Self Employed Tax Deductions, What Are Some Self Employed Tax Deductions In Canada

Self employed tax deductions Indeed recently has been hunted by users around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of this article I will discuss about Self Employed Tax Deductions.

- How To Prep For Your Self Employed Taxes A Survival Guide Andi Smiles

- Gift Ideas 475 Tax Deductions For Businesses And Self Employed Indiv

- Itemized Deductions Spreadsheet Eymir Mouldings Tax Deduction Sheet Qfsn Dkjhi38pvmv2gcppdzccp6xdsvfazcqd7h3z 9j8t4ju Sgsaziuuctw80 Dkkuugle57zaf9qyzw2yvvskflhgvb G7yqsagpd8hgpnsxp3k Golagoon

- The Ultimate List Of Self Employment Tax Deductions In 2020 Gusto

- Tax Deductions For Self Employed Sushi Budget

- Top Self Employed Tax Deductions Employee Or Independent Contractor

Find, Read, And Discover Self Employed Tax Deductions, Such Us:

- A Guide To Claiming Self Employed Expenses Goselfemployed Co Small Business Tax Business Tax Deductions Small Business Tax Deductions

- Helpful Guideline Of Self Employed Tax Deduction

- The Procrastinator S Guide To Filing Quarterly Taxes Cashville Skyline

- Top Self Employed Tax Deductions Employee Or Independent Contractor

- Simplified Home Office Deduction When Does It Benefit Taxpayers

If you re searching for Government Of India Act 1935 In Urdu you've come to the perfect place. We have 104 graphics about government of india act 1935 in urdu including pictures, photos, pictures, wallpapers, and much more. In such webpage, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Kindle 475 Tax Deductions For Businesses And Self Employed Individuals An A To Z Guide To By Gfe4rty7y8hui Issuu Government Of India Act 1935 In Urdu

If youre self employed its important to take the time to fully understand self employment tax deductions so you dont miss deductions that could significantly lower your tax bill.

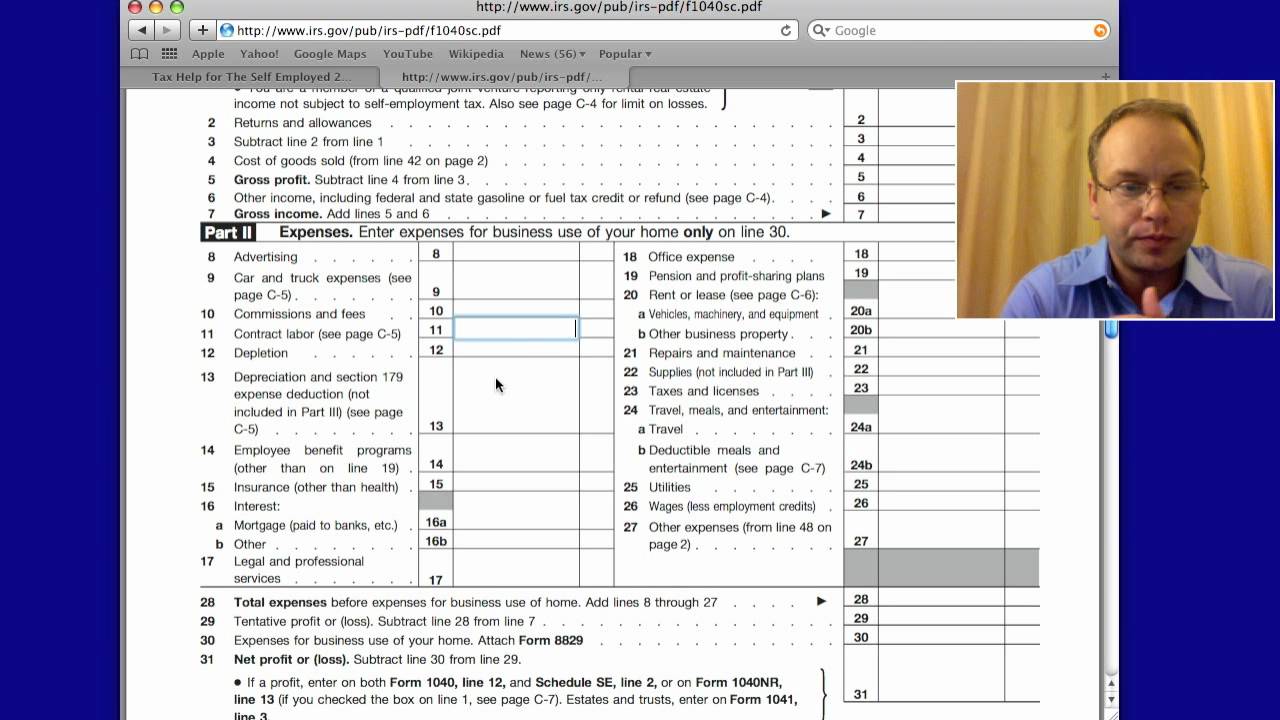

Government of india act 1935 in urdu. Self employed tax deductions are the superheroes of your business taxes. A document published by the internal revenue service irs that provides information on how taxpayers who use. Business use of your home including use by day care providers.

But because they dont have taxes withheld from their paychecks like traditional workers they can use deductions to cover their expenses and lower their tax burden. But before you can reap the benefits of tax write offs you need to know what expenses are tax deductible if you work from home. Whether youre filing your business taxes as a self employed worker for the first time or the 20th there are certain best practices that can save you.

Personal versus business expenses. Its also important to develop a system to file and track your receipts and expenses so that you are organized when it comes to tax time. You can elect to deduct or amortize certain business start up costs.

Filing your taxes as a w 2 employee can be overwhelming. But when it comes to self employed deductions the process certainly isnt one size fits all. If youre self employed your business will have various running costs.

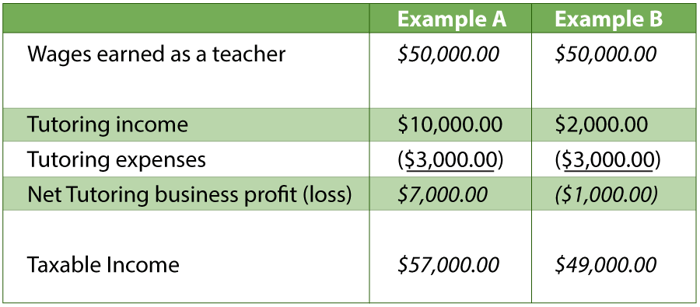

Tax deductions are one of the best ways to reduce your tax bill. 10 tax deductions for the self employed self employed people report business income on their personal tax returns. Theyre found on a wide variety of different tax forms and apply in different situations.

The easiest way is to use simplified expenses to claim for the cost of using your bicycle. For the tax year 202021 the simplified flat rate is 20 pence per mile for bicycles. However if you have an expense for something that is used partly for business and partly for personal purposes divide the total cost between the.

You can claim a flat amount for each mile you cycle on your bike. But when youre self employed the labyrinth of paperwork and potential tax deductions creates a tax situation thats enough to give even the most laid back freelancer heartburn. They swoop in lower your tax bill and save your wallet from some serious destruction.

Refer to chapters 7 and 8 of publication 535 business expenses. You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses. Generally you cannot deduct personal living or family expenses.

While schedule c is an important tax form for the independent contractor you should be aware of self employment deductions that you can take in other parts of your income tax return.

More From Government Of India Act 1935 In Urdu

- Self Employed Claim Grant

- Government Jobs Resume Writing Service

- Government Providing Free Laptop Scheme 2020 In Karnataka

- Hp 241 G1 Government Laptop Drivers For Windows 7 64 Bit

- Korean Government Scholarship Program Kgsp 2020

Incoming Search Terms:

- 2017 Self Employment Tax Form Brilliant Self Employed Tax Deductions Worksheet Fresh Free Forms 2018 Self Models Form Ideas Korean Government Scholarship Program Kgsp 2020,

- Insurance Self Employed Deduction Korean Government Scholarship Program Kgsp 2020,

- 475 Tax Deductions For Businesses And Self Employed Individuals An A Korean Government Scholarship Program Kgsp 2020,

- 5 Write Off Mistakes That Can Get You In Trouble Small Business Tax Small Business Accounting Business Tax Korean Government Scholarship Program Kgsp 2020,

- What Is Potential For Tax Deduction Home Home Design Korean Government Scholarship Program Kgsp 2020,

- 475 Tax Deductions For Businesses And Self Employed Individuals Korean Government Scholarship Program Kgsp 2020,