Self Employed Health Insurance Deduction 2019 Turbotax, Intuit Turbotax Shares 9 Things You Didn T Know Were Tax Deductions Aol Finance

Self employed health insurance deduction 2019 turbotax Indeed lately has been sought by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of the post I will talk about about Self Employed Health Insurance Deduction 2019 Turbotax.

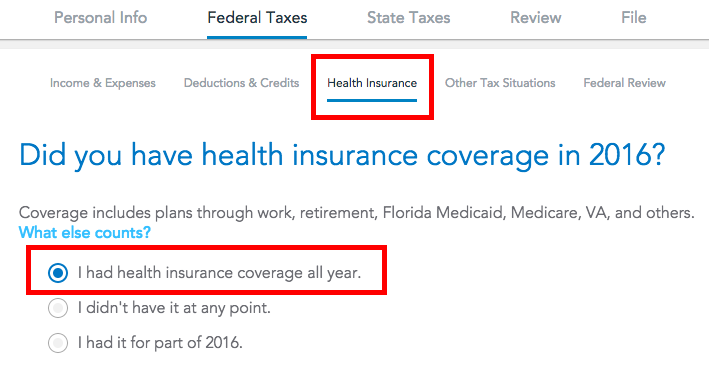

- The Tutorial Doing Your Taxes With Turbotax Free Software

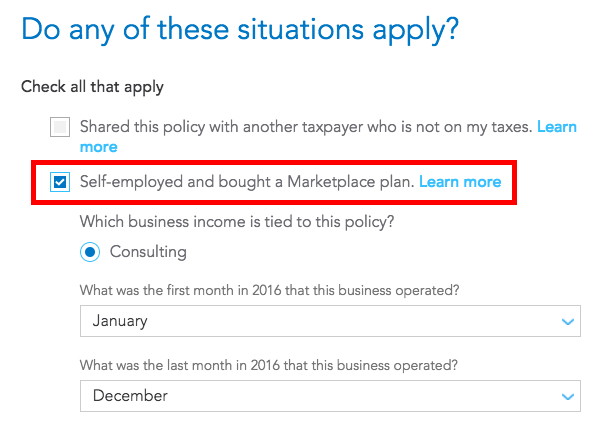

- Tax Filing For Self Employed Health Insurance Through Aca

- Tax Software Bake Off Self Employed Health Insurance And Aca Premium Tax Credit

- The Tutorial Doing Your Taxes With Turbotax Free Software

- Self Employed Health Insurance Deduction 1040 Sch

- The Tutorial Doing Your Taxes With Turbotax Free Software

Find, Read, And Discover Self Employed Health Insurance Deduction 2019 Turbotax, Such Us:

- Turbotax Self Employed Review Best For Business Owners 2019

- Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

- Turbotax Live Do It Yourself Taxes Plus Live Expert Help Club Thrifty

- Turbotax Review 2020 Tax Filing Service Price Plans

- Turbotax Vs Taxslayer Vs Credit Karma Which Is Best For You

If you re looking for Government Holidays 2020 India Pdf you've reached the perfect place. We have 104 images about government holidays 2020 india pdf including pictures, photos, pictures, wallpapers, and more. In these webpage, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

The deduction is limited to the amount of net income profit of your business.

Government holidays 2020 india pdf. Also included with turbotax free edition after filing your 2019 tax return. Included with turbotax deluxe premier self employed turbotax live or with plus benefits. Make changes to your 2019 tax return online for up to 3 years after it has been filed.

Self employed health insurance deduction goes on form 1040 schedule 1 line 16 then to 1040 line 8a as long as the expense is not greater than your net self employment income. And that will help to keep you healthyand happyin 2020 and beyond. If it does exceed your net self employment income it gets split automatically.

If this is your first time entering info about your self employment work youll be asked some initial questions before coming to the expenses. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent. Search for schedule c and select the jump to link.

When both the self employed health insurance deduction and the premium tax credit are involved in a return there situations where the circular calculation that this involves does not converge to amount that is within 1. Terms and conditions may vary and are subject to change without notice. Self employed individuals calculating your own retirement plan contribution and deduction accessed dec.

Click jump to self employed. Keep in mind that youre only eligible to claim the write off for health insurance premiums during the months when you are not eligible to participate in any employer subsidized health plan. In turbotax you enter your self employed health insurance premiums in the business expenses section of your business.

Publication 554 page 2. Turbotax will check to see if you qualify for one or both of the deductions after you enter your premiums in the self employed business expense section or the health insurance section if you received a 1095 a. A child includes your son daughter stepchild adopted child or.

Enter your cobra premiums under medical insurance premiums. Type self employed health insurance deduction in the search bar. Self employed health insurance deduction.

You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. Go to business expenses other common business expenses health insurance premiums. Claiming the self employed health insurance deduction with the premium tax credit.

I paid health insurance premiums and the policy is in my name and not from a marketplace. As a self employed person you may be eligible to deduct health insurance premiums for yourself your spouse and your dependents. To enter self employed health insurance.

More From Government Holidays 2020 India Pdf

- Government Logo Design Competition

- Furlough Leave Latest

- Furlough Scheme Uk Amount

- Sindh Government Services Hospital Karachi Logo

- Government Official Request Letter Format In English

Incoming Search Terms:

- Turbotax Self Employed Review Best For Business Owners 2019 Government Official Request Letter Format In English,

- Turbotax Vs Freetaxusa Tax Filings Comparison 2020 Government Official Request Letter Format In English,

- Turbotax Review 2020 2019 Tax Year Is It The Best Diy Tax Software Government Official Request Letter Format In English,

- Intuit Turbotax Shares 9 Things You Didn T Know Were Tax Deductions Aol Finance Government Official Request Letter Format In English,

- Tax Filing For Self Employed Health Insurance Through Aca Government Official Request Letter Format In English,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqiewi Wtmabl9jlmm 9thnq Xw6p8gp0ng0q Usqp Cau Government Official Request Letter Format In English,

/self-employment-health-insurance-deduction-3193015-final-c6496da4c8c64e838ee4875236d13c41.png)