Government Budget Constraint Implies That, Solved Consider The Standard One Period Model Of The Macr Chegg Com

Government budget constraint implies that Indeed lately has been sought by consumers around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of the post I will discuss about Government Budget Constraint Implies That.

- Optimal Taxation With Incomplete Markets Pdf Free Download

- Universidad De Montevideo Macroeconomia Ii The Ramsey Cass Koopmans Model Pdf Free Download

- Http Www3 Nd Edu Esims1 Sims Wolff May 2014 Final Pdf

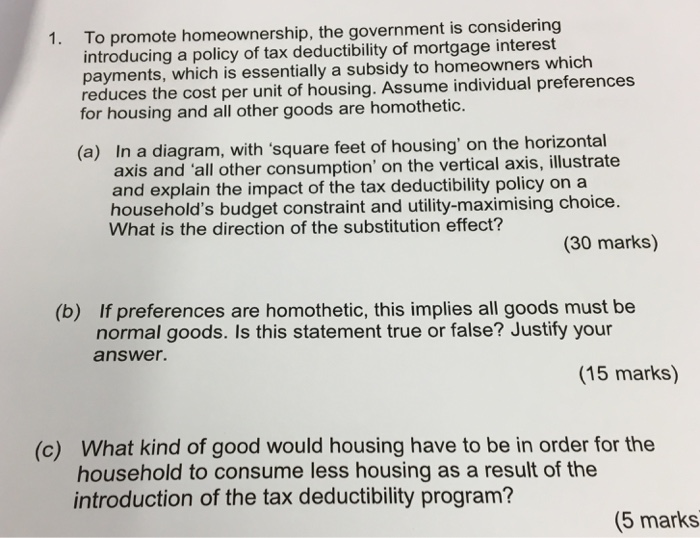

- Solved To Promote Homeownership The Government Is Consid Chegg Com

- 2

- Solved Garbanzo Beans Price 2 4 6 8 10 5 000 1 000 4 Chegg Com

Find, Read, And Discover Government Budget Constraint Implies That, Such Us:

- Http Www Nber Org Papers W17989 Pdf

- Http Www1 Worldbank Org Publicsector Pe Pfma06 Easterly Pdf

- Optimal Taxation With Incomplete Markets Pdf Free Download

- 1 Chapter 9 Policy Tools For Macroeconomic Analysis C Pierre Richard Agenor The World Bank Ppt Download

- The Government Budget Constraint Implies That A Government Borrowings Course Hero

If you re searching for Self Employed Definition Irs you've reached the right location. We have 100 graphics about self employed definition irs adding images, photos, photographs, backgrounds, and more. In these webpage, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

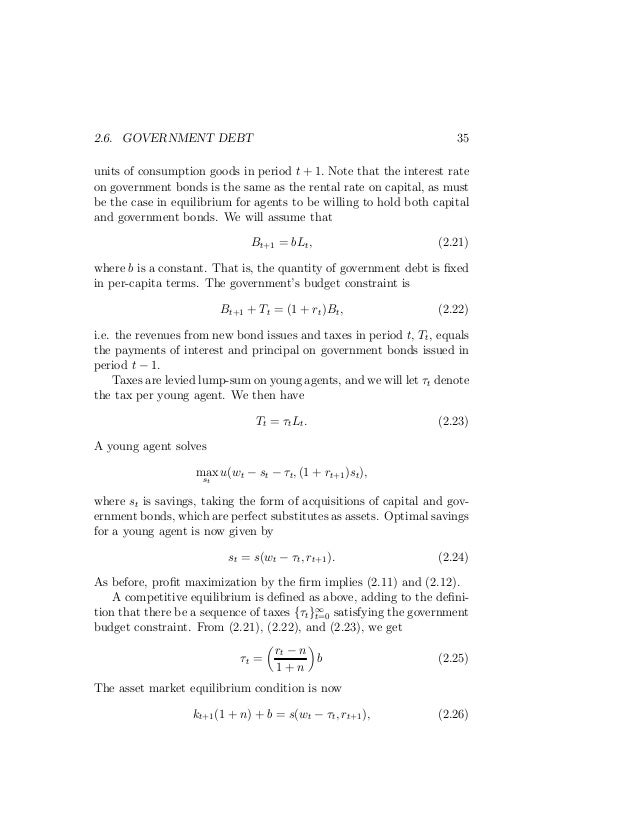

32 it is because p 2 1.

Self employed definition irs. Given the stance of fiscal policy s t and the real value of existing liabilities a t the central banks interest rate determines the rate of growth of nominal. Both concepts have a ready graphical representation in the two good case. B government borrowings taxes and user charges government spending transfers.

B government borrowings taxes and user charges government spending transfers c government spending transfers taxes and user charges government borrowing. It represents all the good except x 1 that the consumer is capable of buying. Balanced price and income changes.

A t 1 a t 1 s t a t i where s t i i m t s t is the surplus inclusive of seigniorage. Current debt outstanding discounted present value of future primary surpluses. Specifically it is the requirement that.

The government budget constraint implies that government expenditure must be from econ 1102 at university of new south wales. Government borrowings government spending transfers taxes and user charges. The government budget constraint implies that a government borrowings government spending transfers taxes and user charges.

2 selling interest bearing government debt to the private sector bonds. C the present value of government spending must be equal to the present value of taxes. So the budget constraint will also hold under this interpretation ie x 2 is a composite good.

In this case the budget constraint will take the following form. Consumer theory uses the concepts of a budget constraint and a preference map to analyze consumer choices. And 3 issuing non interest bearing high powered money money creation.

Various scenarios are constructed to show that. The positive difference between the sale price and the purchase price of an asset. Marginal tax rate mtr.

51 the governments present value budget constraint states that a taxes must equal government spending in each period. The government budget constraint implies that. The government budget constraint implies that.

Asked jul 13 2016 in economics by dorothy. In particular the flow budget constraint 7 implies. B the present value of government spending must be equal to the present value of consumers disposable incomes.

In economics a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within his or her given income. P 1 x 1 x 2 m. Mainstream economics uses the government budget constraint framework gbc to analyse three alleged forms of public finance.

More From Self Employed Definition Irs

- Furlough Retention Scheme Claim

- Government Grants For Individuals

- Self Employed Jobs From Home Ideas Uk

- Government Majority

- Income Self Employed Letter Sample

Incoming Search Terms:

- Https Www Ecb Europa Eu Events Pdf Conferences Galietal Pdf Income Self Employed Letter Sample,

- Government Spending Corruption And Economic Growth Sciencedirect Income Self Employed Letter Sample,

- Http Www Econ Yale Edu Smith Econ510a Notes99 Pdf Income Self Employed Letter Sample,

- Https Www Jstor Org Stable 2077787 Income Self Employed Letter Sample,

- The Political Economy Of Budget Deficits The Political Economy Of Budget Deficits Income Self Employed Letter Sample,

- Http Webspace Qmul Ac Uk Gfella Teaching Macropol Lectures Lecture5 Pdf Income Self Employed Letter Sample,

/dotdash_Final_Ricardo_Barro_Effect_Apr_2020-013-e69df9ace8dc455ca5b824eff822861f.jpg)