Self Employed Furlough Scheme August, Xczx6koq Blcvm

Self employed furlough scheme august Indeed lately has been sought by users around us, maybe one of you personally. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of this post I will talk about about Self Employed Furlough Scheme August.

- Coronavirus Self Employed And Furlough Support Schemes Extended Farmers Weekly

- Covid 19 Personal Tax Self Assessment French Duncan Professional Chartered Accountants

- Self Employed Income Support Scheme Coronavirus Job Retention Scheme Update 8 June 2020 Holden Associates

- 1 Uatdeuy Qelm

- Furloughed Workers Will Still Get 80 Of Their Salaries Until October Metro News

- Employers To Contribute To Furlough Scheme From August

Find, Read, And Discover Self Employed Furlough Scheme August, Such Us:

- More Than One In Four Uk Workers Now Furloughed Bbc News

- Furlough Scheme Extended To 31 October 2020 Churchgates

- Support For Self Employed Extended And Furlough Scheme Changes Confirmed Your Money

- Chancellor Confirms Employers Will Need To Contribute To Coronavirus Job Retention Scheme From August

- Seiss Deadline Falls Next Week As Self Employed Numbers Fall By 238 000 How To Apply Personal Finance Finance Express Co Uk

If you re looking for Self Employed Jobkeeper Application you've come to the right place. We ve got 101 graphics about self employed jobkeeper application including pictures, photos, photographs, wallpapers, and more. In such web page, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Coronavirus Businesses Must Pay Towards Furlough Scheme From August Chancellor Announces Business News Sky News Self Employed Jobkeeper Application

Information about what to do if you were not eligible for the grant or have been overpaid has.

Self employed jobkeeper application. For more info see martins video below on zero hours workers. If you are self employed therefore taxed through self assessment and not paye you wont be eligible for furlough or the job support scheme but you may be eligible for the self employment income support scheme grants or be able to claim benefits. The scheme will then end on october 31.

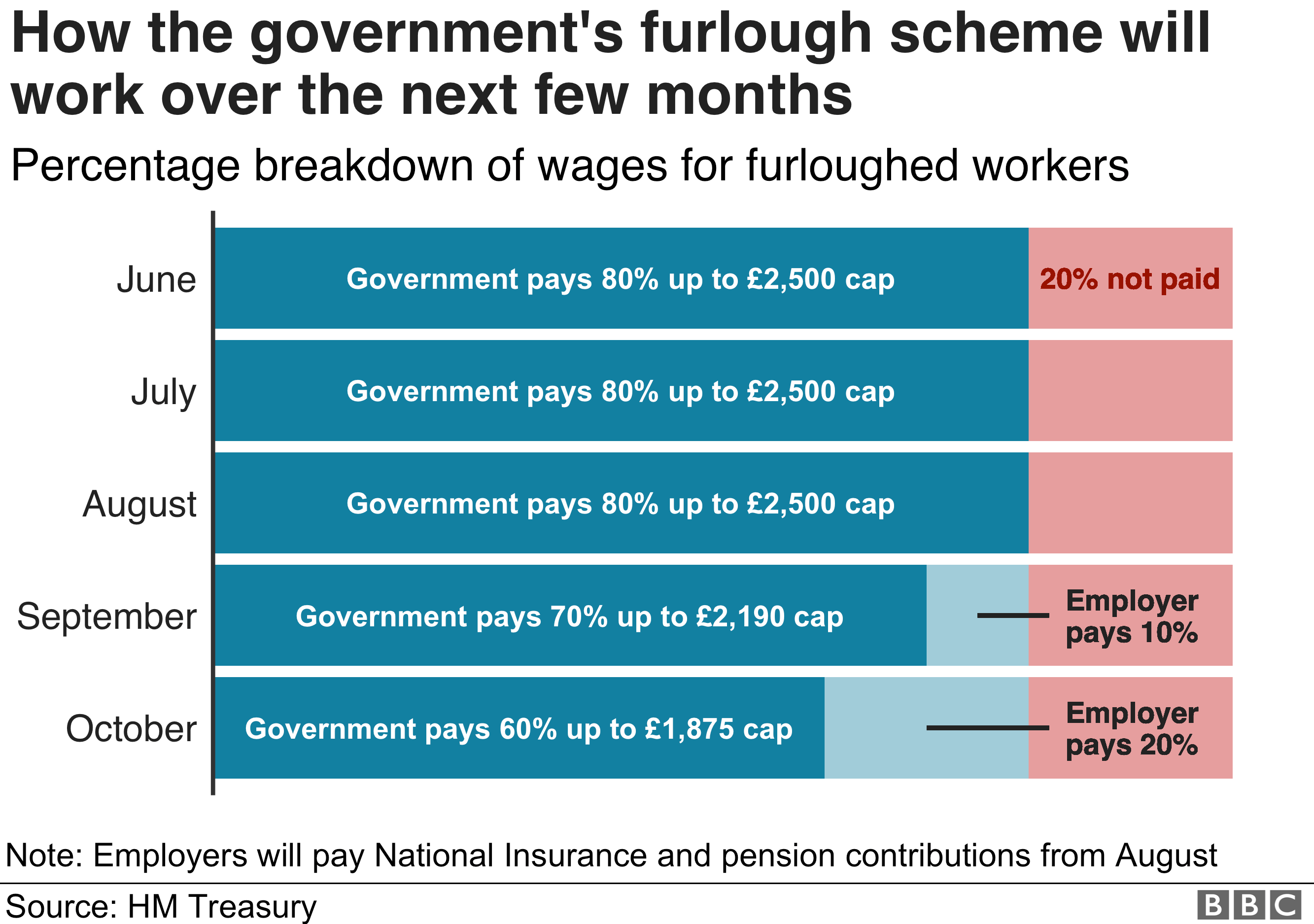

Furlough changes from august 1 explained with employers starting to pay wages. It means employers footing the bill for 23 per cent of employment costs. Self employment income support scheme up until 19 july 27 million workers claimed under the self employment income support scheme seiss with the total value of claims standing at 78bn.

Seiss allows eligible applicants to receive a taxable grant worth 80 of average monthly profits based on the last three years of tax returns up to a. Those eligible for the self employment income support scheme seiss will be able to claim the additional grant in august which will be worth up to 70 of their average monthly trading profits though its capped at 6570 overall. Individual firms will decide the hours and shift patterns their employees will work on their return so that they can decide on the best approach for them and will.

The coronavirus job retention scheme cjrs better known as the furlough scheme will be extended for another month following the announcement of a new national lockdown. Furlough scheme and self employed scheme update august 3rd 2020 from 1 july 2020 businesses will be given the flexibility to bring furloughed employees back to work part time. The self employed could face financial calamity if the government does not expand its support scheme further bringing them closer in line with the latest furlough changes it has been claimed.

Between march and july the government paid for 80 of furloughed workers wages up to 2500 a month and it also covered employers national insurance ni and. The money will again be paid out in a single instalment covering june july and august. In the second round in august eligible people got 70 of their.

More From Self Employed Jobkeeper Application

- Korean Government Scholarship 2021

- What Is Furlough Uk

- Government Law Colleges In Delhi For Ba Llb

- Government Tax Spending Chart

- Government Forms Pdf

Incoming Search Terms:

- Guidance On New Furlough And Self Employed Schemes Naylor Accountancy Services Ltd Government Forms Pdf,

- Hm Revenue Customs On Twitter New From 17 August Customers Will Be Able To Claim Their Second Self Employed Income Support Scheme Grant As Jimharrahmrc Has Just Told Martinslewis Itvmlshow Https T Co Wh0nx1qhs5 Government Forms Pdf,

- Support For Self Employed Extended And Furlough Scheme Changes Confirmed Your Money Government Forms Pdf,

- Self Employed Support Michelle Donelan Mp Government Forms Pdf,

- Coronavirus Businesses Must Pay Towards Furlough Scheme From August Chancellor Announces Business News Sky News Government Forms Pdf,

- Sunak Announces Revisions To Furlough Extends Support For Self Employed Government Forms Pdf,