Self Employed Workers Comp Exemption, Quick Guide To Workers Comp Insurance For Self Employed

Self employed workers comp exemption Indeed lately has been hunted by users around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of the article I will talk about about Self Employed Workers Comp Exemption.

- Workers Compensation Insurance For Small Business Coverwallet

- Https Www Wcrb Org Forms Xs Wc 0001 0002 Wi 10 14 Excess Workers Compensation And Employers Liability Coverage Pdf

- Workers Compensation Insurance For 1099 Contractors Workcomplab

- Https Www Rsu Edu Wp Content Uploads 2015 05 Exemptstatus Pdf

- Workers Compensation Insurance For Small Business Coverwallet

- Http Www Ohiobwc Com Downloads Blankpdf U 3e Pdf

Find, Read, And Discover Self Employed Workers Comp Exemption, Such Us:

- Fillable Online Independent Contractor Waiver Of Workers Compensation Agreement Fax Email Print Pdffiller

- 2

- Http Www Icrb Net Forms Pdfs State Form 45899 Pdf

- Https One Oecd Org Document Daf Comp Wd 2019 39 En Pdf

- Division Of Workers Compensation

If you re looking for Limited Government Picture And Meaning you've reached the ideal location. We ve got 103 graphics about limited government picture and meaning adding pictures, pictures, photos, wallpapers, and more. In such page, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

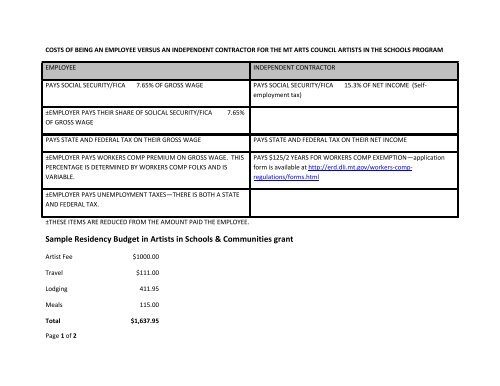

Workers compensation for the self employed is considered to be personal coverage for business owners and independent contractors.

Limited government picture and meaning. Businesses meet this requirement of the law by. Independent contractors are not employees. Each state has different regulations that exempt certain types of workers from being covered by workers compensation insurance.

An individual employer partner limited liability company member self employed person or corporate executive officer owning 25 or more of the common stock is not required to be covered but may elect to be covered if. The workers compensation law requires that employers obtain and continuously keep in effect workers compensation coverage for all their employees. Generally an employer with one or more employees must carry workers compensation insurance to cover those employees.

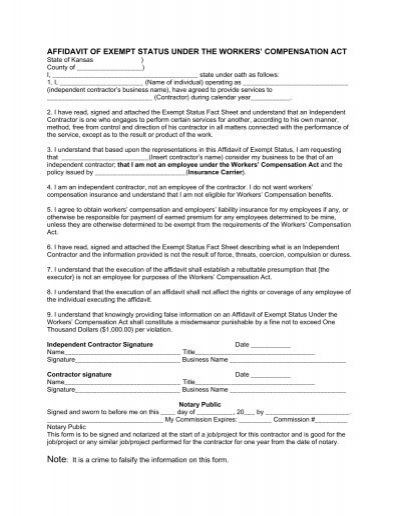

Upon issuance of a certificate of election to be exempt the officer or member is not an employee and may not recover workers compensation benefits. The most common type of excluded worker is an independent contractor. However a self employed person can get workers compensation insurance but it may or may not be worth pursuing.

In massachusetts you can face civil fines of up to 250 a day criminal fines of up to 1500 and jail time. In new jersey failure to carry workers comp is considered a criminal offense punishable by a fine of 10000 or imprisonment for up to 18 months. This covers expenses pertaining to most work related injuries including medical bills and lost wages with some exceptions.

If you are self employed or a sole proprietor the state does not require any company to provide you with insurance nor does it require you to get it for yourself. When investing in this insurance a business owner or independent contractor can access wage replacement if they are injured while working. If you do not have workers comp you will not be covered and cannot receive benefits if you are injured on the job.

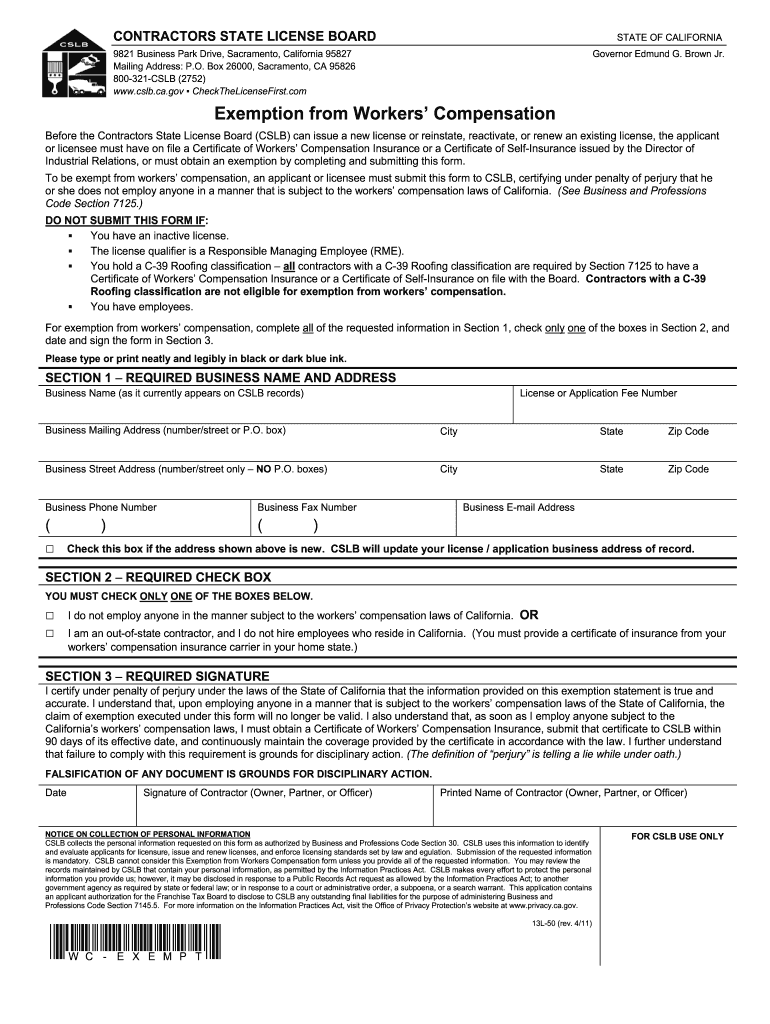

In exchange for this coverage employees waive the right to sue their employer for injuries although employees may still sue in certain instances. Obtaining self insurance for workers compensation. The purpose of filing an exemption is for an officer of a corporation or member of a limited liability company to exclude themselves from the workers compensation laws.

If youre an employee and receive a w 2 form at the end of the tax year then your employer is most likely required to carry workers compensation insurance. Workers compensation exemption certificate clearance the indiana department of revenue dor issues a workers compensation exemption certificate clearance to individual taxpayers who are independent contractors or otherwise not required to carry workers compensation insurance on themselves under the workers compensation act of indiana.

More From Limited Government Picture And Meaning

- Communicating With Government Officials Clipart

- Self Employed Nail Technician Insurance

- Self Employed Pandemic Unemployment Assistance Ky

- Government Revenue On Supply And Demand Graph

- Resume For Government Jobs Canada

Incoming Search Terms:

- Does A Sole Proprietor Need Workers Compensation Insurance Next Insurance Resume For Government Jobs Canada,

- Https Annemarie Dellaquila Gwzs Squarespace Com S Affidavit Of Exempt Status Under The Workers Pdf Resume For Government Jobs Canada,

- More Employers Ask Workers To Sign Covid 19 Waivers But They May Not Be Legal Leaders Choice Insurance Resume For Government Jobs Canada,

- Quick Guide To Workers Comp Insurance For Self Employed Resume For Government Jobs Canada,

- Workers Comp What Small Business Owners Should Know Resume For Government Jobs Canada,

- Https Www Uppermoreland Org Documentcenter View 65 Affidavit Of Workers Compensation Insurance Coverage Pdf Resume For Government Jobs Canada,