Self Employed Sss Maternity Benefits Requirements, Sss Contribution Table 2020 Sss Benefits For Filipinos

Self employed sss maternity benefits requirements Indeed recently has been sought by consumers around us, maybe one of you. Individuals now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of this post I will discuss about Self Employed Sss Maternity Benefits Requirements.

- Ultimate Guide How To Compute For Sss Maternity Benefit The Pinay Investor

- Sss Salary Loan For Self Employed Or Voluntary Members A Quick Guide Scribbling Neurons

- Republic Of The Philippines Social Security System

- Hr Talk 13 Questions Answered About The 105 Day Maternity Leave Law And An Excel Calculator To Compute Mat Ben Tina In Manila

- Sss Maternity Benefits Based On Expanded Maternity Leave Law

- Sss Maternity Benefit In The Philippines A How To Claim Guide Theasianparent Philippines

Find, Read, And Discover Self Employed Sss Maternity Benefits Requirements, Such Us:

- Hr Talk 13 Questions Answered About The 105 Day Maternity Leave Law And An Excel Calculator To Compute Mat Ben Tina In Manila

- Guide For The Sss Expanded Maternity Leave Law Moneygment

- How To Compute For Sss Maternity Benefit Under The Expanded Maternity Law Sss Inquiries

- Sss Maternity Reimbursement Form Pdf Republic Of The Philippines Social Security System Mat 2 Maternity Reimbursement Rev 03 99 Please Read Course Hero

- Sss Online Maternity Benefits Calculator E Pinoyguide

If you re searching for Government Contract Types Chart you've reached the perfect location. We have 104 graphics about government contract types chart including images, photos, pictures, wallpapers, and much more. In such page, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Sss Bank Enrollment Form Fill Online Printable Fillable Blank Pdffiller Government Contract Types Chart

Sss will pay the full maternity benefit for those who are self employed voluntary and those who have been separated from their employers before giving birth.

Government contract types chart. Paid at least three 3 monthly contributions within the 12 month period preceding the semester of sickness. She has given the required notification of her pregnancy to sss through her employer if employed. If there had been a work related sickness or injury the self employed member will receive loss of income benefits medical benefits and careers allowance and rehabilitation services involving the provision of remedial treatment entrepreneurial or vocational assessment and training.

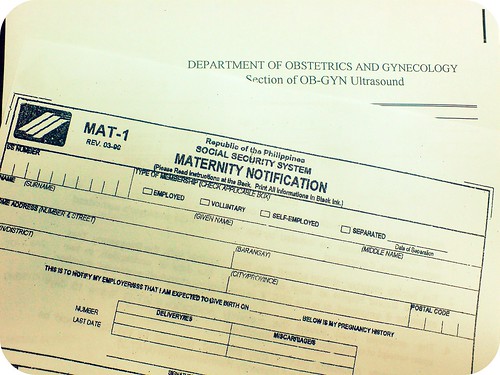

Unemployed self employed or voluntary paying members should notify the sss directly. Any case of delay or failure to notify the employer or the sss within the required period may lead to denial or disapproval of maternity benefit application. For those voluntary paying and self employed members they should visit the sss branch to notify about the pregnancy.

The maternity benefit shall be paid only for the first four 4 deliveries or miscarriages starting may 24 1997 when the. Confined for at least four 4 days. The sss maternity benefit is paid for 60 days for normal delivery or 78 days for caesarean delivery.

Sickness benefit daily cash allowance paid to a member for the number of days heshe is unable to work due to sickness or injury. New sss contribution computation effective 2019. The sss will then reimburse the full amount that the employer paid the employee.

Or submitted the maternity notification directly to the sss if separated from employment a voluntary or self employed member. Requirements for maternity notification. The sss maternity benefit can be enjoyed regardless of whether the mother is employed voluntary self employed or an ofw.

The sss maternity benefit is equal to 100 of your average daily salary multiplied by 60 days for normal delivery or miscarriage and 78 days for caesarean section delivery. Effects of failure or delay in notification. Diane is a self employed sss member and she has been paying p1760 per month for her sss contributions since january 2015.

Sss benefits for self employed members. The maternity benefit is applicable regardless of the mothers marital status. Sss will pay the benefit upon submission of all the required documents of the female member including pregnancy and birth delivery documents.

For self employed un employed and voluntary members they can go directly to their nearest sss branch to comply above required documents. The employer is mandated by law to issue the full maternity benefit within 30 days from the date the member filed her maternity leave. In the case of self employed.

More From Government Contract Types Chart

- Government Institution Image

- Government Administration Jobs In Cape Town

- Central Government Scholarship For College Students Application Form

- Government Nursing Jobs Nj

- Government Vacation Rewards Star Card

Incoming Search Terms:

- How To Compute For Sss Maternity Benefit Under The Expanded Maternity Law Sss Inquiries Government Vacation Rewards Star Card,

- Sss And Philhealth Contribution Tables For 2019 Mastercitizen S Blog Government Vacation Rewards Star Card,

- Sss Contribution Table 2020 Sss Benefits For Filipinos Government Vacation Rewards Star Card,

- Sss Maternity Benefit Frequently Asked Questions Mommy Krystal Government Vacation Rewards Star Card,

- 6 Easy Steps To Compute Your Sss Maternity Benefit Government Vacation Rewards Star Card,

- List Of Sss Application Requirements To Avail Maternity Benefit Howtoquick Net Government Vacation Rewards Star Card,