlough Scheme And Universal Credit, Furlough Scheme Extended To The End Of March 2021 Which News

Self employed furlough scheme and universal credit Indeed recently is being sought by consumers around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the post I will talk about about Self Employed Furlough Scheme And Universal Credit.

- Self Employment Understanding Universal Credit

- Check If You Can Claim A Grant Through The Self Employment Income Support Scheme Newton Abbot Exeter Peplows

- Martin Lewis Reveals When Self Employed Brits Can Expect To Be Contacted And Paid By Hmrc Via Coronavirus Furlough Scheme Wales Online

- Safe Harbour Resolution Foundation

- Covid Do All Tier 3 Area Workers Get 80 Of Their Wages Bbc News

- Pay For More Than 6m Uk Workers Now Covered By Furlough Scheme Financial Times

Find, Read, And Discover Self Employed Furlough Scheme And Universal Credit, Such Us:

- Help For The Self Employed Won T Save Everybody Free To Read Financial Times

- Chancellor Gives Support To Millions Of Self Employed Individuals Gov Uk

- Over One Million Self Employed Are Not Eligible For Government S Coronavirus Income Support Scheme

- Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

- Chancellor Extends Self Employment Support Scheme And Confirms Furlough Next Steps Gov Uk

If you are searching for Types Of Government Quiz Quizlet you've reached the ideal location. We have 100 images about types of government quiz quizlet adding pictures, pictures, photos, wallpapers, and more. In such webpage, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Coronavirus Self Employed Income Support Scheme Seiss Crispin Blunt Mp Types Of Government Quiz Quizlet

Anyway im panicking that my uc application will affect my furlough payment now and wondering whether to cancel the claim.

Types of government quiz quizlet. They say theyre waiting for hmrc to confirm the scheme. More on the interaction between universal credit and the self employed grant scheme. Ingram explains that claimants may continue to work but will receive a deduction from the amount of uc they receive depending on their profits.

Weve explained how furlough affects your benefits and universal credit payments credit. And an immediate priority should be to strengthen universal credit for the many self employed workers who will really need it in the months ahead. The observer uk job furlough scheme.

Alamy under the scheme businesses across the uk can claim 80 per cent of your wages up to 2500 a. Apply for universal credit. However from 1 november the scheme will be extended.

For the self employed awaiting the grant any universal credit claim now wont affect future grant payments. Usual payday is mid of each month. Self employment income support scheme seiss you can no longer make a claim for the first two seiss grants.

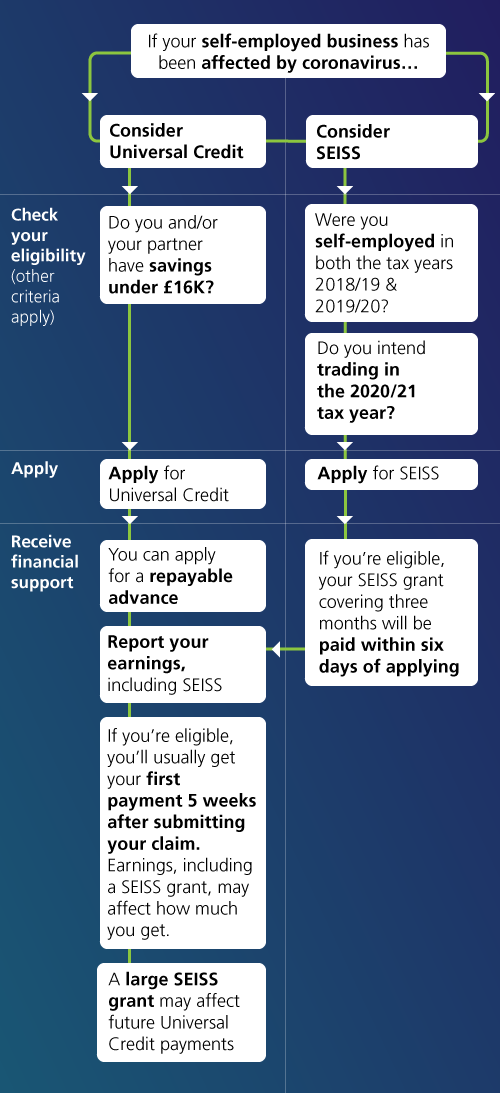

If your business has been affected by coronavirus covid 19 you may be able to get a grant through the self employment income support scheme. For more about any aspect of universal credit see the understanding universal credit website including information about universal credit and self employment. The suns welfare expert explains all you need to know about claiming universal credit and self employed grants credit.

From 23 september all self employed people making a new universal credit claim have been given a 12 month grace period before the minimum income floor kicks in even if theyve been self employed for more than a year. Furlough and universal credit. You applied for universal credit since 23 september 2020 and are in your 12 month grace period.

Self employed avoid big cut to universal credit after return of the minimum income floor. You can apply for a self employed government grant of up to 7500. Up to 512 per month may be earned 292 pm if in receipt of housing benefit with no deduction from uc.

Martin Lewis Tip On Coronavirus Self Employment Scheme Application If You Re On Universal Credit Edinburgh Live Types Of Government Quiz Quizlet

More From Types Of Government Quiz Quizlet

- Self Employed Furlough Scheme Apply

- Government Grants For Homeowners

- Us Government Debt To Gdp Ratio 2020

- Us Government Spending Breakdown 2019

- Self Employed Furlough Taxable

Incoming Search Terms:

- Coronavirus Furlough Extension Bad News For New Starters Bbc News Self Employed Furlough Taxable,

- Self Employed Income Support Scheme Seiss To Be Doubled For November Self Employed Furlough Taxable,

- 2 Self Employed Furlough Taxable,

- The Effects Of The Coronavirus Crisis On Workers Resolution Foundation Self Employed Furlough Taxable,

- Up To 5 6 Million People Are At High Risk Of Losing Work And Falling Through The Cracks In New Economics Foundation Self Employed Furlough Taxable,

- 950 000 Apply For Universal Credit In Two Weeks Of Uk Lockdown World News The Guardian Self Employed Furlough Taxable,