Self Employed Self Employment Tax Form 1099, 10 Things You Should Know About 1099s

Self employed self employment tax form 1099 Indeed recently has been sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of this post I will discuss about Self Employed Self Employment Tax Form 1099.

- E File 1099 Archives Tax2efile Blog

- Miscellaneous Income Form 1099 Misc What Is It Do You Need It

- Dealing With Fraudulent Or Incorrect 1099 Robinson Henry P C

- How To Report 1099 Misc Box 3 Payments On Your 1040

- Taxes For The Self Employed A Tax Guide A 1040 Com A File Your Taxes Online In 2020 Online Taxes Tax Guide File Taxes Online

- Preparation Calculating Correct Entries For Self E Chegg Com

Find, Read, And Discover Self Employed Self Employment Tax Form 1099, Such Us:

- Tax Guide For Independent Contractors

- Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrlds708sj1oc5unwdzvacelcz3r7ilevwwszjjwxkjv9njicm0 Usqp Cau

- Form 1099 Misc Miscellaneous Income Definition

- Instructions For Form 8995 2019 Internal Revenue Service

If you are searching for Government Unemployment Stimulus Texas you've reached the right place. We ve got 104 images about government unemployment stimulus texas including pictures, pictures, photos, backgrounds, and more. In such page, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

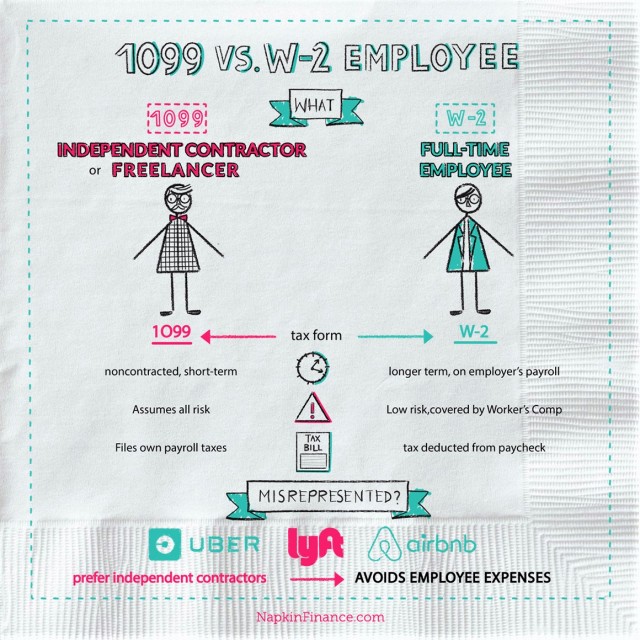

Taxes for the self employed and independent contractors are you a self employed business owner or independent contractor.

Government unemployment stimulus texas. Below is a list of common expenses that most self employed 1099 workers can deduct from their taxes. If the income is reported in box 3 other income include the information on this 1099 misc on line 7a other income. Dont forget that now that youre here you no longer need to search for the 1099 tax form 2019 printable template.

Consider forming an s corporation to enjoy substantial tax benefits. Form 1042 annual withholding tax return for us. As with anything financial or tax related there is some nuance to what and how much you can write off so be sure to consult with an expert.

Form 1040es estimated tax for individuals. If youre self employed youll also need to complete schedule se form 1040 or 1040 sr self employment tax and pay self employment tax on your net earnings from self employment of 400 or more. The 1099 tax rate consists of two parts.

124 for social security tax and 29 for medicare. Sole proprietorships are easy and cheap to form. Form 1099 misc miscellaneous income.

Form 1099 and how to file these forms on a tax return. Learn how to file your income tax return and when to submit quarterly estimated tax payments. Form 1040 or 1040 sr schedule h household employment taxes.

This form also becomes the basis of the social security administration in calculating social security taxes. Most self employed people form sole proprietor businesses and for good reason. If youre self employed youll also need to complete schedule se form 1040 or 1040 sr self employment tax and pay self employment tax on your net earnings from self employment of 400 or more.

Form 1099 misc miscellaneous. Those who earn 400 or more from self employment have to pay self employment tax to the government. Dont feel so intimidated by your tax liability after using our free 1099.

For w 2 employees most of this is covered by your employer but not for the self employed. The self employment tax applies evenly to everyone regardless of your income bracket. Source income of foreign persons.

However when you are pulling in lots of money more than 100000 annually this structure isnt the best for self employment tax savings. Form 1099 r distributions from pensions annuities retirement or profit sharing plans ira insurance contracts. Theres no withholding of tax from self employment income.

Aside from reporting self employed earnings the 1099 2019 tax forms also register such revenue types as government benefits various types of awards rental payments etc. If you dont consider yourself self employed how you report this income on your personal tax return depends on where it is located on the 1099 misc form.

More From Government Unemployment Stimulus Texas

- Uk Government Budget Breakdown

- Government Holidays 2020 Ap

- Government Organization During The Han Dynasty

- When Does The Furlough Scheme Finish

- Non Government Institutions In The Philippines

Incoming Search Terms:

- 22 Printable Income Verification Letter For Self Employed Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller Non Government Institutions In The Philippines,

- How To Fill Out Your Tax Return Like A Pro The New York Times Non Government Institutions In The Philippines,

- 22 Printable Income Verification Letter For Self Employed Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller Non Government Institutions In The Philippines,

- How To Report And Pay Taxes On 1099 Income Non Government Institutions In The Philippines,

- Your Complete Guide To Self Employment Taxes In 2020 Ridester Com Non Government Institutions In The Philippines,

- Can I File Taxes On Self Earned Income Without A 1099 Finance Zacks Non Government Institutions In The Philippines,

/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)

/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)