Self Employed Income Tax Form, Self Employment Tax Form Sample Forms

Self employed income tax form Indeed recently has been sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the post I will discuss about Self Employed Income Tax Form.

- Your Complete Guide To Self Employment Taxes In 2020 Ridester Com

- Self Assessment Tax Return Form Explained Goselfemployed Co

- Income Tax For Self Employed Persons Pdf Free Download

- Schedule Se Self Employment Form 1040 Tax Return Preparation Youtube

- Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips

- Form 1040 Ss U S Self Employment Tax Return Form 2014 Free Download

Find, Read, And Discover Self Employed Income Tax Form, Such Us:

- How To Report And Pay Taxes On 1099 Income

- Income Tax Forms Income Tax Forms For Self Employed

- Income Tax For Self Employed Persons Pdf Free Download

- Free 6 Sample Self Employment Tax Forms In Pdf

- Self Employment Form Fill Out And Sign Printable Pdf Template Signnow

If you re looking for Government Shutdown 2020 Coronavirus you've arrived at the right location. We have 104 graphics about government shutdown 2020 coronavirus including pictures, photos, photographs, wallpapers, and much more. In these web page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Notification to file income tax return.

Government shutdown 2020 coronavirus. You must file an income tax return if you receive a letter form or an sms from iras informing you to do so. In general anytime the wording self employment tax. After filing the tax return automatically deduction of tax will occur and you will get your net income amount.

The self employment short form and notes have been added for tax year 2019 to 2020. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. If you are starting a small business see the checklist for new small businesses.

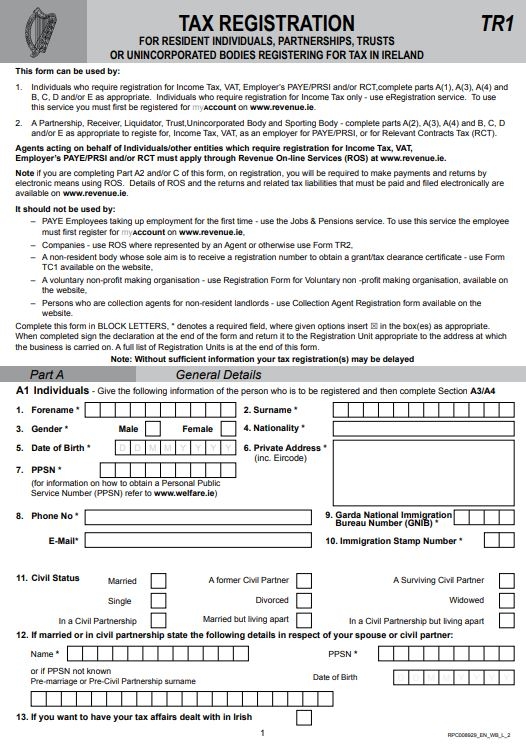

Self employment forms register if youre self employed or a. A self employed is liable to pay tax when the gross income is more than rs250000year. The t4002 contains information for self employed business persons commission sales persons and for professionals on how to calculate the income to report on your income tax return.

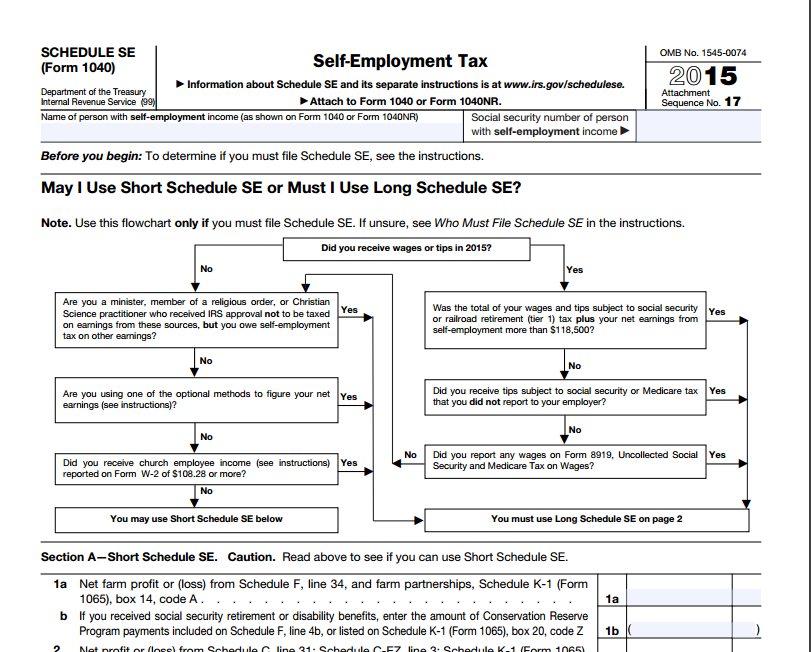

Whats new for small businesses and self. Schedule se form 1040 or 1040 sr self employment tax pdf instructions for schedule se form 1040 or 1040 sr self employment tax pdf schedule k 1 form 1065 partners share of income credits deductions etc. Name of person with self employment income as shown on form 1040 1040 sr or 1040 nr social security number of person with.

The social security administration uses the information from schedule se to figure your benefits under the social security program. If your only income subject to self employment tax is. Instead go to corporations.

A self employer has to pay hisher taxes by filing the income tax return form. If you are incorporated this information does not apply to you. Self employed individuals including those earning income from commissions.

Use schedule se form 1040 or 1040 sr to figure the tax due on net earnings from self employment. It does not matter how much you earned in the previous year or whether your employer is participating in the auto inclusion scheme ais for employment income. Church employee income see instructions.

Find helpsheets forms and notes to help you fill in the self employment and partnership pages of your self assessment tax return. The checklist provides important tax information. Also see instructions for the.

It is similar to the social security and medicare taxes withheld from the pay of most wage earners. Se tax is a social security and medicare tax primarily for individuals who work for themselves.

More From Government Shutdown 2020 Coronavirus

- Government Printable Covid Signs Uk

- Nsw Government Qr Code

- Self Employed Vs Limited Company Tax

- E Government Indonesia

- Government Organization In Russia

Incoming Search Terms:

- Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips Government Organization In Russia,

- Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding Government Organization In Russia,

- Self Assessment Tax Return And The Short Self Employed Tax Return Form Government Organization In Russia,

- Solved Chapter 6 Self Employed Business Income Line 12 O Chegg Com Government Organization In Russia,

- Free 6 Sample Self Employment Tax Forms In Pdf Government Organization In Russia,

- Income Tax Return Filing For Ay 2018 19 How To File Itr For Self Employed In India The Financial Express Government Organization In Russia,