Self Employed Nanny Taxes Canada, Canadian Tax Principles 2016 2017 Edition Volume I And Volume Ii 1st Edition Byrd Test Bank By Howard Issuu

Self employed nanny taxes canada Indeed lately is being sought by consumers around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of this post I will talk about about Self Employed Nanny Taxes Canada.

- The Nanny Tax Must Be Paid For More Than Just Nannies Beachfleischman Cpas

- Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

- Tax Update Employees Vs Independent Contractors And Cross Border Employment Issues Pdf Free Download

- Tax Consequences When Hiring A Nanny Moneysense

- Canada Emergency Response Benefit Cerb For Temporary Foreign Workers And International Students Sps Canada

- 10 Myths About Immigration Thespec Com

Find, Read, And Discover Self Employed Nanny Taxes Canada, Such Us:

- Tax Tips For Nannies And At Home Care Givers Turbotax Tax Tips Videos

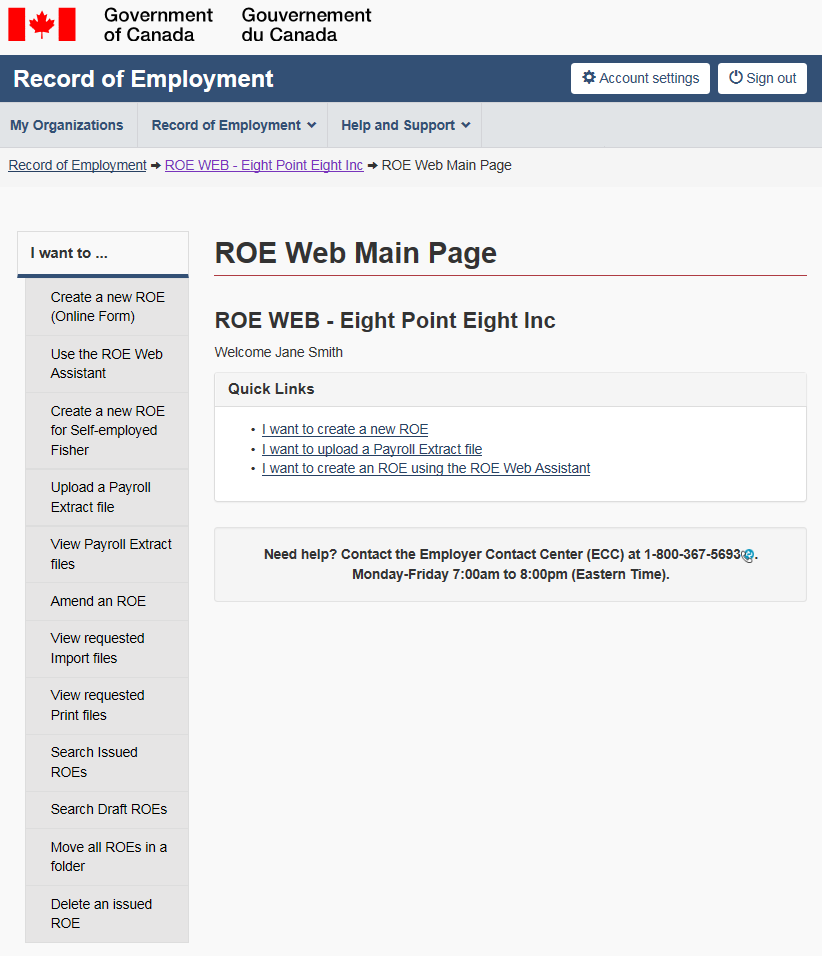

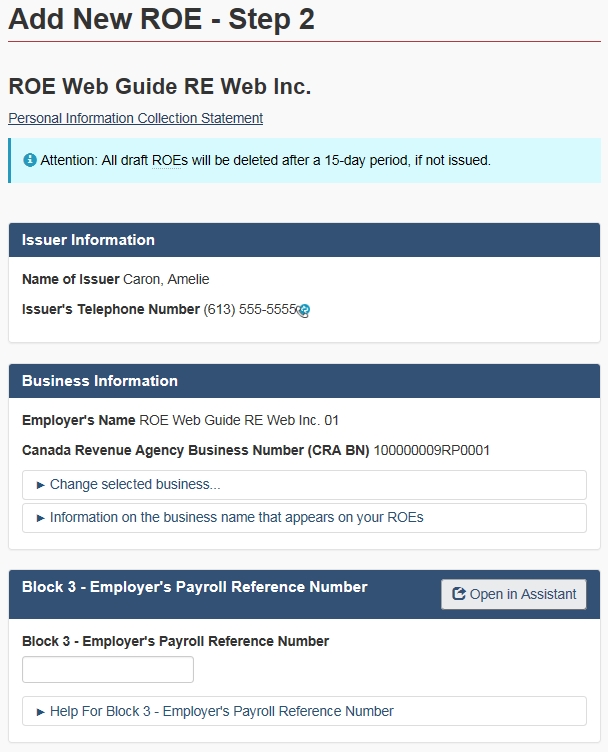

- Roe Web User Guide Canada Ca

- Tax Update Employees Vs Independent Contractors And Cross Border Employment Issues Pdf Free Download

- Employing A Nanny A Practical Guide Raising Children Network

- How To File Your Taxes Without A T4 Or When You Re Self Employed Ratesdotca

If you re looking for Government Gateway Id Example you've arrived at the perfect location. We have 100 graphics about government gateway id example adding images, pictures, photos, backgrounds, and much more. In these webpage, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

If you are filing your return online use the industry code for daycare that your tax preparation software uses.

Government gateway id example. If you determine that you are self employed report your daycare income as business income on your tax return. Instead go to corporations. Enter your gross daycare income on line 13499 and your net income or loss on line 13500.

As of 2019 which accounts for the recent changes under the tax cuts and jobs act you can deduct between 20 and 35 of up to 3000 that you spent on your nanny for one child. If you are incorporated this information does not apply to you. You are responsible for maintaining employment records for up to 6 years which include nannys sin hire date rate of pay hours worked wages earned taxes cpp and ei premiums that were withheld td1 form you need to have the employee complete any other applicable deductions vacation pay and time taken.

This tax can be pretty high for independent contractors so it is always a good idea to find out as soon as possible what the employers intentions are as far as nanny taxes. It must be during the period starting 5 years before the day you apply and ending on the day we make a decision on your application. With that calculator you can plug in your employment income and your estimation of self employed income it will give you an estimate of your average tax rate ie.

The checklist provides important tax information. If you are starting a small business see the checklist for new small businesses. For more information see guide rc4110 employee or self employed.

There was a tax court case in 2011 whereby a part time babysitter with no set hours or availability was determined to be self employed under appeal but a full time caregiver for your children is. Whats new for small businesses and self. Been a self employed person in cultural activities or athletics.

The nanny will then be subject to an independent contractorself employment tax based on the gross earnings for the entire year. 25 and then that should be the percentage you set aside from your self employed income. Relevant experience for a self employed person means at least two years of experience.

You can also use form cpt1 request for a ruling as to the status of a worker under the canada pension plan andor the employment insurance act and send it to your tax services office. Also included with turbotax free edition after filing your 2019 tax return.

More From Government Gateway Id Example

- Government Grants For Individuals Covid 19

- Government Quota In Private Medical Colleges In Tamilnadu Fees Structure

- Budget Us Government Spending Pie Chart

- Government Intervention In The Marketplace Can Contribute To All Of The Following Except

- Open Government Indonesia Adalah

Incoming Search Terms:

- Tax Update Employees Vs Independent Contractors And Cross Border Employment Issues Pdf Free Download Open Government Indonesia Adalah,

- Formative Law Open Government Indonesia Adalah,

- Things You Need To Know When Hiring A Live Out Caregiver In Canada The Urban Daddy Open Government Indonesia Adalah,

- How Much Does A Nanny Cost The Canadiannanny Ca Blog Open Government Indonesia Adalah,

- Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom Open Government Indonesia Adalah,

- Measuring The Gig Economy In Canada Using Administrative Data Open Government Indonesia Adalah,