Self Employed W2 Form, Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctzkwhchxhfj5p 7n6gvapgvn0bwqpuzua8ysf1jdflfsdn3vii Usqp Cau

Self employed w2 form Indeed lately has been hunted by consumers around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of the article I will discuss about Self Employed W2 Form.

- Download 1099 Fillable Form 2017 Impressive Form Misc Miscellaneous In E Info Copy Ly Pdf R On Ro Academy

- How To Report And Pay Taxes On 1099 Income

- W 2 And W 4 A Simple Breakdown Bench Accounting

- Your Complete Guide To Self Employment Taxes In 2020 Ridester Com

- How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

- If You Are Self Employed You May Now Council Member Adrienne Adams Facebook

Find, Read, And Discover Self Employed W2 Form, Such Us:

- Amazon Com 2019 Laser Tax Forms W 2 Income 4 Part Set Self Seal Envelope Kit For 50 Employees Park Forms Office Products

- What Do I Do With My Self Employed Taxes Drive Now Network

- Microsoft Dynamics Gp 2015 R2 Hrp New Features Employee Self Service View Print W 2 Microsoft Dynamics Gp Community

- Form W 2 H R Block

- What Is Tax Form 1040 Schedule Se

If you re searching for Government Issued Id Card United States you've reached the ideal location. We ve got 104 graphics about government issued id card united states adding images, photos, pictures, backgrounds, and much more. In these page, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Understanding Form W 2 A Guide To The Wage Tax Statement Ageras Government Issued Id Card United States

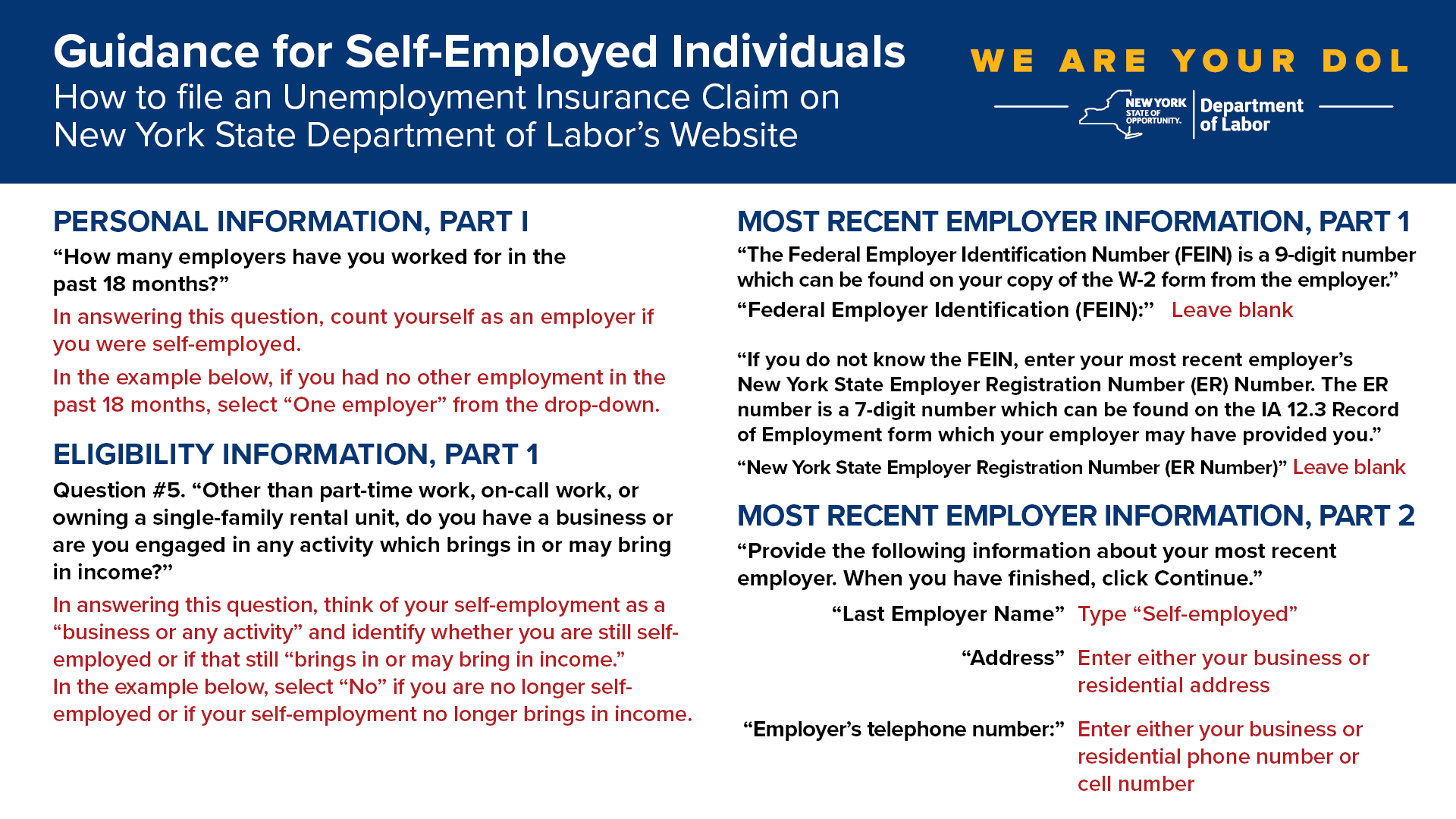

Nys Department Of Labor On Twitter If You Are Self Employed You Can Now Apply For Unemployment Insurance Benefits The Best Way To File Is Online At Https T Co T2tezsp2lf Please See Guidance Below On Government Issued Id Card United States

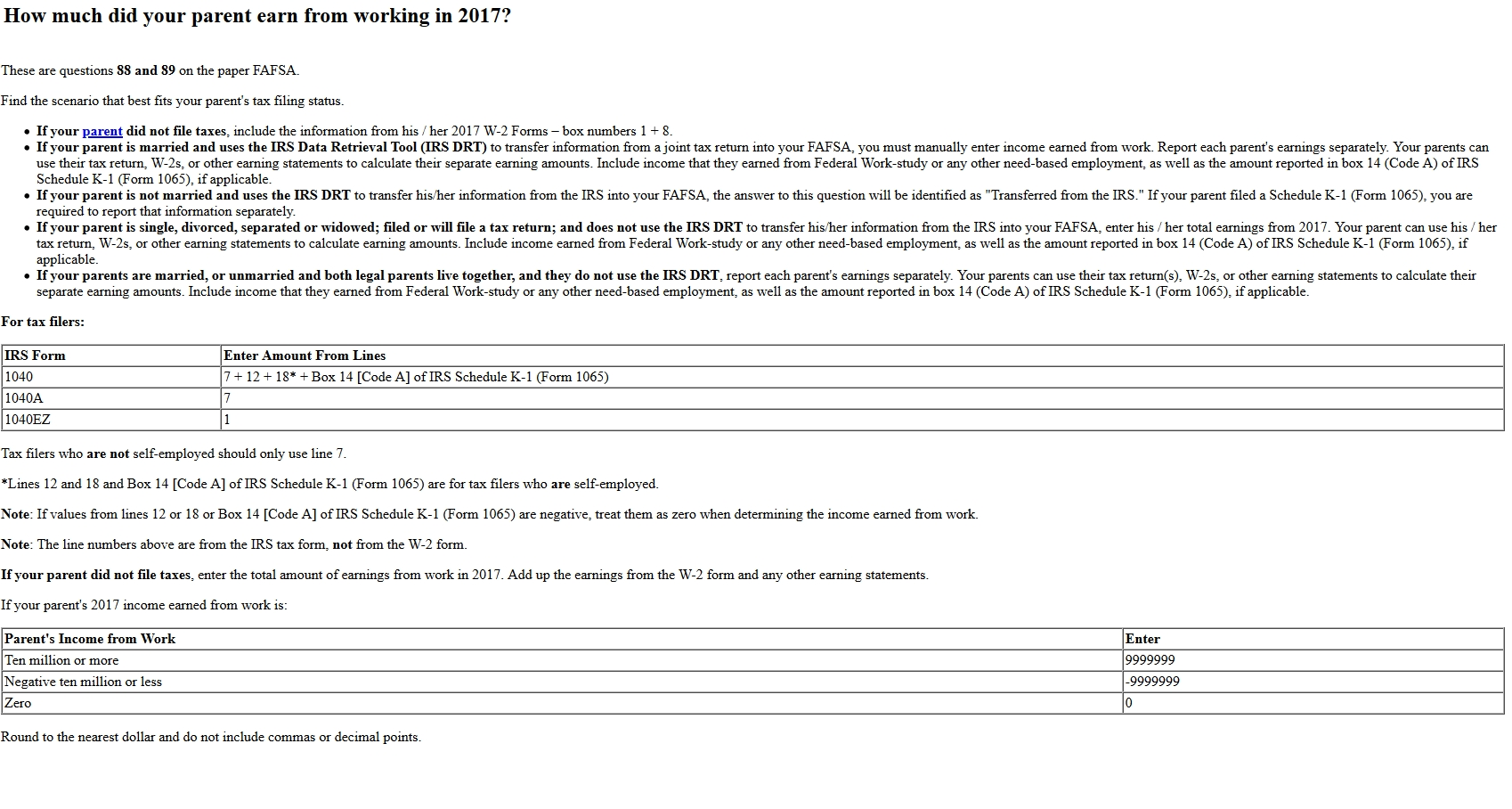

When you have income from self employment or from any work reported on a w 2 form you must file both on your tax return.

Government issued id card united states. As a contractor with a 1099 misc however youre responsible for the full 153 of the self employment tax and you can deduct the one half of the self employment tax on your personal tax return form 1040. First a w2 is the form employees use while 1099 miscellaneous forms are for freelancers. Instead you must report your self employment income on schedule c form 1040 to report income or loss from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.

You do have some specific forms to complete and attach to your tax return to file self employment income. How do i get a w 2 if i am self employed. You dont file as self employed self employment is not a tax status like single or married filing jointly.

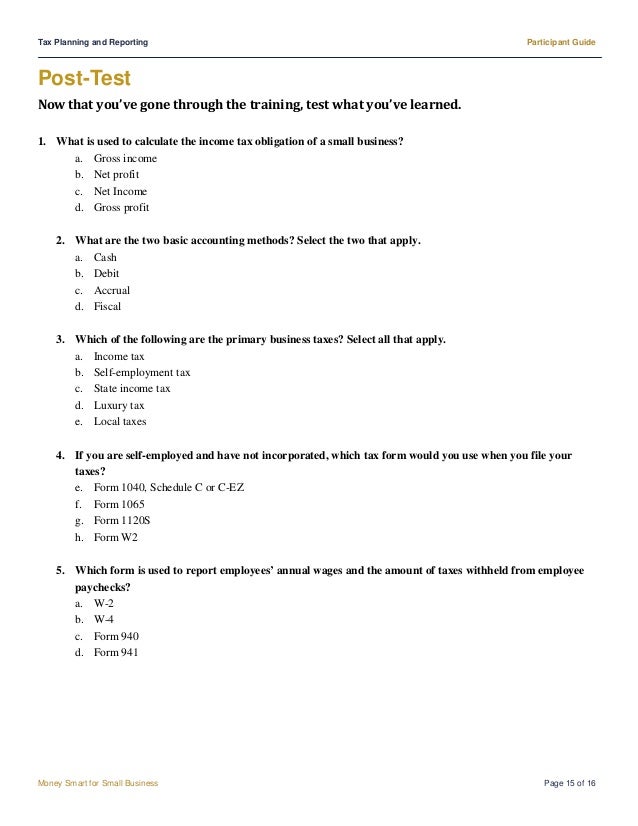

Most self employed individuals will need to pay self employment tax comprised of social security and medicare taxes if their income net earnings from self employment is 400 or more. Her employer pays the employer half of payroll taxes social security on the first 118k of earnings and medicare taxes on all earnings. Supports all major irs forms and schedules.

Self employed workers should speak up if theyre being classified incorrectly by their employer. If you were employed for part of the year your employer will likely report your employee income to the internal revenue service irs on form w 2in addition you may also receive self employment income that your customers reported to the irs on a 1099 nec form 1099 misc in prior years. There is no w 2 self employed specific form that you can create.

A 1099 is a wage statement that your employer will give to you when you worked for them and they did not hold out taxes for you. In this case your taxable income is your self employment income so any income of the self employment business is considered your income. A w2 is a wage statement that your employer will give to you when you worked for them and they held out taxes for you.

Neither if you are reporting your self employment income on schedule c as part of your personal form 1040 filing then you will not need to give yourself either a w 2 or a form 1099 misc. An employee is paid on a w 2 formher taxes are relatively simple to file. Use schedule se form 1040 or 1040 sr self employment tax to figure the tax due.

And given that many states online. W 2 import from providers and access to tax professionals for 35. Receiving w 2 and 1099 tax forms.

Some state filing systems have been asking applicants to submit a recent w 2 tax form a form self employed workers dont get thereby causing a holdup.

1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary Government Issued Id Card United States

More From Government Issued Id Card United States

- Government Effectiveness Index Indonesia

- Uk Furlough Scheme After June

- Self Employed Definition Ato

- Government Furlough Scheme Portal

- Federal Government Taxes Phone Number

Incoming Search Terms:

- Stewart Beauf Is A Self Employed Surfboard Maker I Chegg Com Federal Government Taxes Phone Number,

- Gig Workers Self Employed Disregarded Llc Federal Government Taxes Phone Number,

- 2019 Instructions For Schedule H 2019 Internal Revenue Service Federal Government Taxes Phone Number,

- Wage Tax Statement Form W 2 What Is It Do You Need It Federal Government Taxes Phone Number,

- If You Are Self Employed You May Now Council Member Adrienne Adams Facebook Federal Government Taxes Phone Number,

- 1 Federal Government Taxes Phone Number,