Government Bonds India 2020, Govt Launched 7 15 New Rbi Floating Rate Bonds 2020 Rbi Bonds Explained In Hindi 2020 Youtube

Government bonds india 2020 Indeed lately has been sought by users around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the article I will discuss about Government Bonds India 2020.

- Rbi Announces Rate Of Interest On Government Of India Floating Rate Bonds 2033 Cacult

- What Are Government Bonds How To Invest In Government Securities Key Features Advantages Explained Zee Business

- Government Sovereign Gold Bond Scheme From 8 June 2020 Trendingindia

- How To Buy Or Invest In 7 75 Government Of India Savings Bonds Basunivesh

- What Happened On August 14th How Bond Yields Might Tell Us If World Is Headed For Recession The Economic Times

- India Government Bonds Miss Out On Jp Morgan Index Inclusion

Find, Read, And Discover Government Bonds India 2020, Such Us:

- Sovereign Gold Bond Scheme 2020 21 Series V Issue Price Udaipur News Udaipur Latest News Udaipur Local News Udaipur Updates

- Sovereign Gold Bond Scheme 2020 21 Indiathinkers

- Floating Rate Savings Bonds 2020 Launched All You Need To Know About Them

- Rbi Savings Bonds 2020 Floating Rate Taxable

- Government Of India Bond Rates December 2017 Actuarial Valuation For Gratuity Leave And Pension

If you re looking for Self Employed Wage Subsidy Search you've come to the perfect location. We ve got 104 graphics about self employed wage subsidy search adding pictures, photos, pictures, wallpapers, and more. In such web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

As per the reserve bank of india rbi press release the interest rate on these bonds will be reset every six months the first reset being on january 01.

Self employed wage subsidy search. The government has announced the launch of floating rate savings bonds 2020 taxable with an interest rate of 715 per cent. The bonds will be exempt from wealth tax under the wealth tax act 1957. Treasury bills are available with a maturity period of 91 days 182 days and.

As interest on bank fixed deposits have been trending lower for higher tax bracket taxpayers the yield on maturity or return on investment on tax free bonds could be 565 572 as against fd. Taxation of 775 government of india savings bonds. The rates given below are based on the benchmark fimmda fixed income markets and derivatives association of india indices.

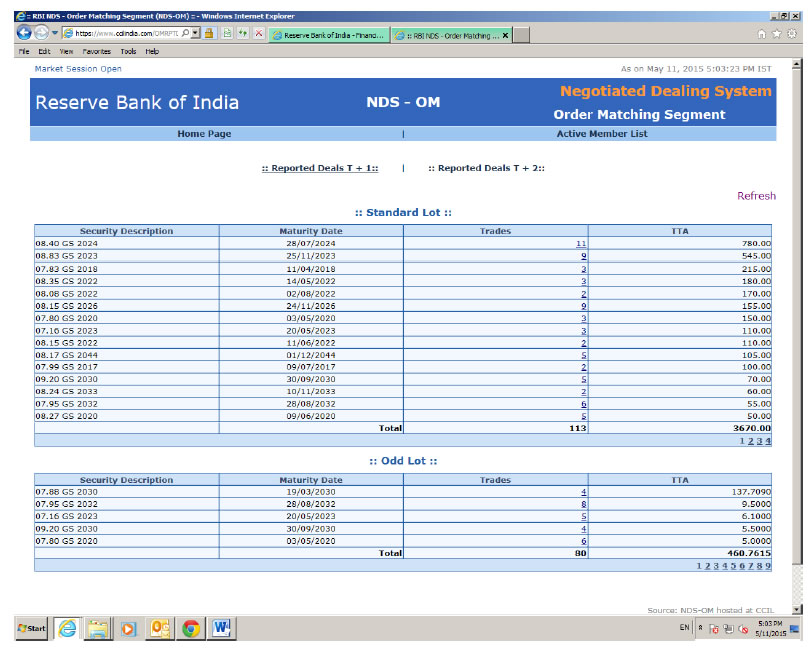

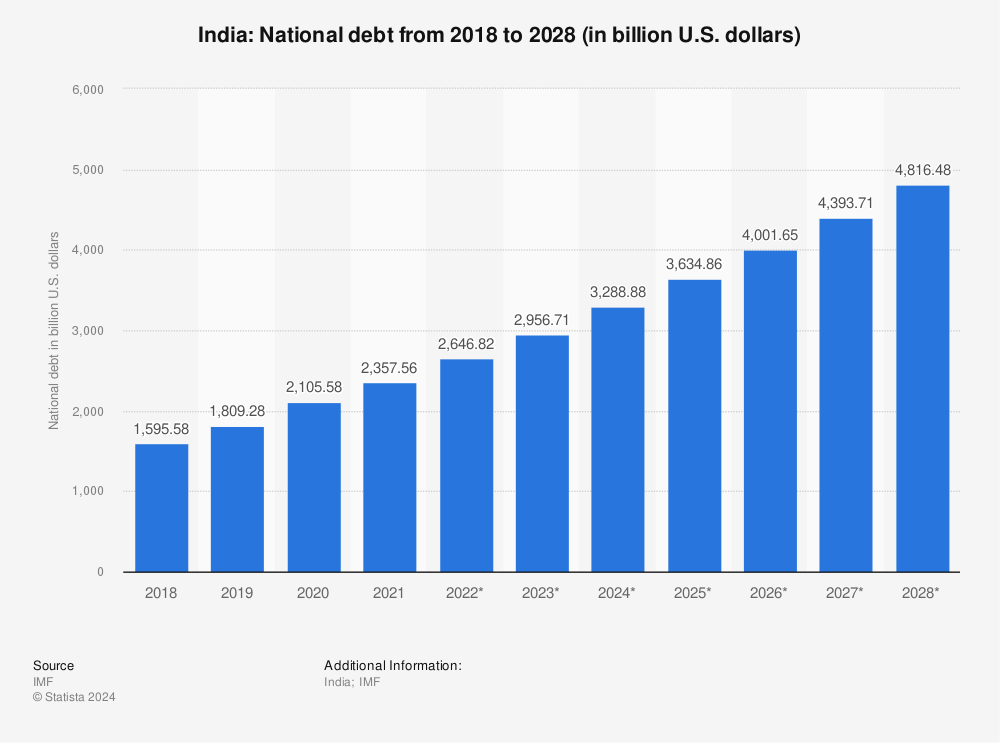

Current 5 years credit default swap quotation is 10714 and implied. In india short term g sec bonds with a maturity of less than one year are referred to as treasury bills or t bills. Government of india bond rates as on 31 st march 2020.

Interest income from 775 government of india savings bonds will be taxable. The india credit rating is bbb according to standard poors agency. A conspicuous silence from the reserve bank of india regarding support for the nations bonds has left traders wondering whether the recent gains in yields is a new normal.

The bonds are available for subscription july 1 2020 onwards. Thus by purchasing a bond an investor loans money for a fixed period of time at a predetermined interest rate. Central bank rate is 400 last modification in may 2020.

Gilt mutual funds provide good returns during times of falling interest rates depending upon its maturity or duration. Bonds bond refers to a security issued by a company financial institution or government which offers regular or fixed payment of interest in return on the amount borrowed money for a certain period of time. Tax will be deducted at source tds while interest is paid.

However there is no wealth tax you have to pay. Normal convexity in long term vs short term maturities. Gilt funds in india are an answer to this.

The yield rates below are comprised of indian government bills and bonds. 10 years vs 2 years bond spread is 1715 bp. Investors investing in these funds need to have enough time for tracking their investments since the.

Best government bond mutual funds 2020 updated on november 1 2020 33869 views. The india 10y government bond has a 5886 yield. Want to invest during falling interest rates.

More From Self Employed Wage Subsidy Search

- Self Employed Jobs From Home In Tamil

- Government Quarters Application Form Gujarat

- Government Help To Buy Electric Car Uk

- Politics Government Vs Governance Venn Diagram

- Government Expenditure Definition

Incoming Search Terms:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrul7u7z0kvro8yt3kprlags9eyuz9elb 3wjijf Wgstmdgs89 Usqp Cau Government Expenditure Definition,

- Best Tax Free Bonds For 2020 In India Should You Invest Government Expenditure Definition,

- New Rbi Bonds 2020 Floating Rate Rbi Taxable Bonds Goodmoneying Government Expenditure Definition,

- Bond Investors To Test India S Yield Comfort In First Auction Of The Year Government Expenditure Definition,

- 7 75 Goi Savings Taxable Bonds Should You Invest Now Government Expenditure Definition,

- Sovereign Gold Bonds 2020 21 Why You Should Invest Government Expenditure Definition,