Government Expenditure Multiplier In Is Lm Model, Changes In Government Spending With Diagram Is Lm Curve Model

Government expenditure multiplier in is lm model Indeed recently is being hunted by users around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of the post I will talk about about Government Expenditure Multiplier In Is Lm Model.

- Monetary Policy Multiplier Introduction To Macroeconomics Exam Docsity

- Is Lm Framework Part 4 Bill Mitchell Modern Monetary Theory

- Buy Income Expenditure Model And The Multiplier The Is Lm Model And Money And Credit Market From A Modern Keynesian Perspective Book Online At Low Prices In India Income Expenditure Model And The

- Chapter 2 The Is Lm Model Lev Lafayette

- Aggregate Demand Ii Applying The Is Lm Model Ppt Download

- Is Lm Model

Find, Read, And Discover Government Expenditure Multiplier In Is Lm Model, Such Us:

- Sage Books Macroeconomics Simplified Understanding Keynesian And Neoclassical Macroeconomic Systems

- 2

- Aggregate Demand I Building The Is Lm Model Ppt Download

- Lm Curve In Macroeconomics Definition Equation Video Lesson Transcript Study Com

- Pdf Class 5 The Is Lm Model And Aggregate Demand Vinh San Nguyen Academia Edu

If you are searching for Self Employed Live In Care Jobs London you've arrived at the right place. We have 104 graphics about self employed live in care jobs london adding pictures, photos, photographs, wallpapers, and much more. In such page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

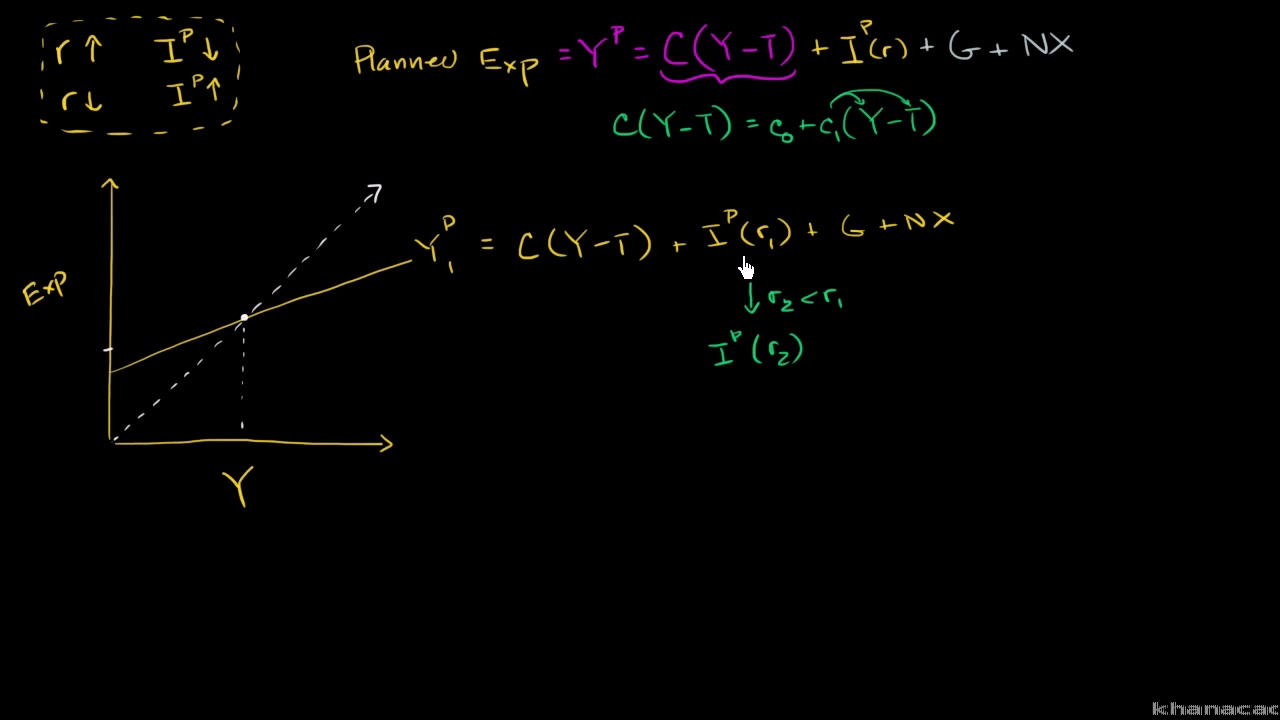

Connecting The Keynesian Cross To The Is Curve Video Khan Academy Self Employed Live In Care Jobs London

246 is less than ek which would occur in keyness model.

Self employed live in care jobs london. This is because keynes in his simple multiplier model assumes that investment is fixed and autonomous whereas is lm model takes into account the fall in private investment due to the rise in interest rate that takes place with the increase in government expenditure. How much income would expand depends on the value of mpc or its. Therefore the money used for payment of taxes does not appear in the successive rounds of consumption expenditure in the multiplier process and the multiplier is reduced to that extent.

You dont have to worry about this too much for the sake of this. The increase in the interest rate partially offsets the expansionary effect. In other words an autonomous increase in government spending generates a multiple expansion of income.

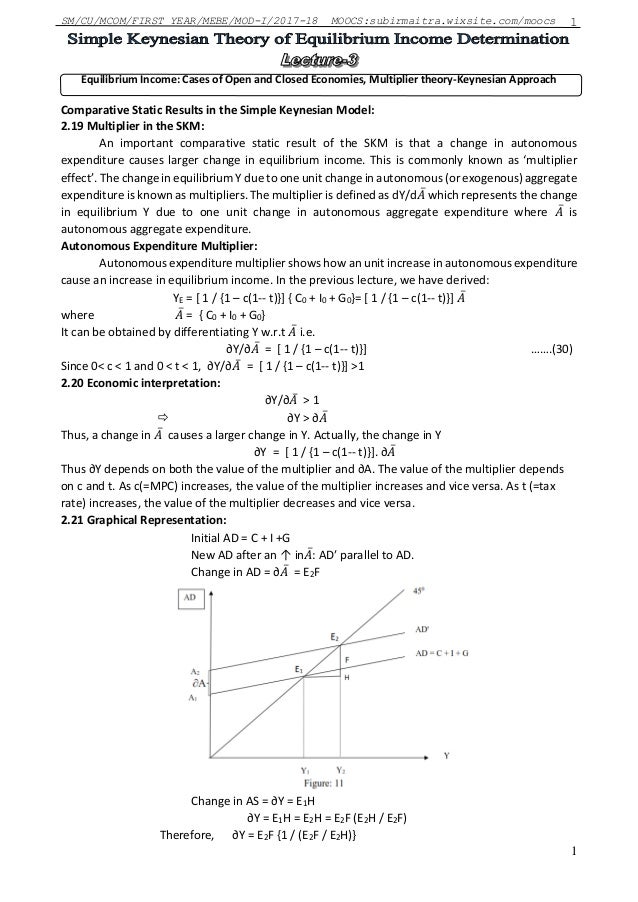

Say that business confidence declines and investment falls off or that the economy of a leading trading partner slows down so that export sales decline. This is the currently selected item. The government expenditure multiplier is shown in fig.

1 where income is taken on the horizontal axis and government expenditure cig is taken on the vertical axis. The multiplier effect on consumption raises the national income and product. That is increase in government expenditure crowds out some private investment.

We saw that by adequately combining price rigidities and a non ricardian framework we could obtain in a model looking very much like the traditional islm an income multiplier greater than one or in other words that an increase in government spending could lead to an increase in private consumption. Thus is lm model shows that expansionary fiscal policy of increase in government expenditure raises both the level of income and rate of interest. The government expenditure multiplier is thus the ratio of change in income y to a change in government spending g.

However if the money raised through taxation is spent by the government the leakage through taxation will be offset by the increase in government expenditure. The multiplier applies to any type of expenditure eg. 69a the combined investment plus government spending curve shifts out to the right from i 0 g 0 to i 0 g.

Government spending and the is lm model. Its actually going to be equal to the multiplier which is 1 minus the marginal propensity to consume times our change in government spending. If government spending increases to g in fig.

Keynesian economics and its critiques. At a fixed interest rate r 0 investment will remain unchanged and i 0 g is greater than i 0 g 0 by dg g 1 g 0. Changes in government spending with diagram.

It is worth noting that in the is lm model increase in national income by y 1 y 2 in fig. According to keynes two sector model c i is the total expenditure curve which cuts the 450 curve at point e and oy is the initial equilibrium income level. Thus k g yg and y k g.

More From Self Employed Live In Care Jobs London

- Governors Island Nyc Glamping

- Government Company List In Stock Market

- Major Types Of Government Quizlet

- Self Employed Job Support Scheme Wales

- New Government Furlough Scheme November

Incoming Search Terms:

- Balanced Budget Multiplier With Diagram New Government Furlough Scheme November,

- Islm Tutorial New Government Furlough Scheme November,

- Solved 2 Algebra And Is Lm Is C Co C1 Y T I I0 I1 R F Chegg Com New Government Furlough Scheme November,

- Is Lm Model Concept Graph And Example New Government Furlough Scheme November,

- The Is Lm Flowchart With Taxes Download Scientific Diagram New Government Furlough Scheme November,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqtnd74f Wd6diixycnvmwuhjz9vr V1fh58nzzoskzrj W8ksj Usqp Cau New Government Furlough Scheme November,