Self Employed Tax Deductions List, How To Fill Out Your Tax Return Like A Pro The New York Times

Self employed tax deductions list Indeed lately is being sought by consumers around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will talk about about Self Employed Tax Deductions List.

- How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

- Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax Credits For People Who Work

- Resources Tax 29

- How To Fill Out Your Tax Return Like A Pro The New York Times

- The Epic Cheat Sheet To Deductions For Self Employed Rockstars

- What Is Self Employment Tax And Schedule Se Stride Blog

Find, Read, And Discover Self Employed Tax Deductions List, Such Us:

- The Tax Deduction List For Self Employed Professionals Elorus Blog

- Income Tax Deduction Exemptions Section 80c 80ccd 80d 80gg Finserv Markets

- The Epic Cheat Sheet To Deductions For Self Employed Rockstars

- Turbotax Self Employed Review 2020 Features Pricing The Blueprint

- Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax Credits For People Who Work

If you re searching for Quickbooks Self Employed App Review you've arrived at the right location. We ve got 104 images about quickbooks self employed app review adding images, pictures, photos, wallpapers, and much more. In such page, we additionally have number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Self employed record keeping checklist.

Quickbooks self employed app review. Or choose turbotax live full service for self employed. They swoop in lower your tax bill and save your wallet from some serious destruction. A document published by the internal revenue service irs that provides information on how taxpayers who use.

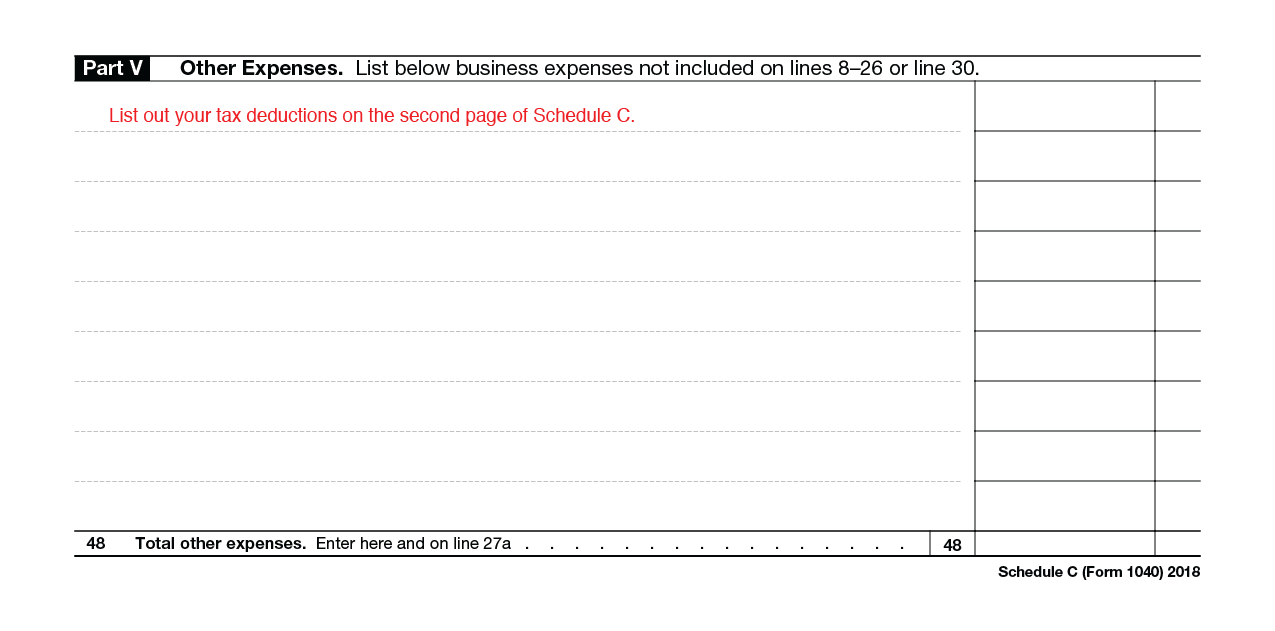

For self employed business owners deductions are taken on a schedule c profit or loss from business or a schedule c ez for tax filers with deductions totaling less than 5000. Its likewise critical to building up a framework to document and track your receipts and costs so you are composed with regards to tax time. Business expenses whereas taxpayers employed at a company may only deduct business expenses that exceed 2 percent of their adjusted gross income agi self employed taxpayers may deduct most business expenses without.

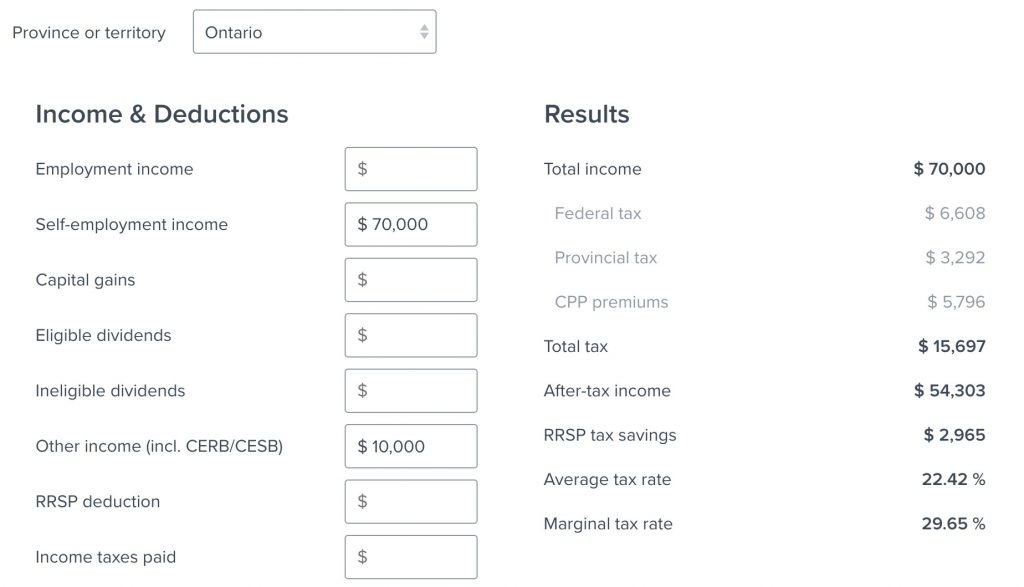

For self employed professionals with less than 100 employees. This list is relevant for many self employed professionals. For the self employed the combination of self employment taxes and income taxes can easily add up to be the biggest single expense you will face in your annual budget.

Click here to download our self employed tax prep checklistuse this checklist with turbotax self employed to make filing your income taxes smooth easyhowever if you feel a bit overwhelmed consider turbotax live assist review self employed and get unlimited help and advice as you do your taxes plus a final review before you file. You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses. To combat this imbalance the us.

Income taxes and self employment taxes are usually the biggest single expenses for the small business owner. Use this checklist to be sure you dont miss a tax deduction. Other retirement plan options that provide tax deductions for self employed professionals are.

Self employed tax deductions are the superheroes of your business taxes. Tax deductions for self employed individuals. But before you can reap the benefits of tax write offs you need to know what expenses are tax deductible if you work from home.

Use this list to make sure that you dont miss deductions that could essentially bring down your tax bill. Savings incentive match plan for employees simple ira. Tax code allows for special and expanded tax deductions specifically for the self employed.

10 self employed tax deductions list. There are a variety of tax deductible items available for the self employed. Business use of your home including use by day care providers.

If youre self employed your business will have various running costs. Self employed expenses checklist.

More From Quickbooks Self Employed App Review

- Self Employed Nanny Insurance

- Furlough Return Rules

- Government Spending Pie Chart Uk 2019

- Self Employed Job Ideas Working From Home

- Self Employed Login

Incoming Search Terms:

- The Ultimate List Of Self Employment Tax Deductions In 2020 Gusto Self Employed Login,

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Self Employed Login,

- Tax Deductions For Tradies Give Your Refund A Boost Self Employed Login,

- The Definitive Guide To Common Business Deductions Self Employed Login,

- The Master List Of All Types Of Tax Deductions Infographic Small Business Tax Business Tax Deductions Business Tax Self Employed Login,

- Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Self Employed Login,