Self Employed Nanny Taxes, 2019 Instructions For Schedule H 2019 Internal Revenue Service

Self employed nanny taxes Indeed recently has been sought by consumers around us, maybe one of you. People now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this post I will talk about about Self Employed Nanny Taxes.

- What Happens If My Nanny Filed For Unemployment Sittercity

- How Does A Nanny File Taxes As An Independent Contractor

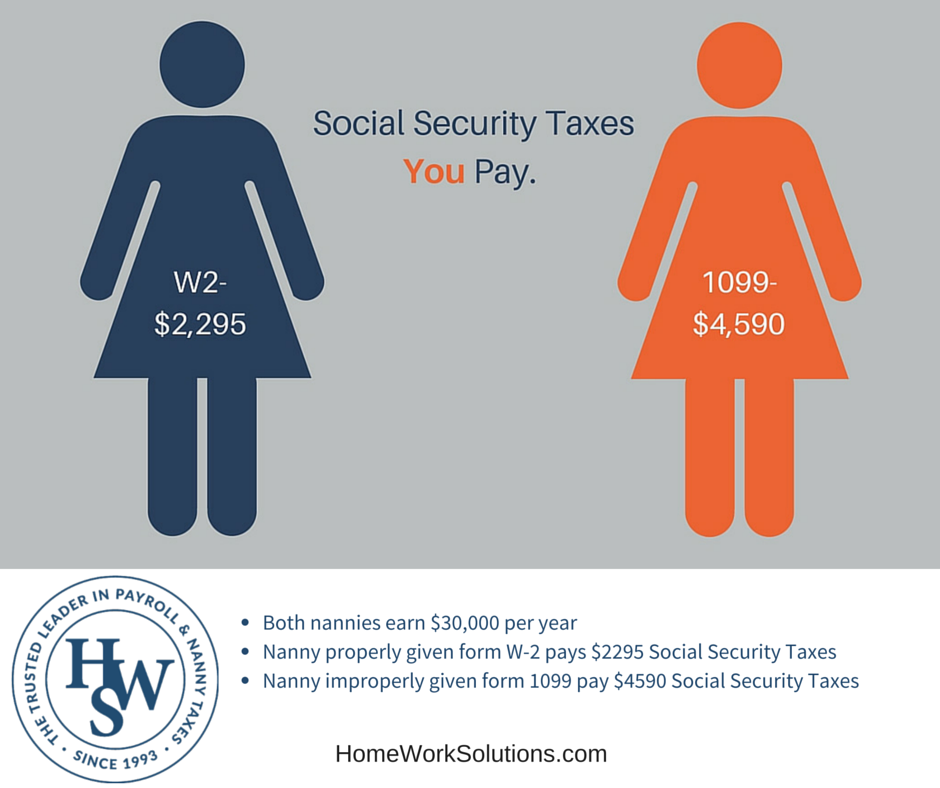

- How To Be The Best Nanny The 1099 Trap Nannies Are Not Self Employed

- 1

- 2019 Instructions For Schedule H 2019 Internal Revenue Service

- Everything You Really Should Know About The Nanny Tax Wsj

Find, Read, And Discover Self Employed Nanny Taxes, Such Us:

- Invoice Template For Nanny Services

- How To Be The Best Nanny The 1099 Trap Nannies Are Not Self Employed

- Nannies Self Employment Nannytax

- Guide To Nanny Taxes For Household Employers Gtm Payroll

- Nanny Given A 1099 Fights Back

If you are looking for Newspaper Article About Government you've reached the right location. We ve got 102 graphics about newspaper article about government adding pictures, photos, pictures, backgrounds, and much more. In such webpage, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Do i pay taxes as a nanny.

Newspaper article about government. The transfer of a self employed status between jobs is not automatic and the family is responsible for requesting written confirmation of the nannys self employment status from hmrc. None of which apply to a nanny. We are often asked if nannies can be self employed and therefore sort out their own tax and national insurance.

Yes by law as an employee you are required to file and pay taxes. Share facebook twitter google reddit whatsapp pinterest email linkedin. However if you were to call hmrc and ask them to register you as self employed they will allow you to.

If a nanny was previously self employed. However in some cases hmrc do grant nannies self employed status for example if the nanny works in a series of temporary positions or works for three or more families at the same time in which case she would have to register with ofsted as a child minder. Typically a self employed contractor provides their own equipment and determines their own hours.

The employer is responsible for requesting written confirmation of the nannys self employed status from hmrc. Also included with turbotax free edition after filing your 2019 tax return. In summary i hope that this helps you with the main self employed nanny tax deductions for your tax return.

Self employed child care providers provide their own supplies or equipment and offer their services to the public perhaps for a number of different clients. While most nannies are household employees some could be self employed. Included with all turbotax deluxe premier self employed turbotax live or prior year plus benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312021.

Can i be self employed. Transfer of a self employed status between jobs is not automatic. There was a tax court case in 2011 whereby a part time babysitter with no set hours or availability was determined to be self employed under appeal but a full time caregiver for your children is.

These kinds of care providers are generally in home day care providers and not household employees. Social security medicare futa federal unemployment tax act and both federal and state taxes. The information contained herein is general in nature and is not intended as legal tax or investment advice.

If it later comes to light that nanny is not self employed then its the employer not the nanny who will be committing a. If you need to get help with your tax return request a free tax quote. The tax information contained in this article should not be used for any actual nanny relationship without the advice and guidance of a professional tax advisor who is familiar with all the relevant facts.

Self employed nanny tax deductions.

More From Newspaper Article About Government

- Self Employed Furlough Can You Still Work

- Types Of Government Reading And Worksheet Answers

- Self Employed News

- Self Employed Jobkeeper Payment Ato

- Update On Self Employed Furlough Scheme

Incoming Search Terms:

- Nanny And Caregiver Payroll Services Caregiver Tax Services Your Nanny An Employee Or Contractor Update On Self Employed Furlough Scheme,

- Employment Law Changes In April 2020 Update On Self Employed Furlough Scheme,

- Nannies Aren T Self Employed Nanny Advice Pay My Nanny Update On Self Employed Furlough Scheme,

- Nanny Taxes Guide How To Easily File For 2019 2020 Sittercity Update On Self Employed Furlough Scheme,

- Key Facts To Employing A Nanny Pc Payroll Update On Self Employed Furlough Scheme,

- How To File Nanny Taxes For Nannies Employers Benzinga Update On Self Employed Furlough Scheme,

/hire-a-nanny-58e10a823df78c516250c87c.jpg)