Self Employed Hmrc Contact Number, Https Www Edinburgh Gov Uk Downloads File 27256 Newly Self Employed Hardship Fund Privacy Policy

Self employed hmrc contact number Indeed lately has been hunted by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the article I will talk about about Self Employed Hmrc Contact Number.

- The Government S Coronavirus Support Package For The Self Employed

- How To Register As A Self Employed Business Owner Start Up Loans

- How To Register As Self Employed With Hmrc Ridgefield Consulting

- Uk Tax System Too Difficult For Landlords And Self Employed Financial Times

- Self Employed Invited To Get Ready To Make Their Claims For Coronavirus Support

- 2

Find, Read, And Discover Self Employed Hmrc Contact Number, Such Us:

- Https Www Edinburgh Gov Uk Downloads File 27256 Newly Self Employed Hardship Fund Privacy Policy

- Coronavirus Government To Pay Self Employed 80 Of Earnings Stv News

- Coronavirus Financial Advice For The Self Employed Eazitax

- Self Assessment Tax Return A Guide For The Self Employed

- Rochdale News News Headlines Hmrc Invites Self Employed To Get Ready To Make Their Claims Rochdale Online

If you re looking for Furlough Scheme Uk Until When you've arrived at the perfect place. We ve got 100 images about furlough scheme uk until when adding pictures, pictures, photos, wallpapers, and more. In these page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Hmrc tax credits contact number.

Furlough scheme uk until when. Call hmrc if youre self employed and have an income tax enquiry or need to report changes to your personal details. You maybe be able to find a direct phone number to call using the uk government website here or you can connect to the main tax office hmrc helpline number by using our call connection service number below. If you are looking to contact the tax office hmrc for a general enquiry for example to change your address then using the main hmrc enquiry phone number is normally the best option.

Please be aware we are completely unaffiliated to the tax office. Closed on saturdays sundays and bank holidays. If you are unsure whether you are classed as self employed contact hmrc.

Hmrc contact number self employed. If you have more of a specific tax enquiry for example about self assessment online or vat it would be time saving to contact that particular department in the first instance. Hmrc self assessment contact number.

Looking for information around hmrc contact number self employed. Hmrc tax contact number. Hmrc tax rebate contact number.

Helpful tax phone numbers. The self employment income support scheme grant extension provides critical support to the self employed in the form of two grants each available for three month periods covering november 2020 to. 44 135 535.

44 161 931 9070. 0300 200 3300 phone an advisor for hmrc by calling their dedicated mobile friendly local rate helpline contact number 0300 200 3300. Contact hmrc general enquiries by calling their main uk phone number call hmrc for free on their helpline 0300 200 3300 if you are calling from a mobile phone with free inclusive minutes.

In your self assessment tax return you can include your business costs if you are a sole trader or part of a business partnership hmrc tax office will be able to assist with any questions you have you can call them on the hmrc contact telephone number you can contact. Official hmrc tax credits number. You can also find out information in.

Due to measures put in place to stop the spread of coronavirus we have fewer advisers available to answer your calls.

More From Furlough Scheme Uk Until When

- Government And Public Administration Careers

- Government Guidelines For Exercise Uk

- Government Company Meaning In Hindi

- New Furlough Scheme September

- Furlough Rules October Uk

Incoming Search Terms:

- How To Claim The Self Employment Grant Patterson Hall Chartered Accountants Furlough Rules October Uk,

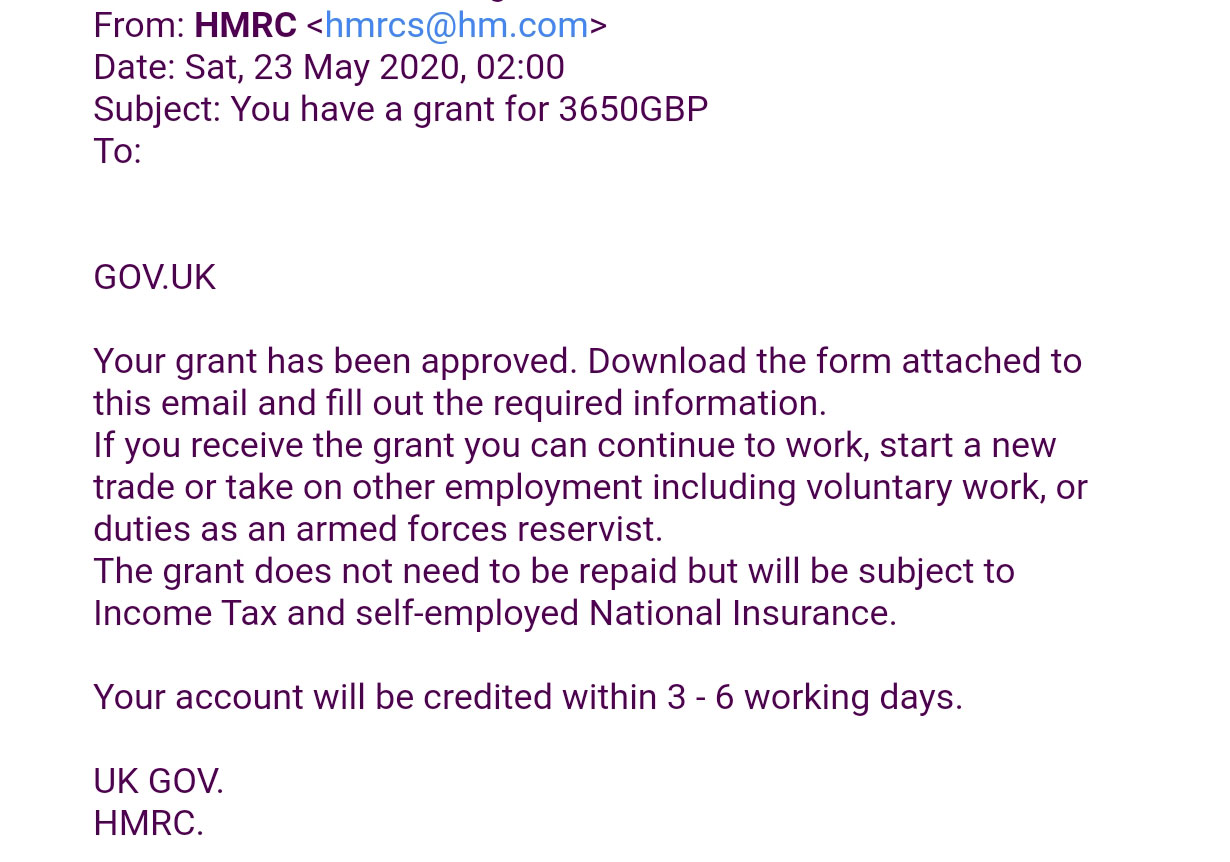

- New Hmrc Sms Phishing Scam Targets Self Employed Workers Furlough Rules October Uk,

- The Business Support Helpline Providing You With Business Advice Under The Coronavirus Outbreak Community Interest Companies Furlough Rules October Uk,

- Hmrc Glitch Means Self Employed Risk Underpaying Tax Bill Accountancy Age Furlough Rules October Uk,

- How To Claim For The Self Employment Income Support Scheme Eazitax Furlough Rules October Uk,

- Hm Revenue Customs Updates Self Employment Income Support Scheme Guidance Knights Lowe Furlough Rules October Uk,