Self Employed Nanny, Nanny Employed Sau Self Employed Diaspora Romaneasca

Self employed nanny Indeed lately has been hunted by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of this post I will talk about about Self Employed Nanny.

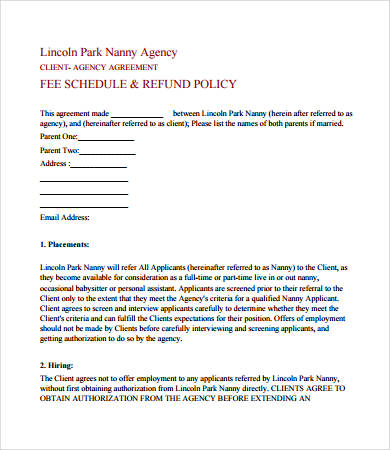

- Free Nanny Contract Template Samples Pdf Word Eforms Free Fillable Forms

- 5 Things You Should Know Before Hiring A Nanny Parentmap

- Sample Nanny Contract Pdf Nanny Contract Nanny Contract Template Nanny

- How To Pay Your Nanny S Taxes Yourself Diy For Paying Household Employees

- Free 7 Sample Nanny Contract Templates In Ms Word

- Hiring A Nanny Housekeeper Or Caregiver Financial Tips For Household Employers Kiplinger

Find, Read, And Discover Self Employed Nanny, Such Us:

- How Much Does Childcare Cost Bilingual Nanny Agency Uk

- Free 7 Sample Nanny Contract Templates In Ms Word

- Free Nanny Contract Template Samples Pdf Word Eforms Free Fillable Forms

- Sample Nanny Contract Nanny Contract Nanny Contract Template Part Time Nanny

- Employing A Nanny A Practical Guide Raising Children Network

If you are searching for Local Government Administration Course you've come to the right location. We have 102 images about local government administration course adding images, photos, pictures, wallpapers, and much more. In such page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

No a nanny cannot be considered self employed.

Local government administration course. The employer is responsible for requesting written confirmation of the nannys self employed status from hmrc. Self employed child care providers provide their own supplies or equipment and offer their services to the public perhaps for a number of different clients. Which unfortunately in the eyes of hmrc is tax evasion.

An application for an ein can be done here on the irss website. To be or not to be self employed as a nanny with very few exceptions as explained above british nannies should always be employed by the family they work for. Not to mention the pressure from potential families to be self employed so they avoid paying out on things such as holiday and sick pay.

What the websites dont tell you is that in 999 of cases a nanny cant be self employed. But the latest growing trend on these websites is to promote the idea of hiring a self employed nanny. These kinds of care providers are generally in home day care providers and not household employees.

So actually what they are really promoting is paying a nanny cash in hand. The onus for this is always on the employer and it is the employer who can be fined heavily by hmrc for not doing this correctly. However in some cases hmrc do grant nannies self employed status for example if the nanny works in a series of temporary positions or works for three or more families at the same time in which case she would have to register with ofsted as a child minder.

Self employed nannies are often such a grey area with hmrc not giving clear guidance on the matter and accountants often encouraging nannies to be self employed childminders. Each new family should complete the hmrc employment status indicator to decide whether the nanny should be their employee or can be self employed for the job. Transfer of a self employed status between jobs is not automatic.

To hire a nanny or a household employee one must apply for an employer identification number ein. As nannies generally fall into the first list they cannot be considered self employed. If it later comes to light that nanny is not self employed then its the employer not the nanny who will be committing a.

The transfer of a self employed status between jobs is not automatic and the family is responsible for requesting written confirmation of the nannys self employment status from hmrc. If a nanny was previously self employed. The ein will be used for identification purposes on tax returns and other related documents.

Ensure you have up to date written confirmation of her self employed status as you may be pursued to pay her tax. Can a nanny be self employed. If it later comes to light that the nanny is not self employed its the employer not the nanny who will be committing a criminal offence and pursued for.

More From Local Government Administration Course

- Furlough Scheme Rules Part Time

- Government Law College Kozhikode Kozhikode Kerala

- Government Furlough Scheme Shielding

- Self Employed Ppp Loan And Unemployment

- Government Of India Act 1858

Incoming Search Terms:

- Editable Nanny Contract Nanny Contract Nanny Contract Template Nanny Government Of India Act 1858,

- Sample Nanny Contract Nanny Contract Nanny Contract Template Part Time Nanny Government Of India Act 1858,

- Self Employed Nanny Contract How To Draft A Self Employed Nanny Contract Download This Self Employe Nanny Contract Template Nanny Contract Contract Template Government Of India Act 1858,

- Government Help For Small Businesses And Self Employed Nanny Mcphee Government Of India Act 1858,

- Nanny Resume Sample Monster Com Government Of India Act 1858,

- Nanny Employed Sau Self Employed Diaspora Romaneasca Government Of India Act 1858,

/How-to-Stop-Feeling-That-Your-Child-Loves-the-Babysitter-More-Than-You-58670b4c3df78ce2c3121313.jpg)