Self Employed Income Tax Calculator 2019, Uk Tax Calculator Income Tax Calculator

Self employed income tax calculator 2019 Indeed lately is being hunted by consumers around us, maybe one of you. People now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of the post I will talk about about Self Employed Income Tax Calculator 2019.

- Pttswtiyk0nmsm

- Malaysia Personal Income Tax Guide 2019 Ya 2018

- Free Personal Income Tax Calculator Excel Spreadsheet For Self Emp Golagoon

- Federal Income Tax Calculator 2020 Credit Karma

- Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips

- Form W 2 Understanding Your W 2 Form

Find, Read, And Discover Self Employed Income Tax Calculator 2019, Such Us:

- Employment And Labor Law 8th Edition Self Employment Tax Calculator Employee Development Department Employment Self Employment Business Tax Employment

- Free Tax Estimate Excel Spreadsheet For 2019 2020 Download

- Freelancer Guide All You Need To Know About Your Income Taxes

- Online Income Tax Calculator Calculate Your Income Taxes For Fy 2020 2021 Scripbox

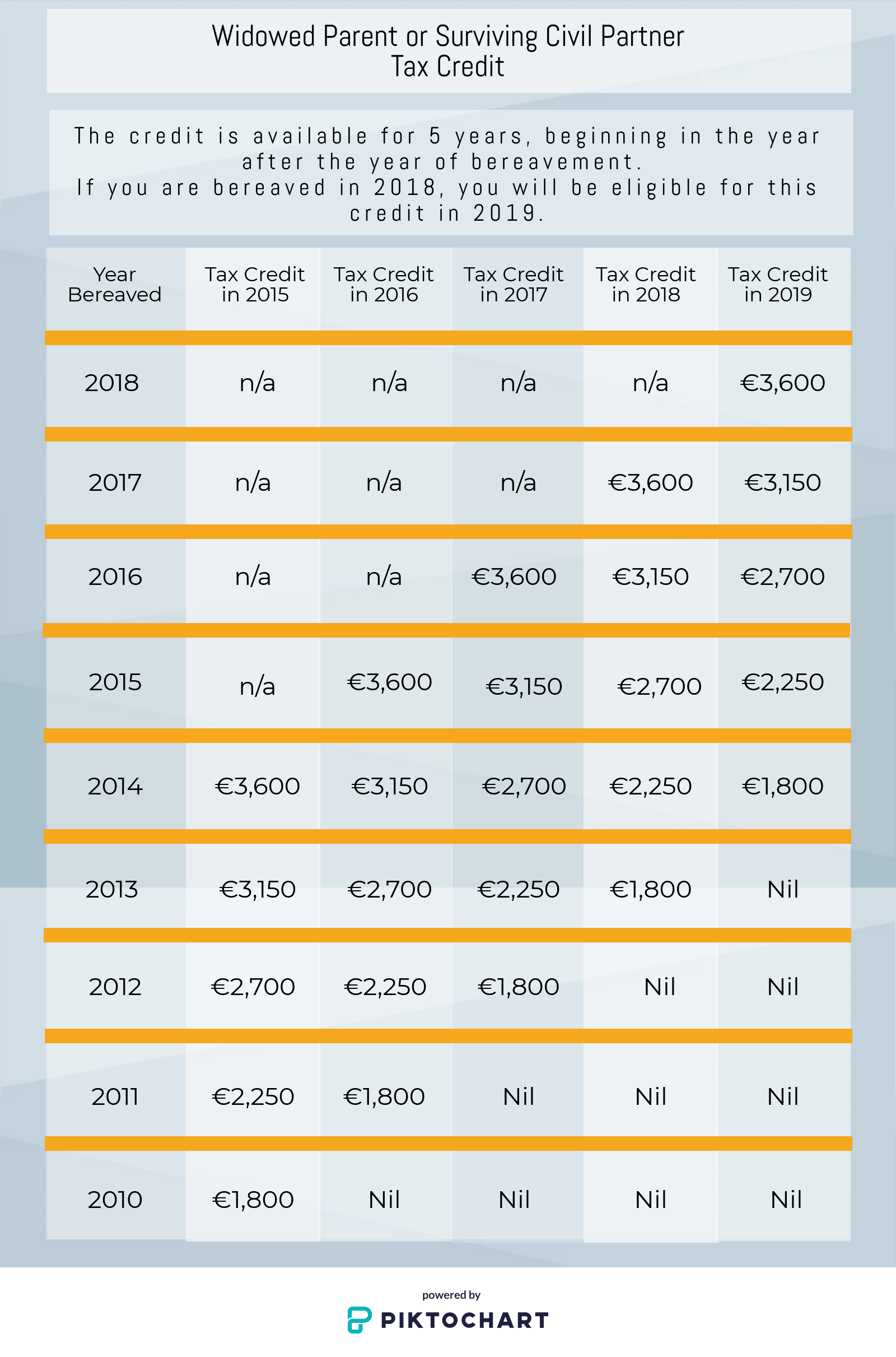

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

If you are looking for Government Canada Immigration Logo you've arrived at the right location. We have 104 graphics about government canada immigration logo including pictures, photos, photographs, backgrounds, and more. In such web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

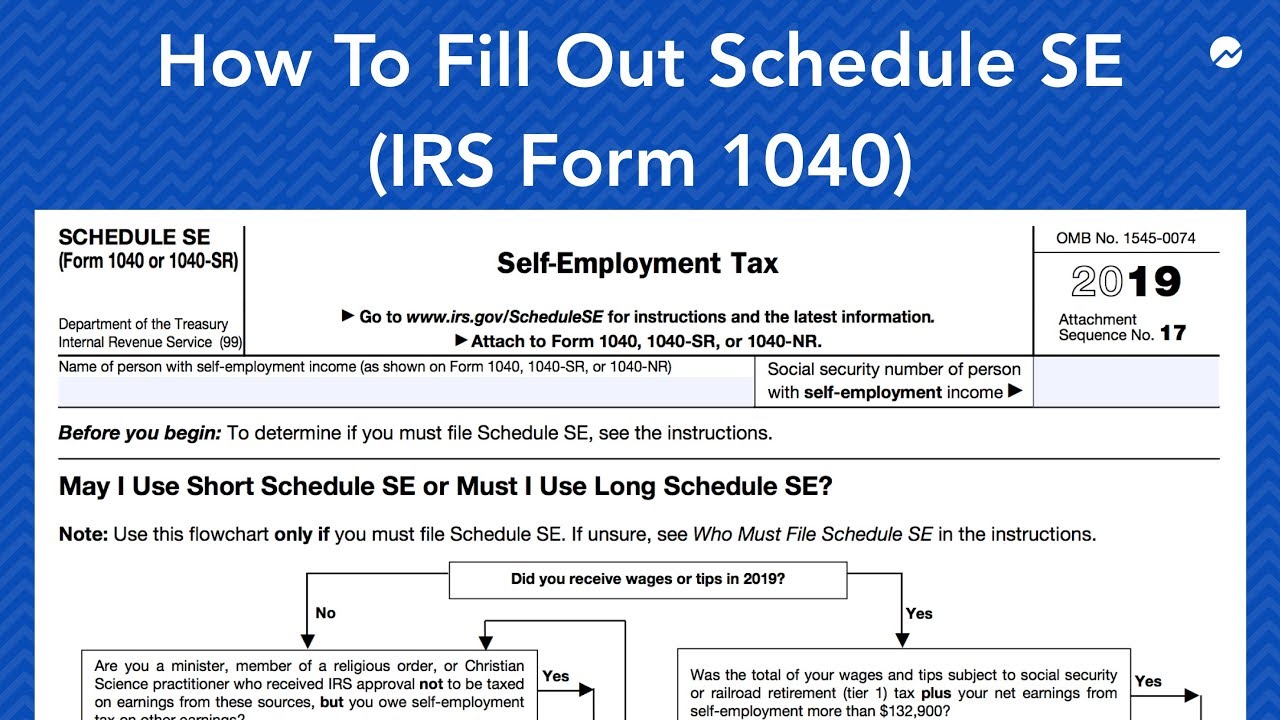

Self employed workers are taxed at 153 of the net profit.

Government canada immigration logo. This percentage is a combination of social security and medicare tax. This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income. Small business owners contractors freelancers gig workers and others whose net profit is greater than 400 are required to pay self employment tax.

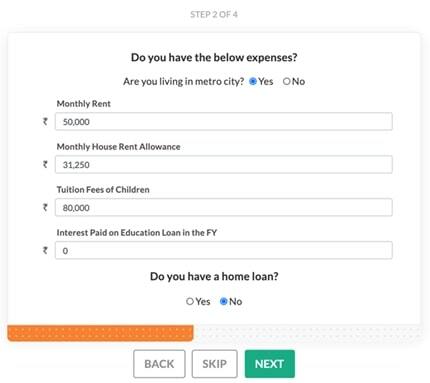

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. Irish tax calculator 2019. Estimates based on deductible business expenses calculated at the self employment tax income rate 153 for tax year 2019.

Self employed tax calculator 2020 2021. Self employment tax consists of social security and medicare taxes for individuals who work for themselves. Employees who receive a w 2 only pay half of the total social security 62 and medicare 145 taxes while their employer is responsible for paying the other half.

The calculator uses tax information from the tax year 2020 2021 to show you take home pay. If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts.

Please note that the constants section does not need to be changed and is exposed for completeness. Self employment profits are subject to the same income taxes as those taken from employed people. Pays for itself turbotax self employed.

You pay 7200 40 on your self employment income between 10000 and 28000. Self employed individuals are responsible for paying both portions of the. For a more robust calculation please use quickbooks self employed.

The deadline is january 31st of the following year. You pay 2000 20 on your self employment income between 0 and 10000. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability.

Check your certificate of tax free allowances to ensure that the specified values are correct. The calculations provided should not be considered financial legal or tax advice. Once you have personalised your calculator dont forget to bookmark it so that you do not have to enter the.

Self employment tax calculator. The key difference is in two areas national insurance contributions and the ability to deduct expenses and costs before calculating any deductions. You will need to submit a self assessment tax return and pay these taxes and contributions yourself.

Please enter your salary details in the variables section below.

More From Government Canada Immigration Logo

- 2021 Government Holidays In Tamil Nadu Go Pdf

- When Does The Furlough Scheme Finish In Scotland

- Hm Government Logo Transparent Background

- Government Laptop Lenovo 2019

- Self Employed Kannada Meaning

Incoming Search Terms:

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Self Employed Kannada Meaning,

- Income Tax Calculator 2019 Self Employed Self Employed Kannada Meaning,

- How To Get Your Sa302 Form Online Or By Phone Goselfemployed Co Self Employed Kannada Meaning,

- Employment And Labor Law 8th Edition Self Employment Tax Calculator Employee Development Department Employment Self Employment Business Tax Employment Self Employed Kannada Meaning,

- Employed And Self Employed Tax Calculator Taxscouts Self Employed Kannada Meaning,

- 2 Self Employed Kannada Meaning,