Self Employed Health Insurance Deduction Schedule C, 2015 Tax Benefits For Long Term Care Insurance Ppt Download

Self employed health insurance deduction schedule c Indeed lately has been sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this post I will discuss about Self Employed Health Insurance Deduction Schedule C.

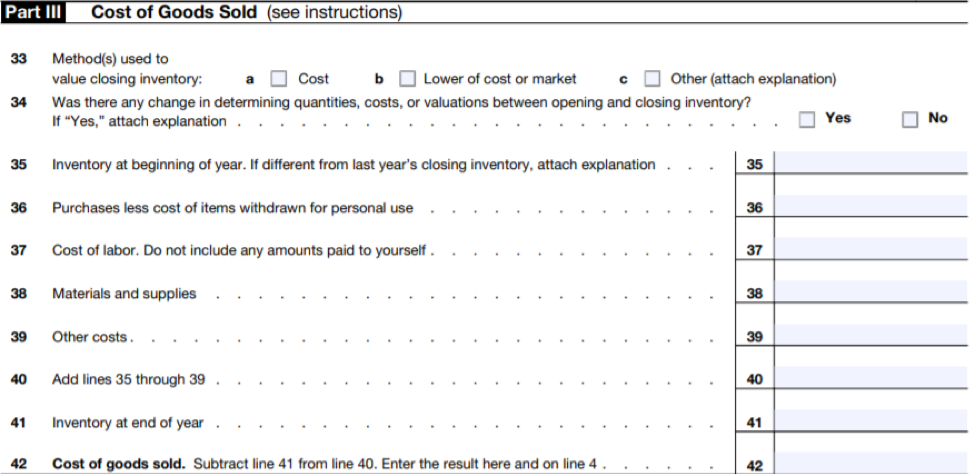

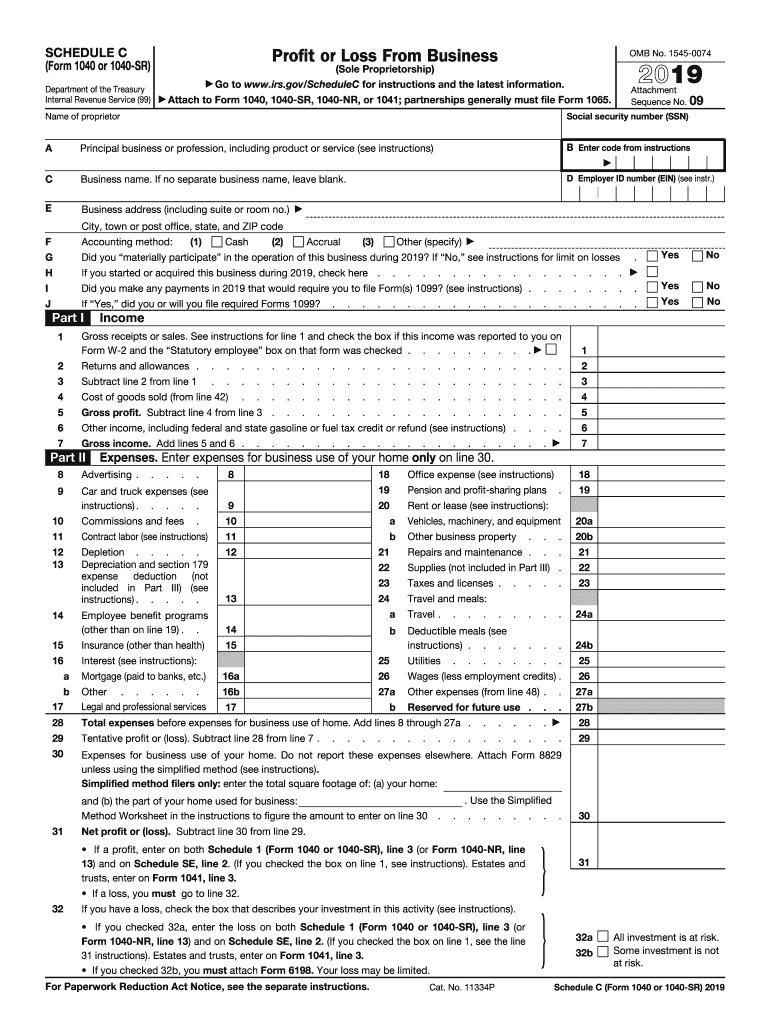

- Irs Schedule C Instructions Step By Step

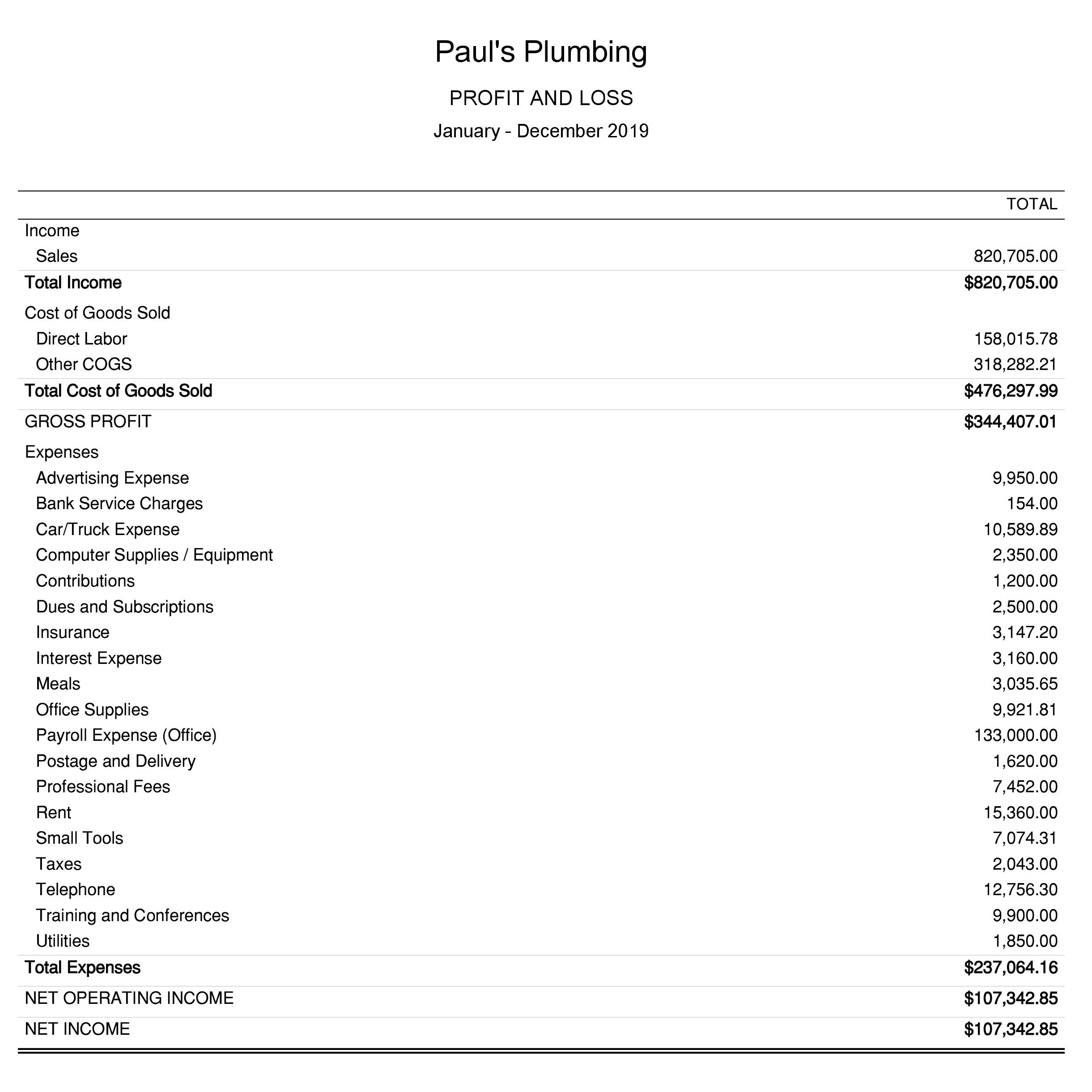

- Solved Carlos Is A Self Employed Plumber During 2017 He Chegg Com

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcspsczlv3p8uqqfln L3xzkhduso8h4an A3six6jivctbg0 5p Usqp Cau

- Https Www Cumortgagedirect Com Globalresources Mortappdocs Selfemployedincome Pdf

- 2015 Tax Benefits For Long Term Care Insurance Ppt Download

- What Is Self Employment Tax And Schedule Se Stride Blog

Find, Read, And Discover Self Employed Health Insurance Deduction Schedule C, Such Us:

- Https C12645812 Preview Getnetset Com Files Schedule C Worksheet Pdf

- Claiming The Self Employment Health Insurance Tax Deduction

- Nonresident Resident Allocation

- What Is Schedule A Of Irs Form 1040 Itemized Deductions Nerdwallet

- Breaking Down The Self Employed Health Insurance Deduction Eric Nisall

If you are searching for Self Employed Registered Address you've come to the ideal place. We ve got 104 graphics about self employed registered address adding pictures, photos, photographs, wallpapers, and much more. In these page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

For 2019 the deduction for self employed health insurance gets reported on line 16 of schedule 1 on the form 1040 not on schedule c.

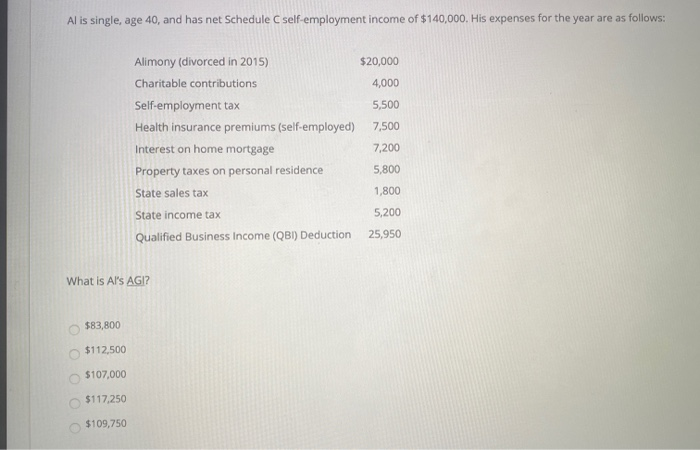

Self employed registered address. You may also qualify for the credit if you meet one of the other requirements. Effect on self employment tax. If you are self employed you may be eligible to deduct premiums that you pay for medical dental and qualifying long term care insurance coverage for yourself your spouse and your dependents.

Qualified long term care insurance contract. Its written to ensure that self employed individuals get a break on their healthcare costs. Qualified long term care insurance.

Only the entry for one business is shown. Self employed health insurance deduction. Drive for uber full time have a business profit profit business income business expenses.

Your self employment income is calculated on schedule c or f and it must be equal to or exceed the amount of your health insurance deduction. Both have legitimate separate self employed health insurance entries on sched. If youre self employed and plan to report a net profit on schedule c you may qualify to claim the self employed health insurance deduction.

Qualified long term care services. For example if your business earned 12000 but premiums cost you 15000 you cant claim the entire 15000. Im missing a trigger somewhere.

Self employed worksheet line 2 of part c for the net profit is blank and i get a zero percent on line 4. This will show up as an adjustment to income on page 1 of the 1040. Instead report it on form 1040 line 29 self employed health insurance deduction are you wondering why isnt health insurance for the owner treated the same as health insurance for employees.

This health insurance write off is entered on page 1 of form 1040 which means you benefit whether or not you itemize your deductions. Unlike other tax deductions for self employed people the self employed health insurance deduction isnt taken on schedule c or on a business return. The self employed health insurance deduction has been around for a whilesince 1987 to be exact.

Husbands business wifes business. Can this be fixed so that the full payments for self employed health insurance for both businesses are shown summed together and deducted on 1040. Its available if you.

Effect on itemized deductions. This is never deductible on schedule c. Health insurance for the owner.

But they do not combine on form 1040 line 29.

More From Self Employed Registered Address

- Government Loans And Grants Covid

- E Government Malaysia Pdf

- Self Employed Vs Limited Company Ireland

- Furlough Rules Coming Back To Work

- Government University In Delhi For Bcom

Incoming Search Terms:

- Blog The Tunstall Organization Inc The Tunstall Organization Inc Government University In Delhi For Bcom,

- Solved Carlos Is A Self Employed Plumber During 2017 He Chegg Com Government University In Delhi For Bcom,

- Schedule C And Form 4562 Tax Year 2017 Ann Miller Chegg Com Government University In Delhi For Bcom,

- Self Employment 1099s And The Paycheck Protection Program Bench Accounting Government University In Delhi For Bcom,

- Turbotax Self Employed Review 2020 Features Pricing The Blueprint Government University In Delhi For Bcom,

- Can I Write My Health Insurance Off As A Business Expense Finance Zacks Government University In Delhi For Bcom,