Self Employed Tax Rates Ireland, Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

Self employed tax rates ireland Indeed recently has been hunted by consumers around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the article I will discuss about Self Employed Tax Rates Ireland.

- Payroll Taxes What Are They And What Do They Fund

- 8 Reduced Ewt Rate For Self Employed Individuals And Professionals Grant Thornton

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Iza World Of Labor Ethnic Minority Self Employment

- 2019 20 Tax Rates And Allowances Boox

- Expat Tax Filing 101 How To File Taxes Abroad Myexpattaxes

Find, Read, And Discover Self Employed Tax Rates Ireland, Such Us:

- Germany Guide Taxes For The Self Employed How Much Do You Have To Pay As A Self Employed Individual If

- Tcy F0pbrv5 Dm

- Iza World Of Labor Ethnic Minority Self Employment

- 8 Reduced Ewt Rate For Self Employed Individuals And Professionals Grant Thornton

- Self Employed In Ireland A Guide To Your Taxes Part 2

If you re looking for Government Regulation In Lieu Of Law Perppu No 12020 you've reached the right location. We ve got 103 graphics about government regulation in lieu of law perppu no 12020 including images, photos, pictures, backgrounds, and more. In these web page, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Tax Institute Calls For Income Tax Cut Timeline Government Regulation In Lieu Of Law Perppu No 12020

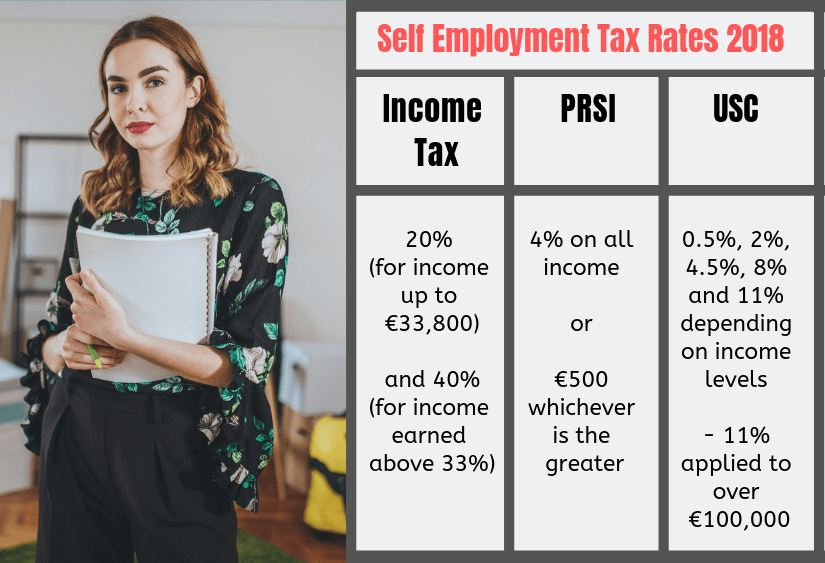

This tax credit is worth 1150 for 2018 950 for 2017 and you can subtract this figure from your tax liability.

Government regulation in lieu of law perppu no 12020. Much of the process of preparing for self employment is about starting a business. Assuming the 40 tax rate applies income tax 40. We can provide further advice on all tax matters by way of consultation.

Everyone is liable to pay the universal social charge usc if their gross income is over 13000 in a year. Calculating your income tax gives more information on how these work. Learn more by speaking to our tax experts today.

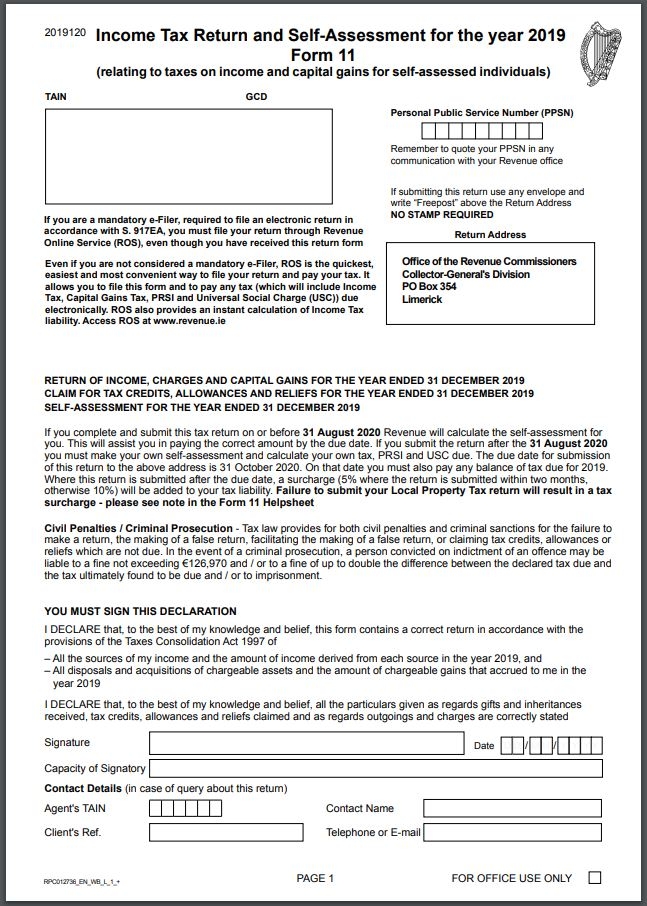

An important recent development is the creative ireland pilot initiative which aims to facilitate artists and writers access to jobseekers allowance. It is brought to you by liam burns a chartered tax adviser with the irish taxation institute and principal of liam burns and co accountants. Being self employed your method for paying tax falls under the self assessment system which you complete once a year.

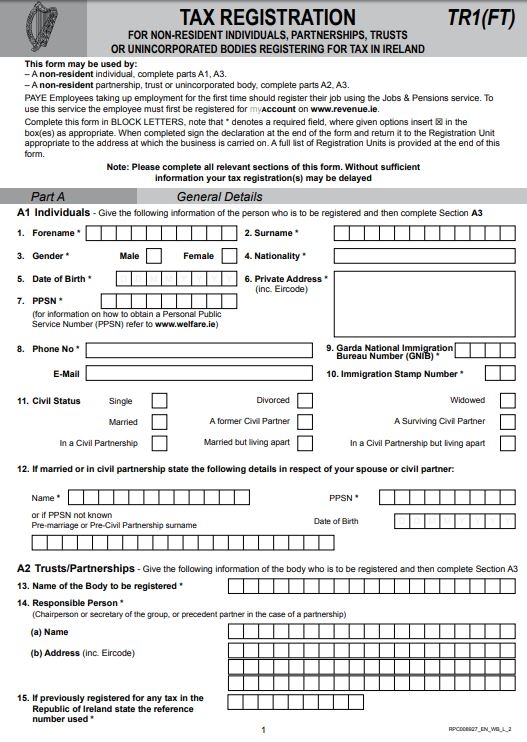

This measure will also be applied for the 2020 tax year. Your tax return is used to declare income you earn and also to claim any tax allowances that can be offset against your tax bill. Before you can use the system you must register with revenue as self employed for which youll need your personal public service number ppsn.

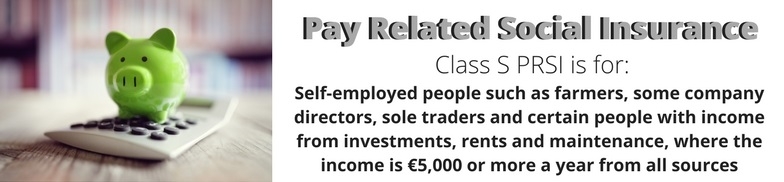

Members of irish tax institute. Universal social charge prsi and vat. This one page guide guide covers the tax codes and legislation which affect how self employed are taxed in ireland.

It was announced in budget 2021 that the earned income tax credit for the self employed will increase from 1500 to 1650. The rates and thresholds for self employed individuals in 2017 are as follows. Guide to 10 tax deductions for the self employed in ireland.

This is the same information whether you are a sole trader or a. Need further tax advice on self employed income. If youre already a citizen of ireland or youve moved to ireland to live there.

If youre self employed in ireland then youre obliged to file a self assessed tax return usually by the deadline of october 31 or by the pay and file deadline of nov 10. If youre self employed or receive income from non paye sources you must register for self assessmentself assessment is where you calculate the income tax you owe for the tax year yourself and it needs to be done every year when you file your tax returns. For starters the earned income tax credit applies to most self employed people.

Income tax rates for the year 2014. Earned income credit cannot be transferred to your spouse or civil partner. Members of chartered accountants ireland.

Revenue attempt to tax a self employed persons. This means that self employed people pay a total of 11 usc on any income over 100000. Income tax 20 up to 32800 and 41.

Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Government Regulation In Lieu Of Law Perppu No 12020

More From Government Regulation In Lieu Of Law Perppu No 12020

- Government Quarantine List Scotland

- 3 Branches Of Canadian Government Diagram

- Top Government Jobs In India

- Profit And Loss Statement Free Template Self Employed

- Self Employed Electrician Invoice Template

Incoming Search Terms:

- Self Employment Statistics Statistics Explained Self Employed Electrician Invoice Template,

- 2019 20 Tax Rates And Allowances Boox Self Employed Electrician Invoice Template,

- Sss Contribution Table Effective April 2019 Grant Thornton Self Employed Electrician Invoice Template,

- Why One In Three Earners Pays No Income Tax Self Employed Electrician Invoice Template,

- Cheating In Europe Underreporting Of Self Employment Income In Comparative Perspective Springerlink Self Employed Electrician Invoice Template,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsfrse0lsuue4cv7wdfk5yxjtva 4t Enzmq1xugd8byo Hfgil Usqp Cau Self Employed Electrician Invoice Template,