Self Employed Tax Return Form 2019 To 2020, 2019 Basics Beyond Tax Blast July 2019 Basics Beyond

Self employed tax return form 2019 to 2020 Indeed recently is being hunted by users around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of this post I will discuss about Self Employed Tax Return Form 2019 To 2020.

- Self Assessment Self Employment Short Sa103s Gov Uk

- 2019 Instructions For Schedule H 2019 Internal Revenue Service

- Do I Need To Complete A Tax Return Low Incomes Tax Reform Group

- Itr Filing Fy2020 21 How To File Itr Online India Paisabazaar Com

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Itr Filing Fy2020 21 How To File Itr Online India Paisabazaar Com

Find, Read, And Discover Self Employed Tax Return Form 2019 To 2020, Such Us:

- A Y 2020 21 Itr Forms Eligibility Criteria Changes

- How To Get Your Sa302 Form Online Or By Phone Goselfemployed Co

- Irs Issues 2020 Form W 4

- Tax Return Forms And Schedules E File In 2021 Or Now

- How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

If you re searching for Is Furlough Scheme A Grant you've reached the perfect place. We ve got 104 graphics about is furlough scheme a grant including images, photos, pictures, wallpapers, and more. In such page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Form 945 annual return of withheld federal income tax.

Is furlough scheme a grant. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. 6 april 2018 the 2017 to 2018 form and notes have been. Sa103f self employment full 2020 subject.

The tax return form and notes have been added for tax year 2018 to 2019 and the self assessment returns address for wales has been updated. Use schedule se form 1040 to figure the tax due on net earnings from self employment. The self employment short form and notes have been added for tax year 2019 to 2020.

Taxes named above to prepare and deliver on or before 31 october 2020 a tax return on this prescribed form for the year 1 january 2019 to 31 december 2019 note. Source income of foreign persons. The social security administration uses the information from schedule se to figure your benefits under the social security program.

Form 945 x adjusted annual return of withheld federal income tax or claim for refund. People and businesses with other income. An individual who is a chargeable person for the purposes of income tax self assessment should complete a form 11 tax return and self assessment for the year 2019.

Form 1040es estimated tax for individuals. Sending a tax return if youre not an individual. The self employment short form and notes have been added for tax year 2018 to 2019.

Tax return 2019 tax year 6 april 2018 to 5 april 2019 201819 sa100 2019 page tr 1 hmrc 1218 1 your date of birth it helps get your tax right dd mm yyyy 2 your name and address if it is different from what is on the front of this form please write the correct details underneath the wrong ones and put the date you changed. If you submit the return after the 31 august 2020 you must make your own self assessment and calculate your own tax prsi and usc due. This will assist you in paying the correct amount by the due date.

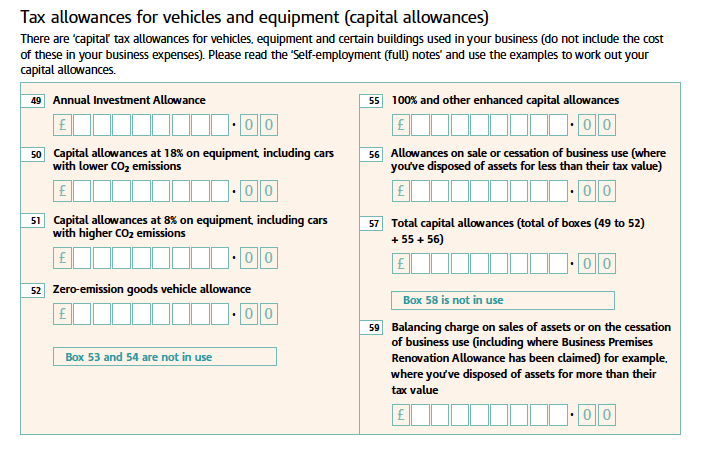

Form 1040 or 1040 sr schedule h household employment taxes. Self assessment for the year ended 31 december 2019 if you complete and submit this tax return on or before 31 august 2020 revenue will calculate the self assessment for you. If youre self employed have more complex tax affairs and your annual business turnover was 73000 or more use the full version of the self employment supplementary page when filing a tax return for the tax year ended 5 april 2020.

The due date for submission.

More From Is Furlough Scheme A Grant

- Hm Government Logo Transparent White

- Self Employed Proof Of Income Form

- Printable Self Employed Invoice Template Pdf

- Government Furlough Scheme Bonus

- Self Employed Second Grant

Incoming Search Terms:

- Other Income On Form 1040 What Is It Self Employed Second Grant,

- Your Self Employed Tax Return Youtube Self Employed Second Grant,

- 2 Self Employed Second Grant,

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Self Employed Second Grant,

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Self Employed Second Grant,

- Hmrc 2020 Tax Return Form Sa100 Self Employed Second Grant,

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png)

/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)