Self Employed Tax Rates Scotland, The Government S Coronavirus Support Package For The Self Employed

Self employed tax rates scotland Indeed recently has been sought by users around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of the article I will discuss about Self Employed Tax Rates Scotland.

- The Government S Coronavirus Support Package For The Self Employed

- Tax Rates For 2019 20 What The Taxman Gets Liquid Friday

- Pensions Can Be A Valuable Tool In An Individual S Tax Planning

- 2019 20 Tax Rates And Allowances Boox

- Rates Thresholds 2020 21 Brightpay Documentation

- Key Take Aways From The Chancellor S Package Of Measures To Support Workers In The Coronavirus Crisis Resolution Foundation

Find, Read, And Discover Self Employed Tax Rates Scotland, Such Us:

- Ask Harry I Earn 60 000 How Could I Be Paying More Tax Than Someone Who Earns 1m

- Dividend Tax Calculator 2019 2020 Income Tax Calculator

- Scottish Budget 2017 Scottish Rate Of Income Tax Anderson Strathern Solicitors Edinburgh Glasgow

- Guide To Being A Self Employed Beauty Therapist Let Us Help You Build A Wildly Successful Salon Business

- Scottish Income Tax Rates And Thresholds Confirmed For 2019 20 What Do They Mean For Scottish Taxpayers Low Incomes Tax Reform Group

If you are searching for Furlough Extension Email you've reached the perfect place. We ve got 104 graphics about furlough extension email adding pictures, photos, photographs, backgrounds, and much more. In such webpage, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Coronavirus job support scheme.

Furlough extension email. Related guides in income tax. Income tax bands are different if you live in scotland. When it comes to paying income tax there arent any differences in the tax rates you pay compared to employees.

This means youll start paying class 4 national insurance on profits above 9500. Self employment profits are subject to the same income taxes as those taken from employed people. Business and self employed childcare and parenting.

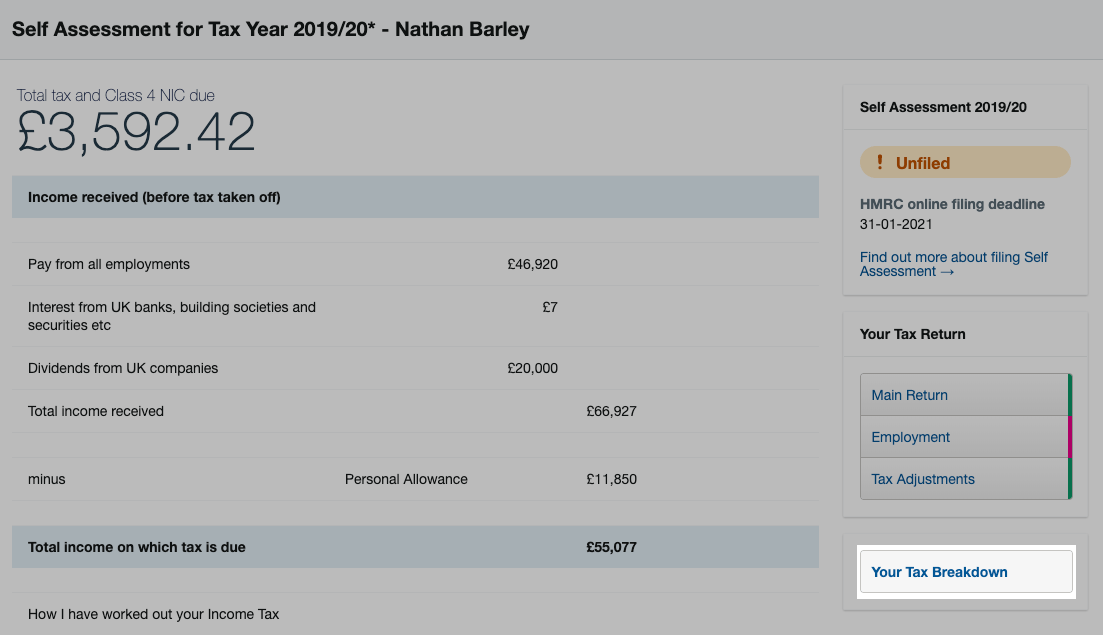

0 on the first 12500 you earn. When checking this box the hmrc self assessment team will know that you should be taxed using the scottish income tax rates for 202021 or any other tax year if filing a self assessment for a different tax year. What are the self employed income tax rates for 2020 21.

Income tax rates and bands the table shows the tax rates you pay in each band if you have a standard personal allowance of 12500. You can use our 2020 21 income tax calculator to find out how much youll pay. The government says this works out on average as a 78 cut in self employed tax.

The tax system is based on marginal tax rates. The key difference is in two areas national insurance contributions and the ability to deduct expenses and costs before calculating any deductions. Self employed tax calculator 2020 2021.

That means its worked out as a percentage of income you earn inside certain thresholds you dont pay the same rate of tax on everything you earn. In the 2020 21 tax year self employed and employees pay. What are the scottish tax bands and rates in 2020 21.

Scotland act 2016 provides the scottish parliament with the power to set all income tax rates and bands except the personal allowance which remains reserved that will apply to scottish taxpayers non savings non dividend nsnd income for tax year 2018 to 2019. The table shows the 2020 to 2021 scottish income tax rates you pay in each band if you have a standard personal allowance of 12500. Business and self employed childcare and parenting citizenship and living in the.

Extra support for tier 2 businesses and self employed workers.

Scottish Income Tax Rates And Thresholds Confirmed What Do The Changes Mean For Scottish Taxpayers Low Incomes Tax Reform Group Furlough Extension Email

More From Furlough Extension Email

- Furlough Scheme From 1st November

- Government Consulting Deloitte

- Furlough Extension Events

- Government Shutdown 2020 Fox News

- Furlough Scheme In The Uk

Incoming Search Terms:

- Taxation In The United Kingdom Wikipedia Furlough Scheme In The Uk,

- Rates Thresholds 2020 21 Brightpay Documentation Furlough Scheme In The Uk,

- What Help Do Self Employed Workers Get During Coronavirus Uk Lockdown Furlough Scheme In The Uk,

- Simple Tax Guide For Americans In The Uk Furlough Scheme In The Uk,

- 2 Furlough Scheme In The Uk,

- Rates Thresholds 2020 21 Brightpay Documentation Furlough Scheme In The Uk,