Self Employed Tax Deductions 2019, How Much Should I Save For Taxes Blue Summit Supplies

Self employed tax deductions 2019 Indeed recently has been sought by users around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the post I will talk about about Self Employed Tax Deductions 2019.

- Tax Savings For The Self Employed

- How Much Should I Save For Taxes Blue Summit Supplies

- What Are The Self Employed Tax Deductions For 2020 Benzinga

- Itemized Deductions Spreadsheet Eymir Mouldings Tax Deduction Sheet Qfsn Dkjhi38pvmv2gcppdzccp6xdsvfazcqd7h3z 9j8t4ju Sgsaziuuctw80 Dkkuugle57zaf9qyzw2yvvskflhgvb G7yqsagpd8hgpnsxp3k Golagoon

- Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog

- 1

Find, Read, And Discover Self Employed Tax Deductions 2019, Such Us:

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse

- Graphic Designers Can Get These Self Employed Tax Deductions Urdesignmag

- Draft Instructions To 2019 Form 8995 Contain More Informal Irs Guidance On Computing Qbi Current Federal Tax Developments

- Your Complete Guide To Self Employment Taxes In 2020 Ridester Com

- Tax Savings For The Self Employed

If you are searching for Government Building Clipart Black And White you've come to the ideal location. We have 104 images about government building clipart black and white including images, photos, photographs, wallpapers, and much more. In these page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Graphic Designers Can Get These Self Employed Tax Deductions Urdesignmag Government Building Clipart Black And White

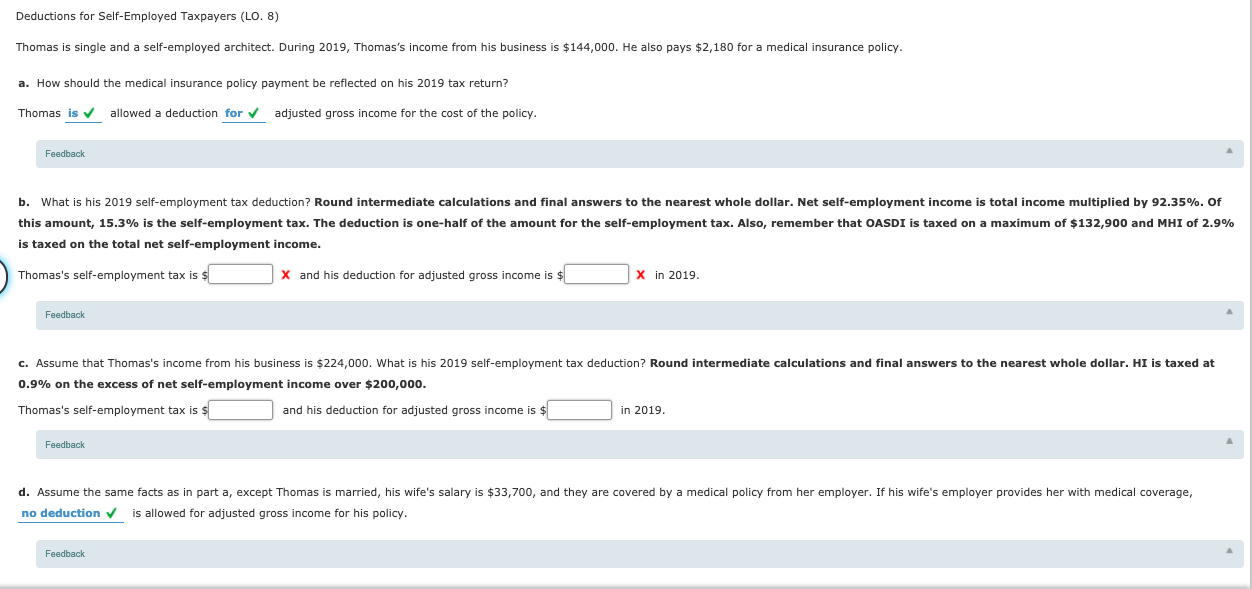

Calculate your allowable expenses using a flat rate based on the hours you work from home each month.

Government building clipart black and white. This means you do not have to work out the proportion of personal and business use for your. Personal versus business expenses. If you are self employed you probably rely on your personal vehicle for many business related.

But when it comes to self employed deductions the process certainly isnt one size fits all. Claiming a deduction for expenses when calculating the profit for your business you may be able to claim a deduction for expenses incurred. Can the self employed take the standard deduction.

Policy holders can contribute as much as either 25 of compensation or up to 56000 in 2019 whichever is less. Other retirement plan options that provide tax deductions for self employed professionals are. Self employed professionals face unique challenges when tax season comes around.

18350 for heads of households. You can elect to deduct or amortize certain business start up costs. 24400 for married couples filing jointly.

Expenses are claimed through the revenue online service ros on a form 11 or form ct1. Refer to chapters 7 and 8 of publication 535 business expenses. Take charge of the situation by looking at these six important tax breaks that you will want to consider for 2019.

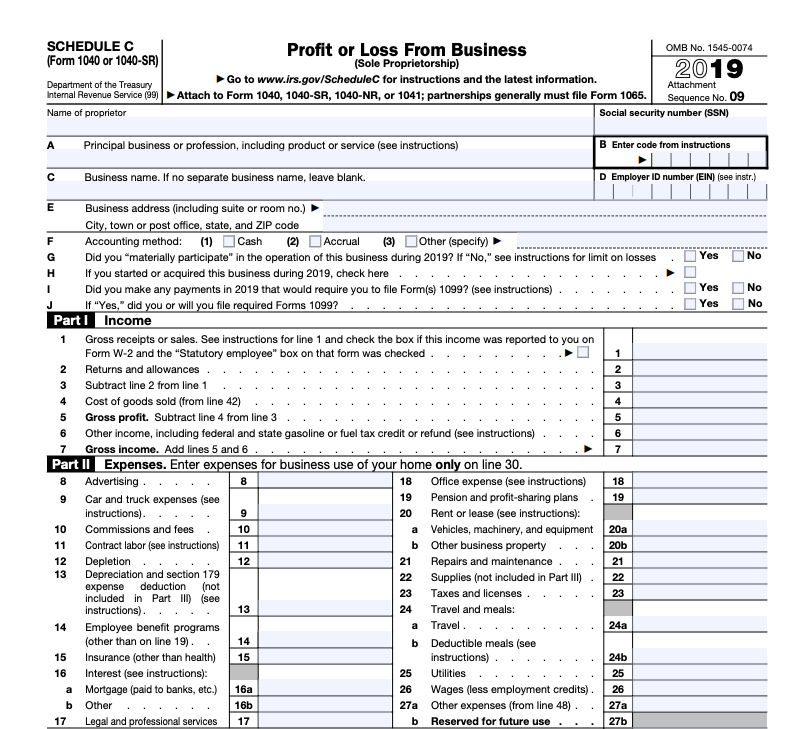

You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses. Yes the self employed can claim the standard deduction on form 1040 line 40. But because they dont have taxes withheld from their paychecks like traditional workers they can use deductions to cover their expenses and lower their tax burden.

For 2019 tax year the standard deduction is. However if you have an expense for something that is used partly for business and partly for personal purposes divide the total cost between the. Business use of your home including use by day care providers.

If youre self employed your business will have various running costs. While it can painful to wonder how you spent so much money youll want to write off as much of it that you can. Generally you cannot deduct personal living or family expenses.

Please also consult with your tax advisor or cpa before claiming a deduction on your tax return as not all deductions. Contributions are tax deductibleup to 25 of net self employment income. Lets talk about self employed tax deductions that you can write off for 2019.

More From Government Building Clipart Black And White

- Self Employed Payslip Template Uk

- Government Help To Buy A Farm

- Self Employed Electrician Reddit

- Government Intervention Economics Essay

- Government Veterinary Hospital Near Me Phone Number

Incoming Search Terms:

- Self Employment Information Leaflet Pages 1 7 Flip Pdf Download Fliphtml5 Government Veterinary Hospital Near Me Phone Number,

- Tax Reform 101 For Self Employed Tax Pro Center Intuit Government Veterinary Hospital Near Me Phone Number,

- How To Claim The Home Office Deduction With Form 8829 Ask Gusto Government Veterinary Hospital Near Me Phone Number,

- What Is Self Employment Tax And What Are The Rates For 2020 Workest Government Veterinary Hospital Near Me Phone Number,

- Iras If You Re Filing Your Taxes Here S A Handy Guide Facebook Government Veterinary Hospital Near Me Phone Number,

- Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips Government Veterinary Hospital Near Me Phone Number,

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

.jpg)