Self Employed Hmrc Registration, Register As Self Employed Freelance Uk

Self employed hmrc registration Indeed lately has been sought by users around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the post I will talk about about Self Employed Hmrc Registration.

- How To File Tax Return Online In The Uk

- 80 Go Self Employed On The Blog Ideas In 2020 Business Checklist Finance Blog Small Business Tips

- Registering As Self Employed In The Uk The Process Ionos

- Prepare And Submit Or File Your Self Assessment Tax Return To Hmrc By Arslanacca

- Self Assessment For Self Employed People And Sole Traders File Your Stock Photo Alamy

- A Guide To Unique Tax Reference Numbers What Is A Utr

Find, Read, And Discover Self Employed Hmrc Registration, Such Us:

- Online Self Assessment Have You Got Your Activation Code

- How To Register As A Freelancer With Hmrc Yellow Cat Recruitment

- How To Register As A Freelancer For The First Time By Kristina Lushey Medium

- Everything You Need To Know About Blogging Taxes And Hmrc Stephanie Toms Uk Fashion Beauty Lifestyle Blog

- I Am A Full Time Employee Do I Still Have To Fill In Self Assessment Tax Return Article Surrey Taxaccolega

If you re searching for Government Icon Clipart you've come to the right place. We have 100 graphics about government icon clipart adding images, photos, photographs, wallpapers, and more. In such webpage, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

A utr number is a 10 digit code posted to you in a letter.

Government icon clipart. Want a personal tax account are an individual who needs to send a self assessment tax return for example to report rental investment or self employment. Set up as self employed a sole trader. Register if youre self employed if you have to send a tax return and did not send one last year you need to register for self assessment and class 2 national insurance.

Sign in to hmrc online services once youve registered you can sign in for things like your personal or business tax account self assessment corporation tax paye for employers and vat. Up as self employed with hmrc and most likely registering as a sole trader. This letter confirms you successfully registered as self employed so will give an indication of when you first registered.

If youre self employed you have to register with hmrc so that it knows how much youre earning and can properly collect tax. Register with hmrc as self employed if youve sent tax returns before. Why do i need to register as self employed with hmrc.

When you first registered as self employed hmrc will have issued you a utr number. Other ways to work for yourself. You register when you tell hmrc that you.

Step by step what you need to do when you start working for yourself either as your only job or at the same time as working for an employer. If you previously had a unique tax reference utr enter the 10 digit number where indicated. Call hmrc to find out when you registered as self employed.

Register as a sole trader with hm revenue and customs and legal responsibilities if you run a business as a self employed sole trader. If youre self employed you may need to set up as a sole trader. Use our how to register as self employed guide to tick this task off your to do list.

Hmrc will have a. Once registered as self employed youll have a number of obligations and responsibilities like completing an annual self assessment tax return. How to register as self employed with hmrc step by step well take you through the process in depth but heres a quick overview of how to register as self employed.

If you have previously registered with hmrc there is a different form you can complete online.

More From Government Icon Clipart

- Government Contractor Jobs Richmond Va

- Self Employed Vs Entrepreneurship

- Government Of India Act 1935 Notes

- Self Employed Jobs Ideas

- Government Affairs Adalah

Incoming Search Terms:

- How Does Self Assessment Work For The Self Employed Government Affairs Adalah,

- Business Start Up Registering As Self Employed By Sarah Tregear Medium Government Affairs Adalah,

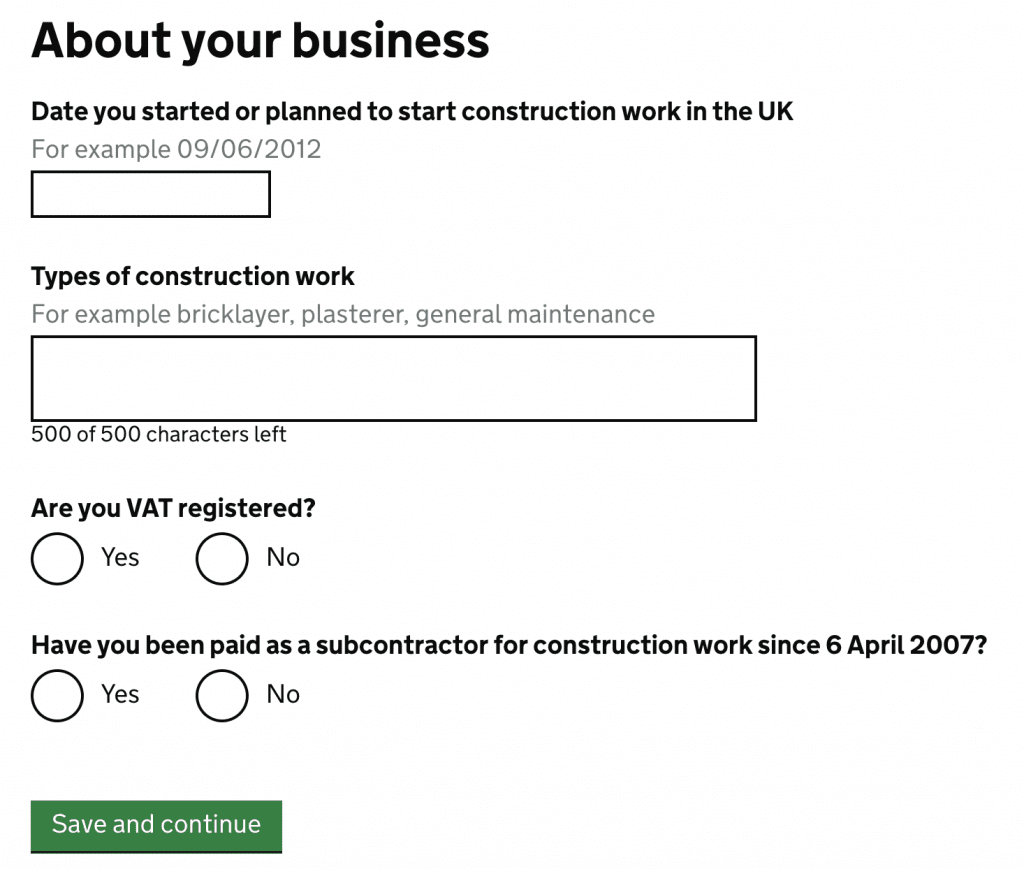

- Step By Step Cis Registration Guide Goselfemployed Co Government Affairs Adalah,

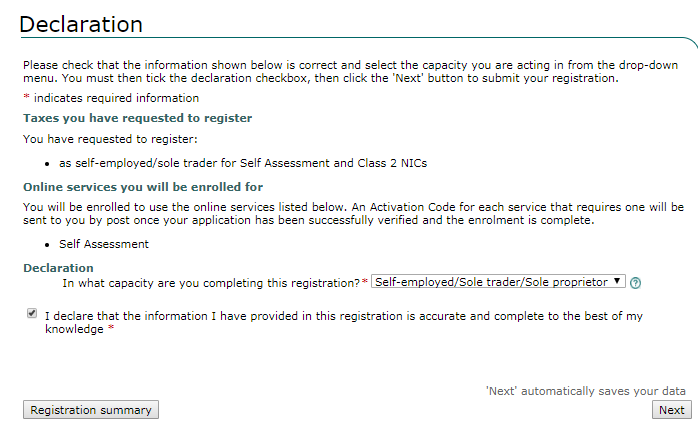

- Register For And File Your Self Assessment Tax Return Register If You Re Self Employed Gov Uk Government Affairs Adalah,

- How To Register As Self Employed Uk Startups Co Uk Government Affairs Adalah,

- Online Self Assessment Have You Got Your Activation Code Government Affairs Adalah,