Government Furlough Scheme Tax, Covid 19 Legal Advice For All Employees Gowing Law

Government furlough scheme tax Indeed recently is being sought by users around us, perhaps one of you. People are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the article I will talk about about Government Furlough Scheme Tax.

- Furlough And Tax Is The Government Taxing Furlough Income Personal Finance Finance Express Co Uk

- Charity Tax Group On Twitter Check If You Can Claim For Your Employees Wages Through The Jrs Guidance Has Been Updated Worth Noting The Number Of Staff You Claim For From 1

- Cjrs Further Updates To Government Guidance Fcsa

- Reporting Implications Of Covid 19 Uk Government Job Retention Scheme And Impact On Salaried Directors

- The Furlough Scheme Is Changing On 1st July Freeagent

- Does Furlough Affect The Amount Of Tax You Pay And Will Your Tax Code Change

Find, Read, And Discover Government Furlough Scheme Tax, Such Us:

- Rishi Sunak Announces New Furlough Plan Where Workers Get 77 Pay For Doing 1 3 Hours Tax Rises To Come

- Sunak Extends Furlough Scheme But Limited Companies Are Forgotten

- Furlough Scheme Uk When Are The First Payments And Do You Pay Tax Metro News

- Government Extends Furlough Scheme For Parents On Statutory Leave Article Essex Hunter Co Ltd

- Covid 19 Payroll Sorted Payroll Sorted

If you are looking for Furlough Rules Canada you've reached the perfect location. We have 104 graphics about furlough rules canada adding images, pictures, photos, wallpapers, and more. In these web page, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Furlough And Tax Is The Government Taxing Furlough Income Personal Finance Finance Express Co Uk Furlough Rules Canada

The coronavirus job retention scheme cjrs better known as the furlough scheme will be extended for another month following the announcement of a new national lockdown.

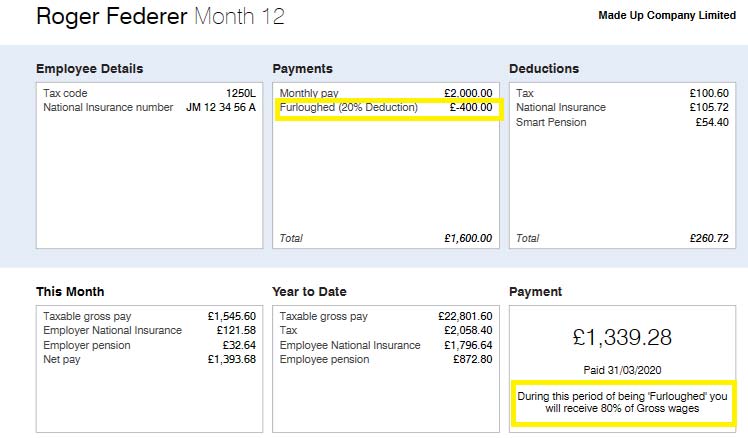

Furlough rules canada. This is in addition to billions of pounds in tax deferrals. While on furlough your wage will be subject to the usual income tax and other deductions the government guidance says. Under the coronavirus jobs retention scheme.

A furlough scheme is offering financial support to millions around the uk. By moya lothian mclean against the odds read. The government has extended the furlough scheme for uk small business employees at 80 per cent of wages for days not worked.

Furloughed workers can receive 80 percent of their monthly salary a result of the governments new job retention scheme. Here we take you through everything you need to know about the furlough scheme and how it affects income tax. Hours before the furlough scheme was due to end the government announced it would be extended until december to cover a further lockdown in england.

The furlough scheme protected over nine million jobs across the uk and self employed people have received over 13 billion in support. The number of people on furlough has fallen from a peak in may of 9 million to about 3 million in september. So far the furlough scheme has cost the exchequer almost 40bn since its launch in march.

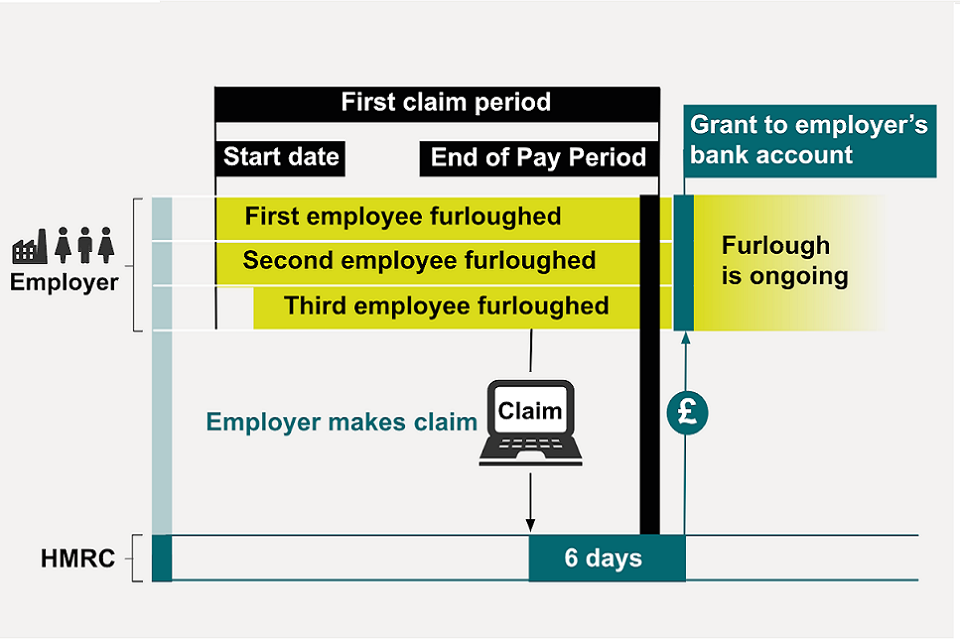

Between march and july the government paid for 80 of furloughed workers wages up to 2500 a month and it also covered employers national insurance ni and. The government launched a coronavirus job retention scheme which. The extended uk wide furlough scheme will run until wednesday december 2 covering 80 per cent of the salary for hours not worked due to compulsory lockdown up to a maximum of 2500.

How to claim money. Government furlough scheme explained. Given it is keeping 75 million jobs safe for now although hundreds of thousands are still excluded from it this is extremely welcome.

But will furlough income be subject to taxation.

More From Furlough Rules Canada

- Furlough Rules Part Time Work

- Government Vouchers Malta Contact Number

- Furlough Rules From November

- Us Government Debt Chart By Year

- Government Nursing Jobs San Diego

Incoming Search Terms:

- Government Furlough Scheme Extended Until October Government Nursing Jobs San Diego,

- Government Delays Job Support Scheme As Furlough Scheme Extended Taxassist Accountants Government Nursing Jobs San Diego,

- Coronavirus Job Retention Scheme Up And Running Gov Uk Government Nursing Jobs San Diego,

- Https Www Icaew Com Media Corporate Files Technical Tax Tax News Taxwire 2020 1007 Tax Faculty Weekly News Update No 1007 Ashx Government Nursing Jobs San Diego,

- Hmrc Extends Furlough Scheme Cut Off Date To 19 March 2020 Government Nursing Jobs San Diego,

- Furlough Can Be Used During Full Notice Periods Employee Benefits Government Nursing Jobs San Diego,