Is The Furlough Scheme Gross Or Net Pay, I M Furloughed And I Ve Been Overpaid Do I Need To Pay The Money Back Your Money

Is the furlough scheme gross or net pay Indeed recently is being hunted by consumers around us, perhaps one of you. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the article I will talk about about Is The Furlough Scheme Gross Or Net Pay.

- Job Retention Schemes During The Covid 19 Lockdown And Beyond

- Coronavirus Job Retention Scheme Information That We Have So Far Bickerstaff Co

- New Job Support Scheme Set To Replace Furlough Programme

- Public Sector Finances Uk Office For National Statistics

- Job Retention Scheme Furlough Workers Guidance Mirandus Accountants

- Coronavirus Job Retention Scheme Processing Furlough Pay In Brightpay Brightpay Documentation

Find, Read, And Discover Is The Furlough Scheme Gross Or Net Pay, Such Us:

- Lewis Silkin Coronavirus Job Support Scheme Faqs For Employers

- A Safety Net For All Rethinking Poverty

- Covid19 Payroll Furlough Facts Coronavirus Job Retention Scheme Hb Accountants

- Uk Government Spending On Virus Measures Pushes Debt To 2 Trillion Bbc News

- How Has The Furlough Scheme Changed And When Does It End

If you re searching for Government Help To Buy Solar Panels you've come to the perfect place. We have 100 graphics about government help to buy solar panels including pictures, pictures, photos, wallpapers, and more. In such webpage, we additionally provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Covid 19 Uk Employment Update Furloughing And Support For Employee Pay Clyde Co Government Help To Buy Solar Panels

Can Uk Employers Claim The Furlough Grant While Employees Are On Notice Clarity Is Required Walker Morris Government Help To Buy Solar Panels

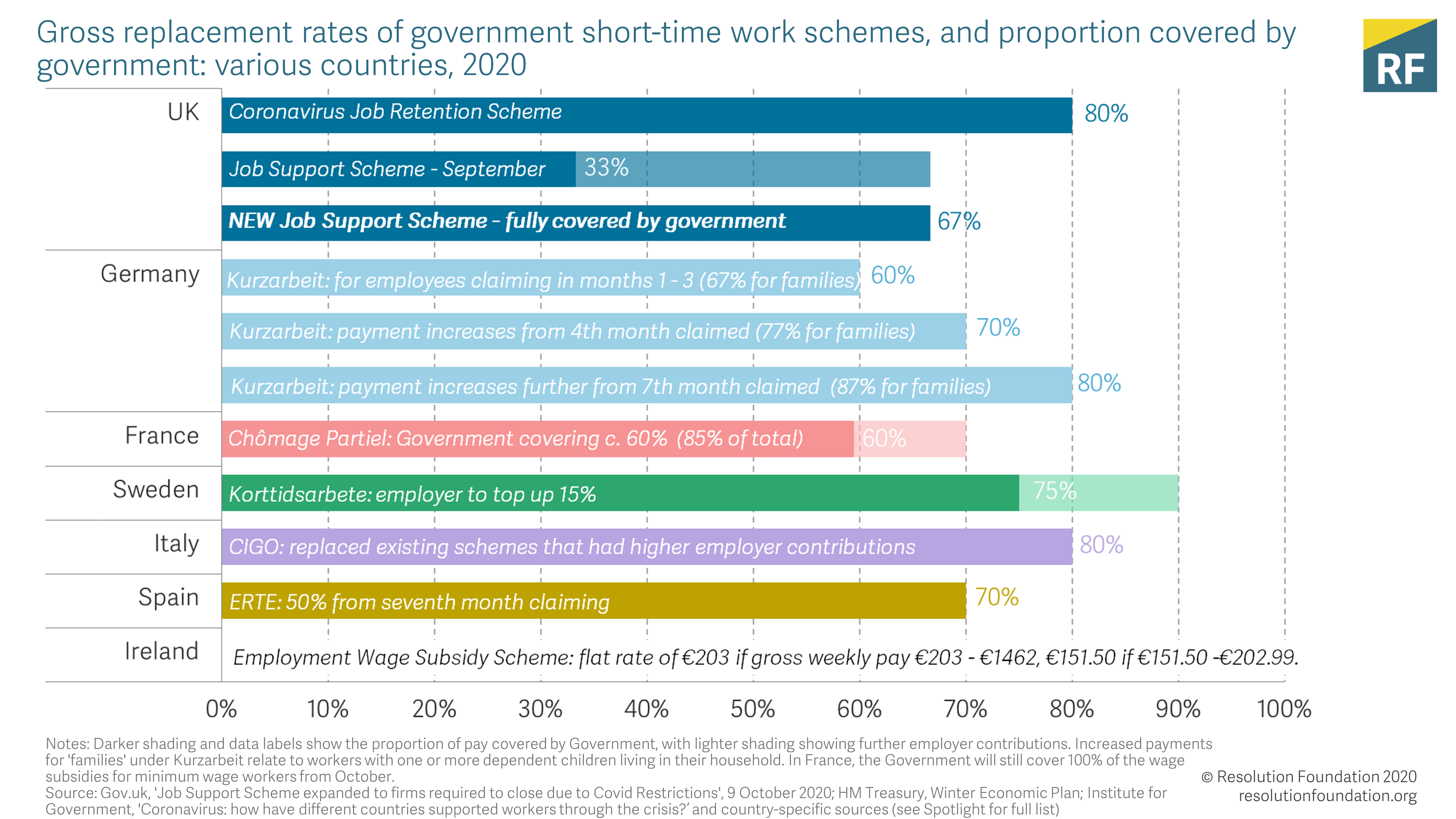

70 of the gross salary or about 84 of the net salary for salaries up to 6927 gross per month.

Government help to buy solar panels. April 17 2020 2 min read. My salary is 40k a year gross pay 3333 and net normally around 2500 tia. Is the 2500 cap gross or net.

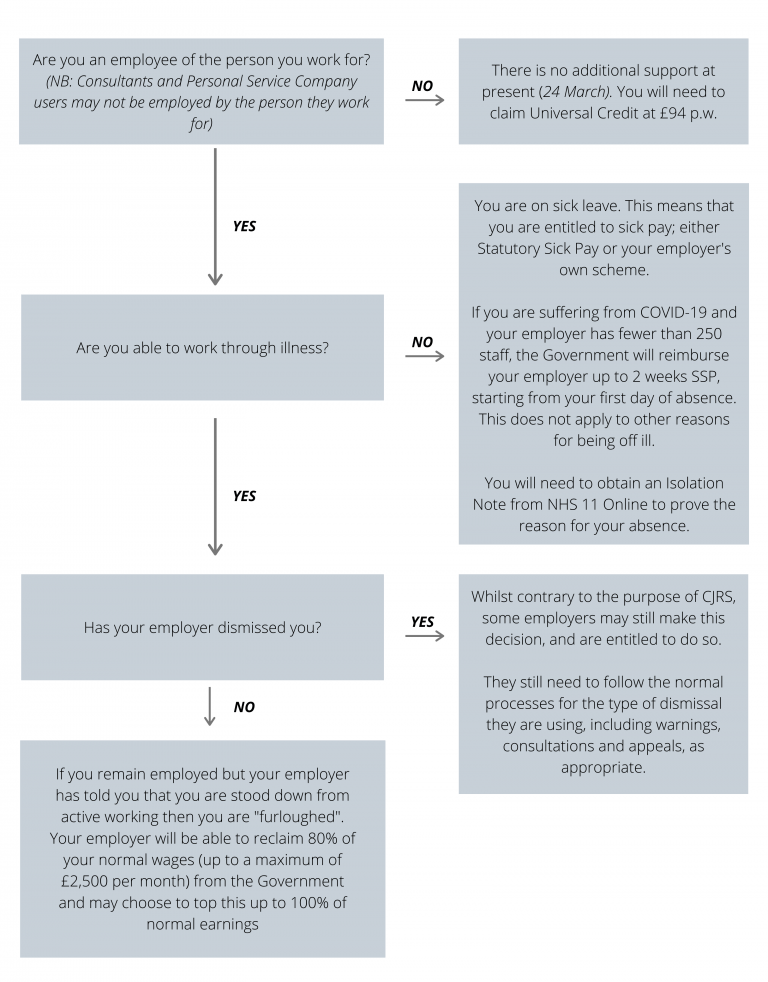

Thanks so the furlough ceiling of 2500 has a take home of 1895 after deductions and a 5 pension contribution. You will pay employees in the normal way through the payroll and then you will recover up to 80 of usual monthly wage costs from hmrc capped at 2500 per month. Employees on minimum wage smic.

Start with the amount of minimum furlough pay 67416 divide by 80. We presume that this means both those employees who would have been made redundant as well as those temporarily laid off where the employer has the. In addition employers can claim employe.

With the government 80 furlough scheme can anyone tell me how much my take home pay will be. Net salary 1337. 26 march at 450pm.

Per month 0. Just trying to get my head round it in case it comes in. It is most likely to be gross.

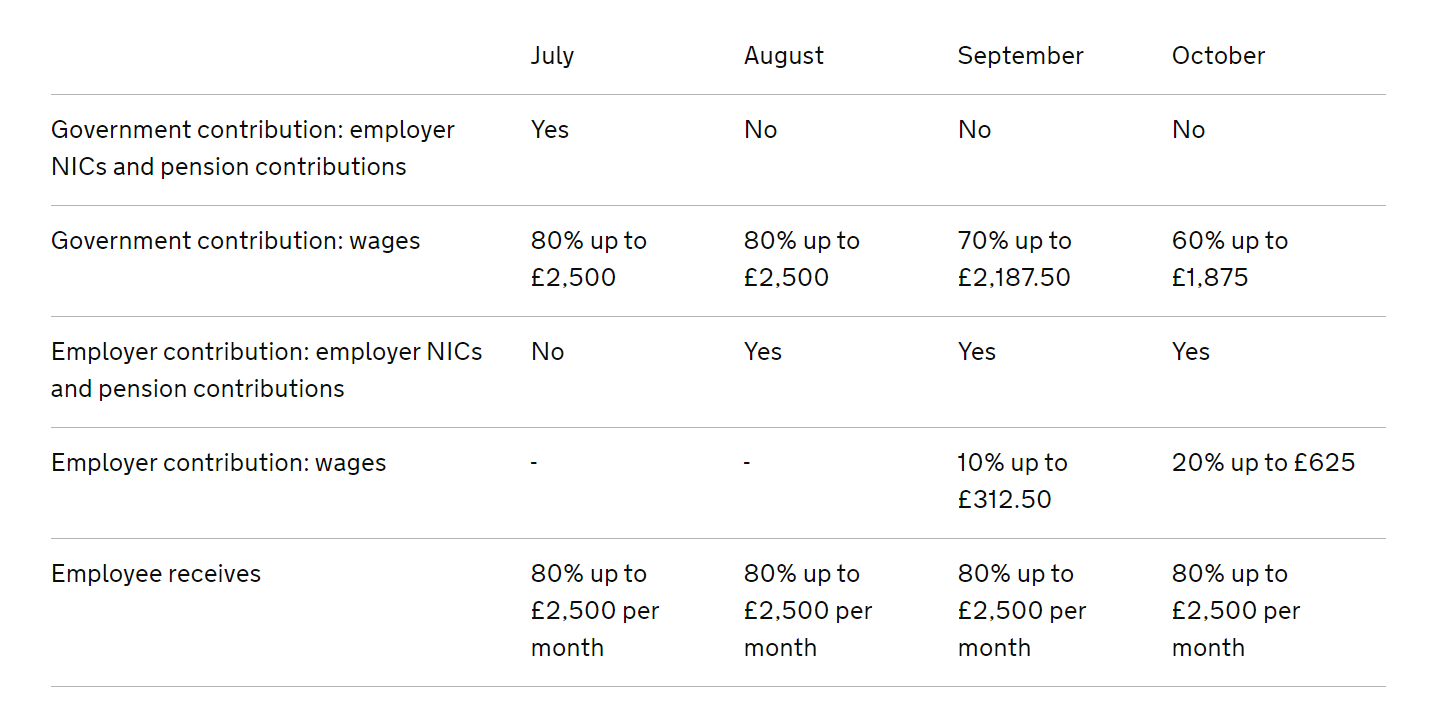

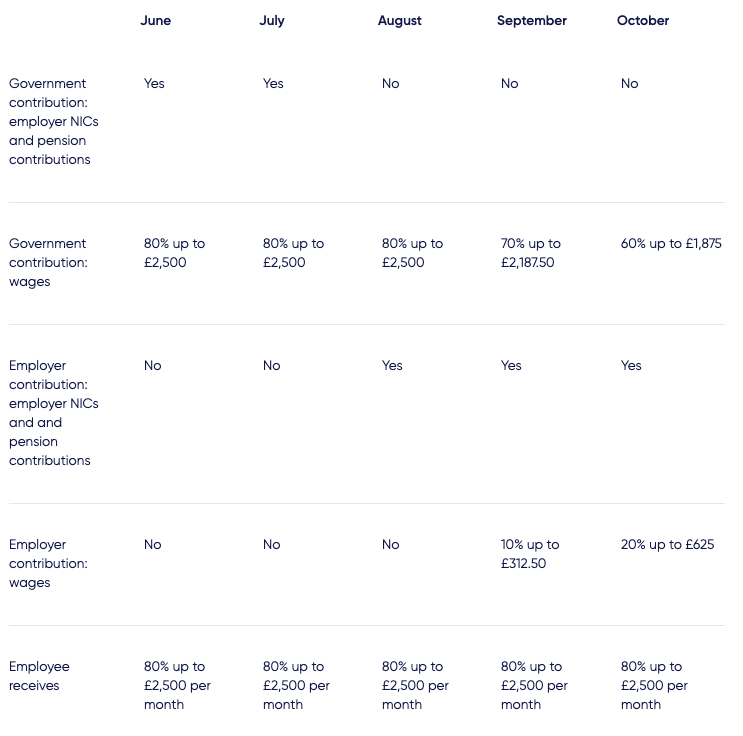

Consent to reduced pay furlough may not be required however if the contract. The grant will cover 80 of your gross employment costs up to a cap of 2500 per employee per month. The grant contribution to the furlough pay reduces from 1 september so a further step is required to calculate how much to claim.

You will earn a gross income of at least 1600 a month on the furlough scheme. The governments scheme to help pay peoples wages in order to ensure that they dont lose their jobs. Will the payments be calculated on gross or net pay.

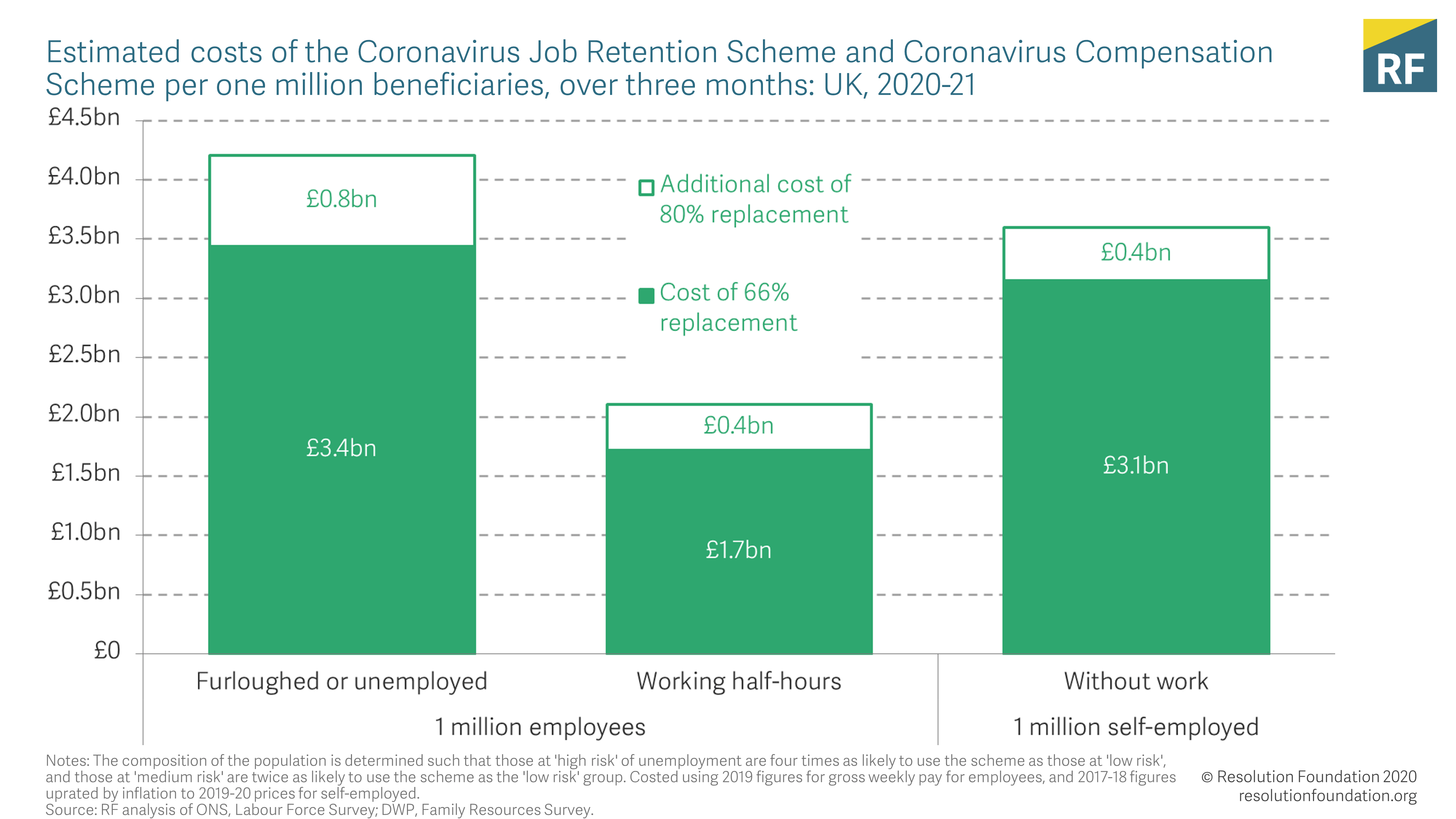

This means 80 of the employees gross pay up to the 2500 plus 80 of your employers nic bill and 80 of any employers pension contribution that you would normally make. Thats around a 30k salary so anyone who earns above that amount usually will drop a fair bit of income during the furlough. The government has announced the coronavirus job retention scheme to provide uk employers with support for paying wages of staff who would otherwise have been laid off as a result of coronavirus.

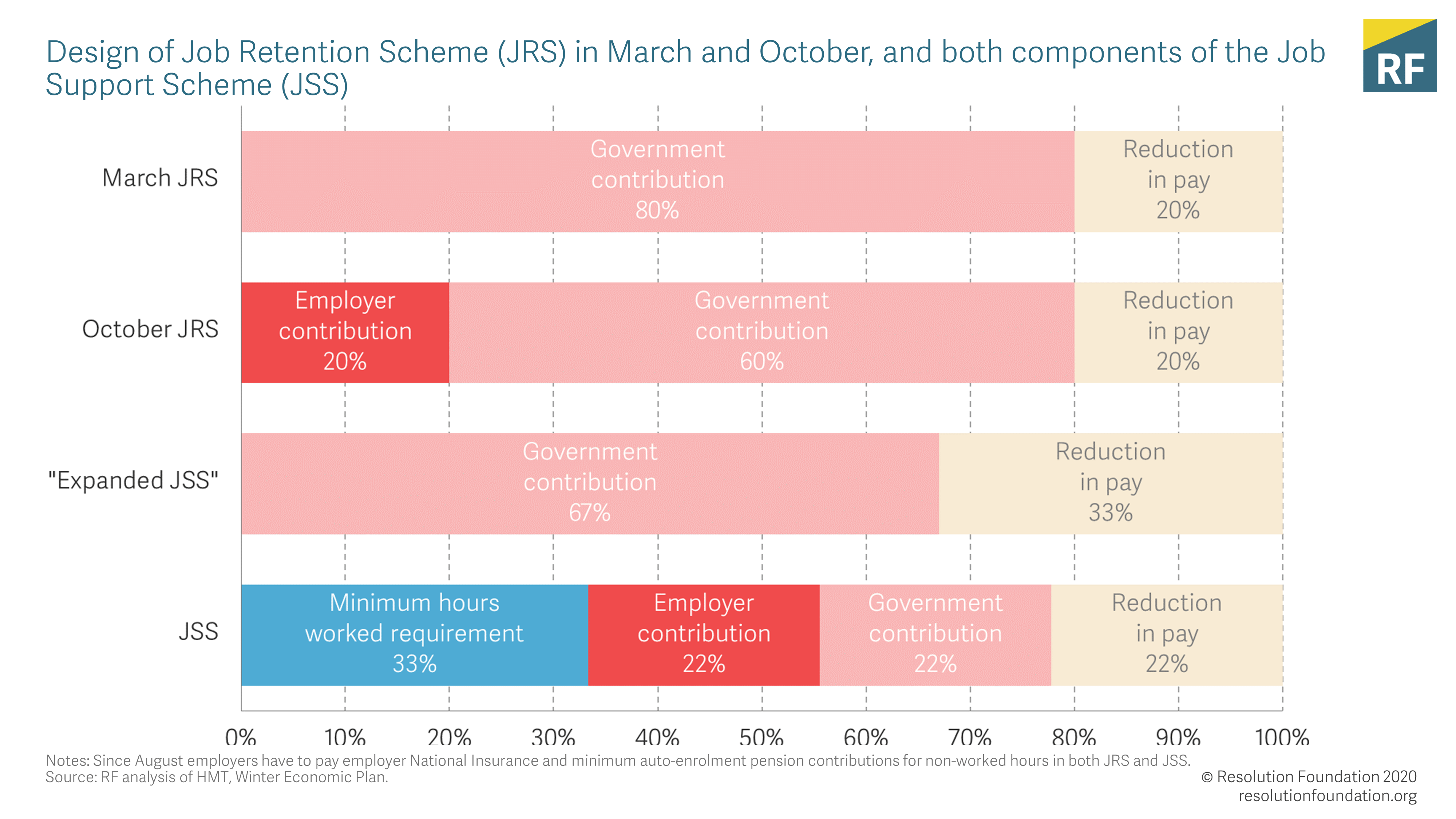

How the uk furlough scheme compares with other countries. The scheme will be available in respect of those employees that would otherwise have been laid off during the outbreak who for the purposes of the scheme are described as furlough workers.

More From Government Help To Buy Solar Panels

- Government Update Covid 19 Uk

- Furlough Extension Letter Example

- Ap Government Notes Pdf

- Government Budget Constraint Definition

- Staff Nurse Vacancy In Gujarat Government 2020

Incoming Search Terms:

- Coronavirus Job Support Scheme The Details And What It Might Mean For Employers Staff Nurse Vacancy In Gujarat Government 2020,

- Update 9 Coronavirus Advice Note On Job Retention Scheme In Depth Gateley Staff Nurse Vacancy In Gujarat Government 2020,

- Support In Payroll For Furloughed Workers Freeagent Staff Nurse Vacancy In Gujarat Government 2020,

- Nanny Salary Index 19 20 Staff Nurse Vacancy In Gujarat Government 2020,

- Basic Paye Tools User Guide Gov Uk Staff Nurse Vacancy In Gujarat Government 2020,

- Uk Government Spending On Virus Measures Pushes Debt To 2 Trillion Bbc News Staff Nurse Vacancy In Gujarat Government 2020,