Self Employed Vs Limited Company Tax, Dividend Vouchers Explained Limited Company Faqs

Self employed vs limited company tax Indeed recently is being sought by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of the post I will talk about about Self Employed Vs Limited Company Tax.

- Free 6 Sample Self Employment Tax Forms In Pdf

- Limited Company Vs Sole Trader 2019 20 Jf Financial

- Download Instructions For Form Or Ltd 150 560 001 Lane Transit District Self Employment Tax Pdf 2019 Templateroller

- Becoming A Ltd Driver 2019 Pages 1 7 Text Version Fliphtml5

- Self Employed Or Limited Company Which Business Structure To Choose

- What Does Ir35 Mean For Nurses And Carers On Florence Updated Jan 2020

Find, Read, And Discover Self Employed Vs Limited Company Tax, Such Us:

- Changing From Sole Trader To Limited Company A Simple Guide

- When Are Llc Members Subject To Self Employment Tax Israeloff Trattner Co P C

- Limited Company Advantages And Disadvantages

- 3

- Should I Be Self Employed A Sole Trader Or Run A Limited Company

If you re searching for Government Laptop Lenovo Model you've come to the ideal location. We have 102 images about government laptop lenovo model including pictures, pictures, photos, backgrounds, and more. In such web page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

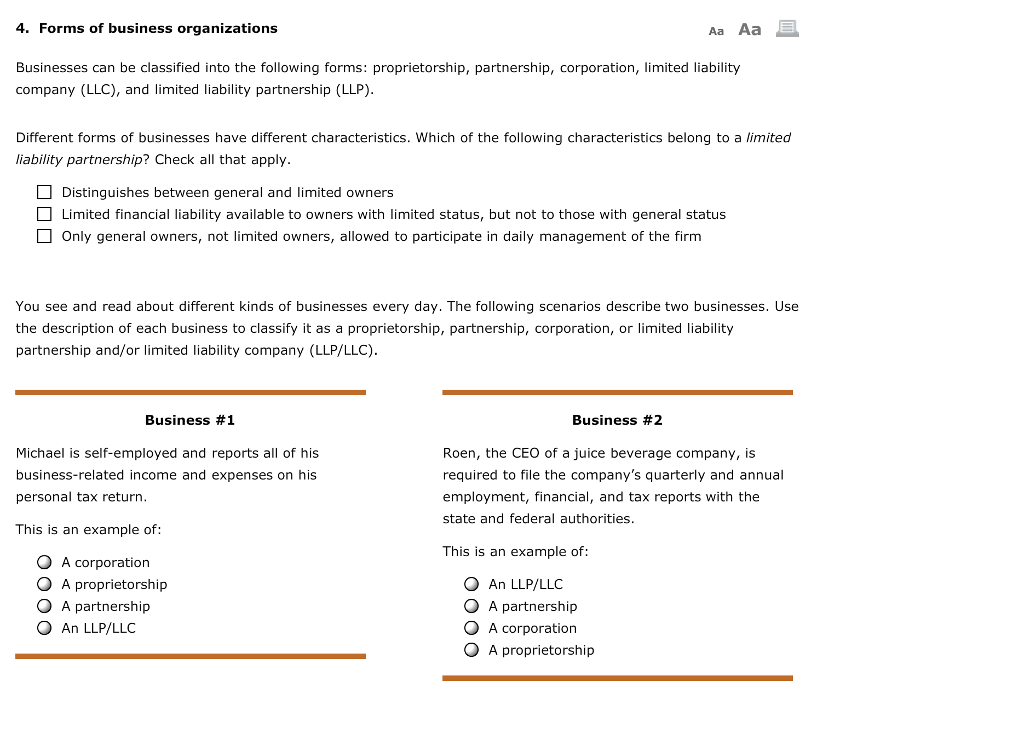

Choosing to set up as a limited company is not as straightforward as registering as self employed and it does come with ongoing additional administration responsibilities.

Government laptop lenovo model. Tax savings as a limited company versus sole trader for the 201920 tax year there are a number of factors to consider when deciding to trade as a limited company. Whilst there are potential tax savings as a limited company there are a number of differences youll need to consider. The business needs to be registered with companies house directors must be appointed and an annual tax return along with a set of accounts must be filed.

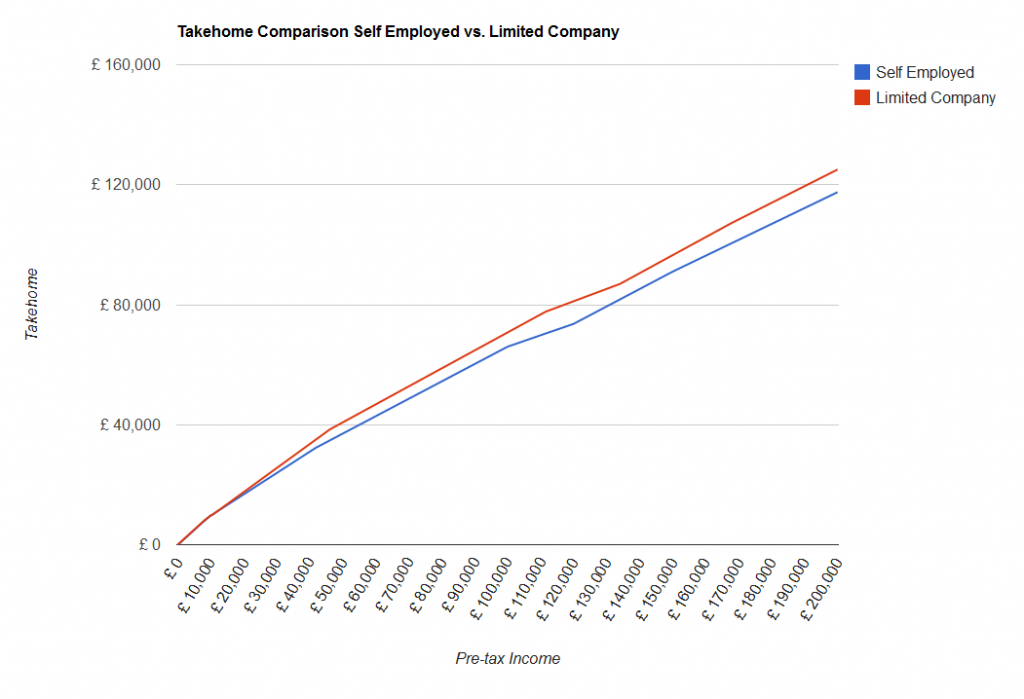

You can however register for vat even if your total sales is under the threshold and i run through whether this is worth considering in this blog. Estimate your annual profits to work out if registering your business as a limited company or as a sole trader is more tax efficient. 2020 2021 values are used to show you how much you get to keep.

This article discusses the pros and cons of a limited company vs sole trader for the 202021 tax year. Vat in a separate tax and once your turnover exceeds 85000 you will need to register for vat regardless of whether you are self employed or trade through a limited company. The limited company tax calculator allows you to see a breakdown of your tax if you are self employed through a limited company.

Use our free online limited company tax calculator to compare your take home pay as a limited company versus as a sole trader. Limited company tax vs sole trader tax. This can sometimes be referred to as being self employed.

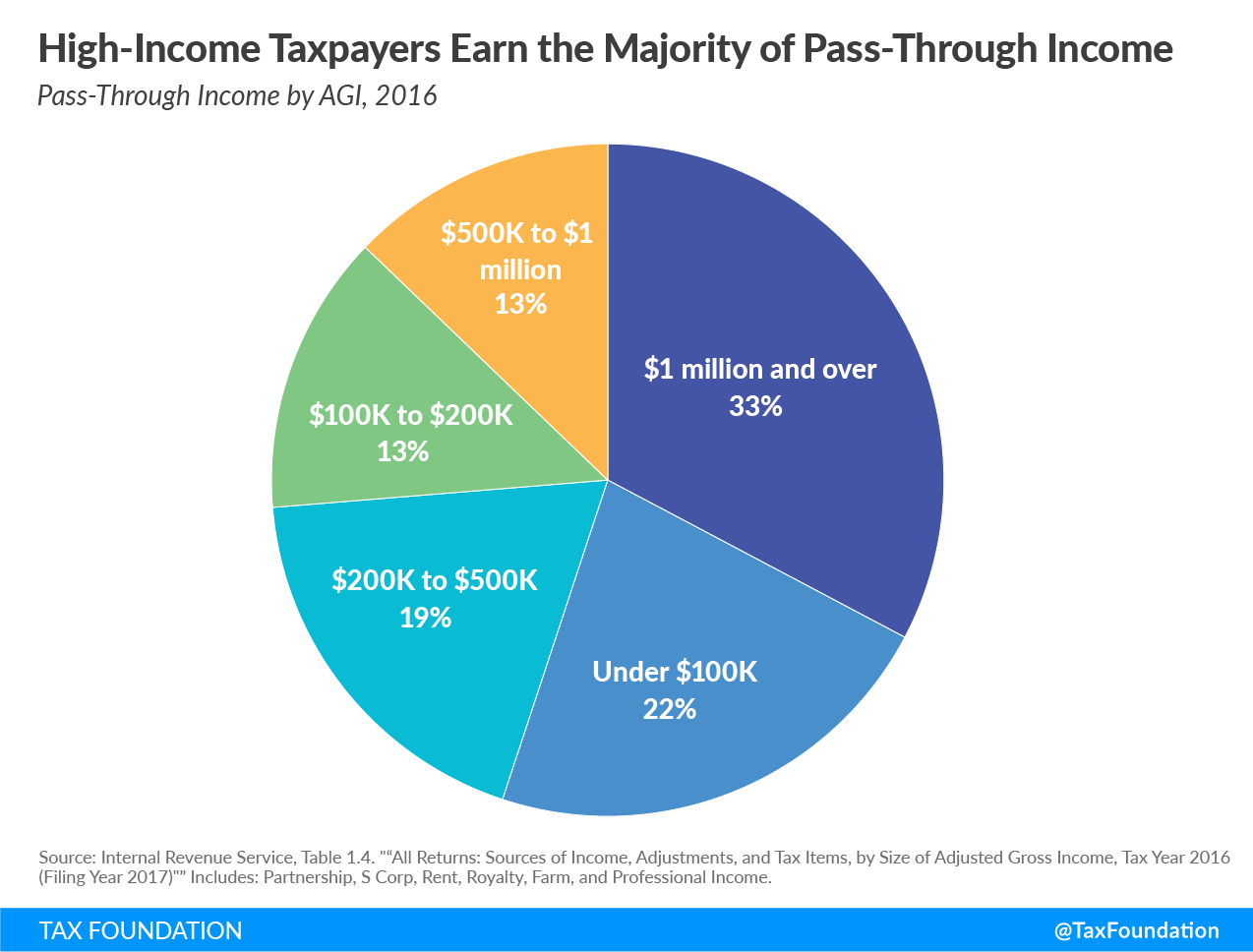

As a self employed individual your personal and business finances are treated as one for tax purposes so your business profits are taxed via the annual self assessment process and you pay any income tax owed by 31st january each year. Invariably one of the primary considerations is the potential tax savings available. To answer this question there are many different factors to consider but the one major factor that is likely to attract freelancers is the tax saving that can be made by trading through a limited company as opposed to becoming self employed.

Self employed vs limited company by vicky evans i had a client come into the office recently to talk about the pros and cons of being self employed versus a limited company a question i am asked alot so i thought i would summarise these for you. Tax for the self employed and limited company directors. More information about the calculations performed is available on the about page.

They will send you out information including a reference number to access their website which you should keep in a safe place. If you set up a company your personal finances and those of the company are completely separate.

More From Government Laptop Lenovo Model

- Government Help To Buy Scheme New Build

- All Government Jobs List In India

- November Furlough Scheme Self Employed

- 3rd Self Employed Grant Claim Date

- Top Government Jobs In India With High Salary

Incoming Search Terms:

- Sole Trader Vs Limited Company What S The Difference Top Government Jobs In India With High Salary,

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Top Government Jobs In India With High Salary,

- Managing Personal Finance When Self Employed 1 Should I Have A Limited Company Youtube Top Government Jobs In India With High Salary,

- Blogging Essentials Part 1 Becoming Self Employed Corporate Dad Uk Dad Blog Top Government Jobs In India With High Salary,

- Corporate Vs Personal Income Tax Overview Top Government Jobs In India With High Salary,

- Business Structure Choosing A Business Structure Truic Top Government Jobs In India With High Salary,

-(1).jpg?sfvrsn=0)