Self Employed Ei Contributions Canada, Social Security Contributions In Canada Revenue Rates And Rationale Hillnotes

Self employed ei contributions canada Indeed recently is being sought by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of the article I will talk about about Self Employed Ei Contributions Canada.

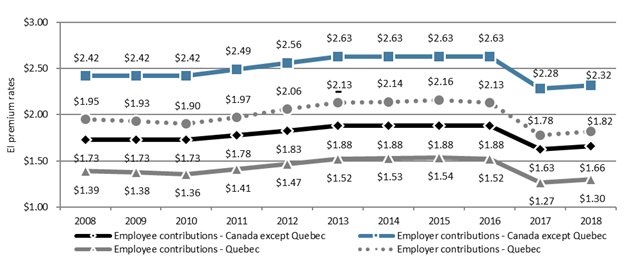

- Chapter 2 Impact Of Effectiveness Of Employment Insurance Benefits Canada Ca

- Employment Insurance Monitoring And Assessment Report For The Fiscal Year Beginning April 1 2017 And Ending March 31 2018 Chapter 2 2 Employment Insurance Regular Benefits Canada Ca

- Covid 19 And The Canada Emergency Response Benefit Nelligan Law

- Worthwhile Canadian Initiative What Is Employment Insurance For

- The Cerb Is Over But Experts Say It Could Shape Future Policy Ipolitics

- 4 Important Things You Probably Aren T Noticing On Your T4 Tax Slip National Globalnews Ca

Find, Read, And Discover Self Employed Ei Contributions Canada, Such Us:

- Disability Insurance Everything You Must Know Life Insurance Canada

- What Are The Changes To The 2020 Employment Insurance And Canada Pension Plan Rates

- A Short History Of Ei And A Look At The Road Ahead

- Government Support For Employees During The Covid 19 Pandemic Employment Insurance Temporary And Long Term Support Monkhouse Law

- Self Employed Slow To Take Up Employment Insurance Cbc News

If you re searching for Self Employed Income Verification Letter Sample you've arrived at the ideal location. We ve got 100 images about self employed income verification letter sample including pictures, photos, photographs, backgrounds, and more. In such page, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Payroll Deductions And Remittances Pdf Free Download Self Employed Income Verification Letter Sample

This calculator applies to all provinces and territories ontario saskatchewan british columbia and many more in canada except quebec.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/7BS425C3ARIFZPNZGL7XTUO2KE.jpg)

Self employed income verification letter sample. 158 employer contribution rate. While this ei measure extends certain ei benefits to self employed individuals enrollment is completely voluntary. Personal income tax on your business earnings minus business expenses.

In 2020 youll pay 158 in ei premiums for every 100 you earn. Under the ei act if you are claiming regular parental compassionate care or family caregiver benefits you can earn either of the following two amounts without changing the amount of ei benefits you receive. Keep in mind that when self employed individuals opt into the ei program they are only required to pay the 188 employee share of the contributions.

As a self employed canadian or permanent resident you can have access to ei special benefits if you register with the canada employment insurance commission. Opting in means youll need to register for the self employed ei benefit program and you can do so through your my service canada account. 2212 general rate x 14 history of employment insurance.

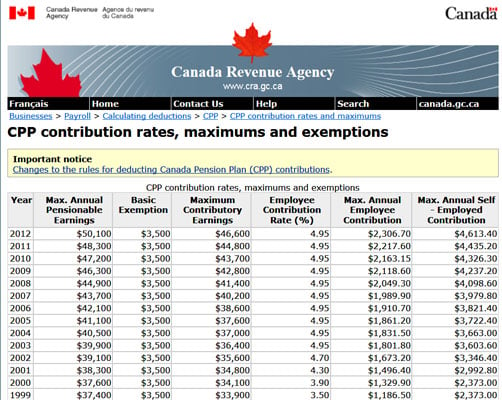

If youre self employed you dont have to pay employment insurance ei premiums on your income but you also dont get access to any ei special benefits family caregiver benefit for children and adults compassionate care sickness maternity or parental needs. When youre self employed and youre operating your business as a sole proprietorship you must pay. Contributions to the canada pension plan cpp contributions to employment insurance ei voluntary.

Ei premiums are calculated based on your income tax return. In 2020 self employed people in quebec who register for the ei program will pay 120 for every 100 of earnings up to a total of 65040 for the year. General contribution rate self employed or employed.

How to calculate how much youll owe if youre self employed. The employers share of the ei contribution is 263 of the insurable earnings of the employee up to the same annual limit. If youre self employed you can still access ei special benefits.

Employment insurance ei in canada. If you want access to these benefits you can participate in the ei special benefits program by entering into an agreement. Ei premiums are paid when the self employed worker files their annual income tax and benefit return using schedule 13 employment insurance premiums on self employment and other eligible earnings.

Adverse selection is something that canada experienced first hand when it introduced the special benefits for self employed workers sbse in 2010 through the ei system which allowed self employed workers to opt in to gain access to maternity and parental benefits sickness benefits and compassionate care and caregiver benefits. This premium rate changes annually. Everyone pays the same rate of ei premiums whether theyre self employed or an employee.

The most youll pay for 2020 is 85636. When self employed persons opt into the ei program to access ei special benefits they pay the same ei premium rate as employees pay.

Self Employed Maternity Leave In Canada What You Need To Know Mileiq Canada Self Employed Income Verification Letter Sample

More From Self Employed Income Verification Letter Sample

- Sss Monthly Contribution 2020 Self Employed

- Self Employed Builder Furlough

- Central Government Scholarship 2020

- Government Shutdown Cartoon

- Government Quarantine Facilities List

Incoming Search Terms:

- Evaluation Of The Employment Insurance Special Benefits For Self Employed Workers Canada Ca Government Quarantine Facilities List,

- Canada Recovery Benefit Vs Ei Which Program Will Get People Working Again The Globe And Mail Government Quarantine Facilities List,

- 20ywfplydhfbem Government Quarantine Facilities List,

- Covid 19 And The Canada Emergency Response Benefit Nelligan Law Government Quarantine Facilities List,

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse Government Quarantine Facilities List,

- Employment Insurance Benefits Canada Ca Government Quarantine Facilities List,