Self Employed Or Employed Uk, The Illusion Of Contribution Www Chronic Oldham Co Uk

Self employed or employed uk Indeed lately has been sought by users around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the title of the article I will discuss about Self Employed Or Employed Uk.

- Self Employed Paid Carer Support Worker Contract

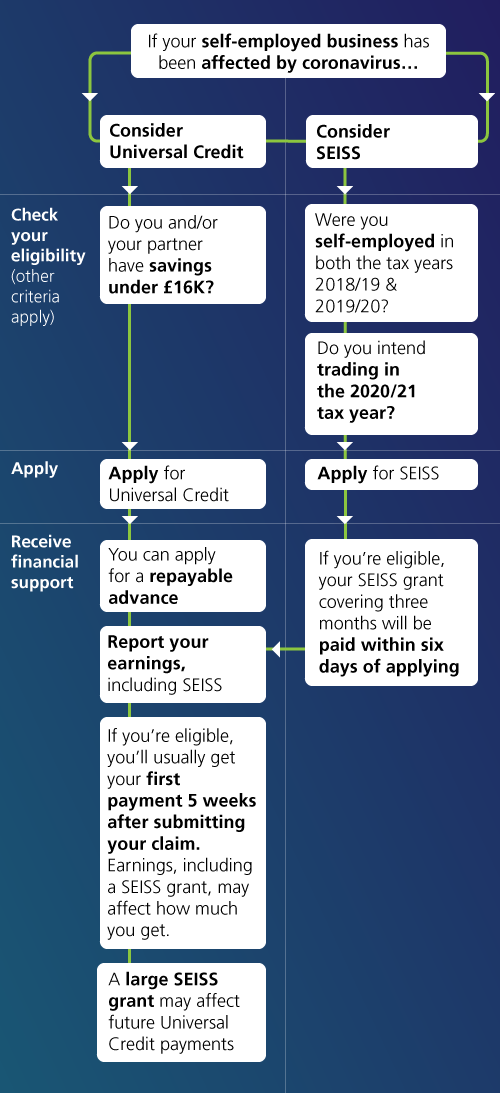

- One In Seven Uk Workers Is Self Employed

- How To Claim Universal Credit If You Re Self Employed Or Have Lost Your Job

- Employed And Self Employed

- Uk Becoming The Self Employment Capital Of Europe Job Market Monitor

- Full Or Part Time Work For Employees And Self Employed For Irish Born Download Table

Find, Read, And Discover Self Employed Or Employed Uk, Such Us:

- Self Employed Invoice Template Addictionary

- Mortgages For Self Employed Uk Mortgage Broker Fox Davidson

- What National Insurance Do I Pay If I Am Self Employed Low Incomes Tax Reform Group

- L8pcjn Sgda1cm

- Quickbooks Self Employed Uk Tax Profile Set Up

If you are looking for New Furlough Scheme Redundancy you've arrived at the ideal place. We ve got 104 images about new furlough scheme redundancy adding pictures, photos, photographs, backgrounds, and much more. In these webpage, we also provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Universal Credit Uk Gov Rule Change Could Mean Self Employed Lose Hundreds Of Pounds From November Hertslive New Furlough Scheme Redundancy

Contractors can also be self employed but they perform tasks on a contractual basis rather than selling any products or rolling bookable services.

New furlough scheme redundancy. There are countless different ways to be self employed. This factsheet is about your employment status a term hmrc use decide if youre employed or self employed. If you are an employee your employer is required by law to operate pay as you earn paye tax and class 1 national insurance contributions on your wages and pay it to hm revenue customs hmrc on your behalf.

By the fourth quarter oct to dec of 2019 there were more than 5 million self employed 1 people in the uk up from 32 million in 2000. Published 13 february 2020. Whether you are employed or self employed will make a difference to the amount of tax and nic you have to pay as well as how you pay it.

You can start your own business work as a freelancer providing services to lots of different clients or be a contractor like freelancing except you work for one employer for a set period of time. A person is self employed if they run their business for themselves and take responsibility for its success or failure. From hairdresser to market stall trader they provide services and products to clients and customers usually for an agreed or advertised cost.

If you start working for yourself youre classed as a sole trader. It will help you check that your employment status is correct. Differences between being self employed and employed.

A self employed person is someone who works for themselves not as an employee. As an employee working for a company youll receive sick pay holiday pay a pension and other perks. Self employed workers arent paid through paye and they dont have the.

This means youre self employed even if you havent yet told hm revenue and customs hmrc. Self employment has contributed strongly to employment growth in the labour market with self employed people representing 153 of employment up from 12 in 2000. You can also do any of these things at the same time as being employed by someone else the gig economy has arisen from large numbers of people providing services and goods in their spare time usually online.

More From New Furlough Scheme Redundancy

- Government Home Loans First Time Buyer

- Federal Government Legislative Branch

- Self Employed Business Owner Resume

- Furlough Rules For Employees Returning To Work

- Karnataka State Government Jobs August 2020

Incoming Search Terms:

- How To Claim The Uk Covid 19 Self Employment Income Support Scheme Karnataka State Government Jobs August 2020,

- Self Employed Vs Limited Company Status What You Need To Know Karnataka State Government Jobs August 2020,

- Was A Heating Surveyor Self Employed Employee Or A Worker Aspire Business Partnership Karnataka State Government Jobs August 2020,

- Coronavirus Covid 19 Self Employment Income Support Scheme Grant Karnataka State Government Jobs August 2020,

- Self Employed Paid Carer Support Worker Contract Karnataka State Government Jobs August 2020,

- The Illusion Of Contribution Www Chronic Oldham Co Uk Karnataka State Government Jobs August 2020,