Self Employed Tax Rate, Ratio Of The Effective Tax Rate Of The Self Employed Over The Effective Download Scientific Diagram

Self employed tax rate Indeed recently has been sought by consumers around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of the article I will talk about about Self Employed Tax Rate.

- Freelance Target Income Calculator By Paul Millerd Reimagine Work Medium

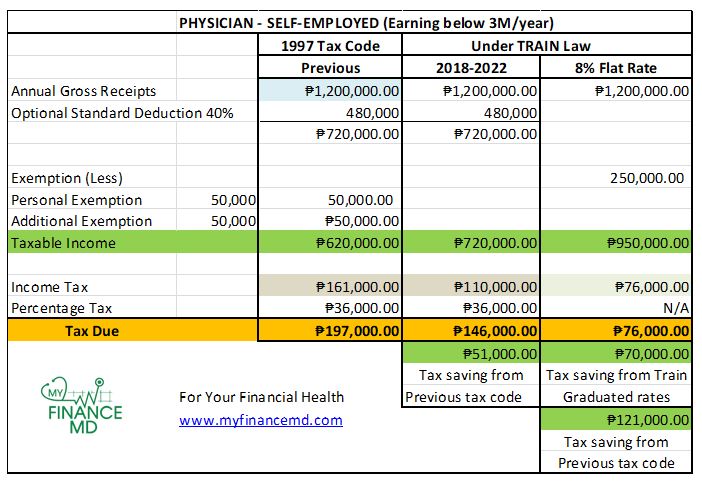

- The Impact Of The Recent Social Security And Income Tax Reform On Business Stakeholders Karageorgiou Associates

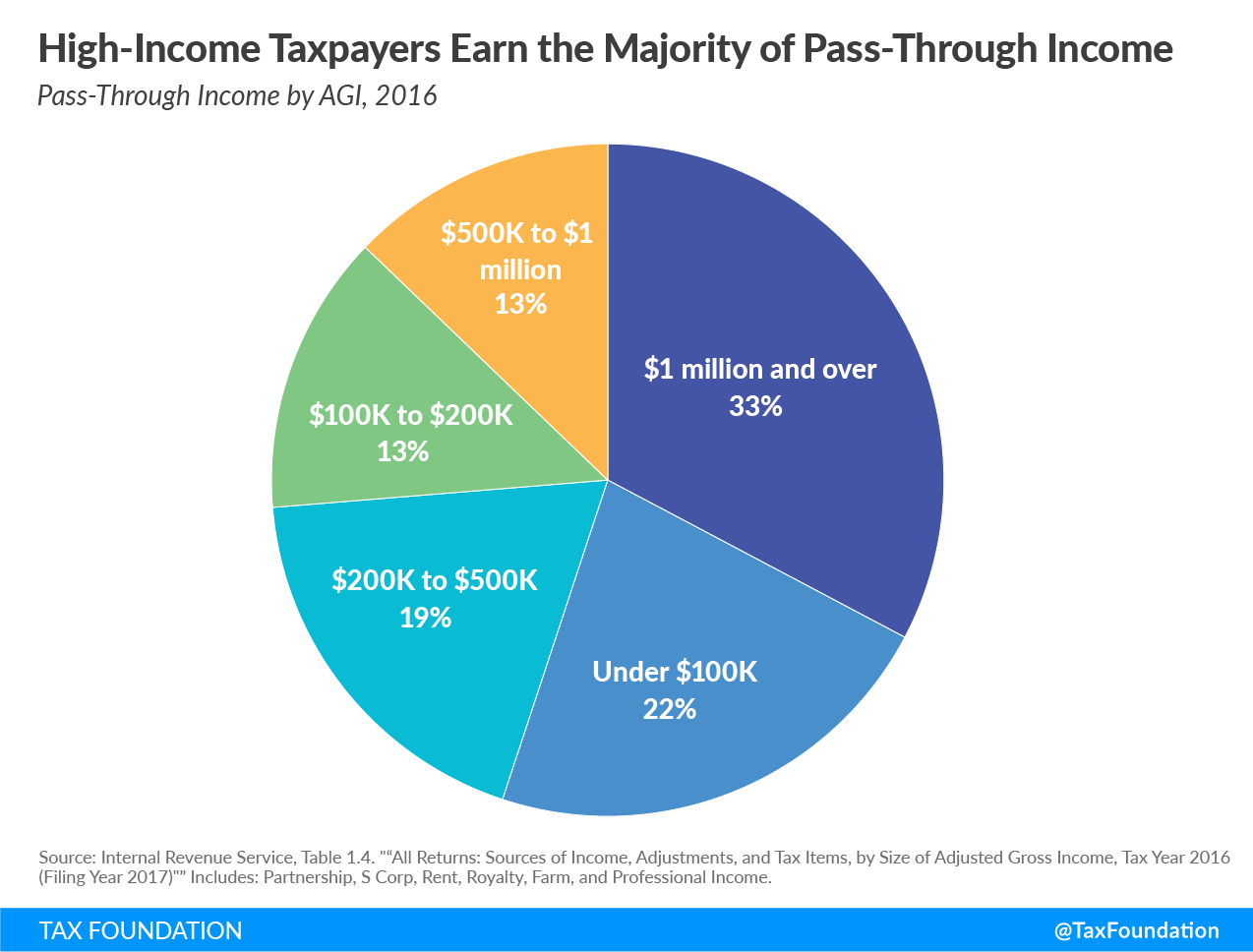

- What Is A Pass Through Business How Is It Taxed Tax Foundation

- Billing Software Business Management Software In 2020 Billing Software Business Management Business Management Quotes

- Ratio Of The Effective Tax Rate Of The Self Employed Over The Effective Download Scientific Diagram

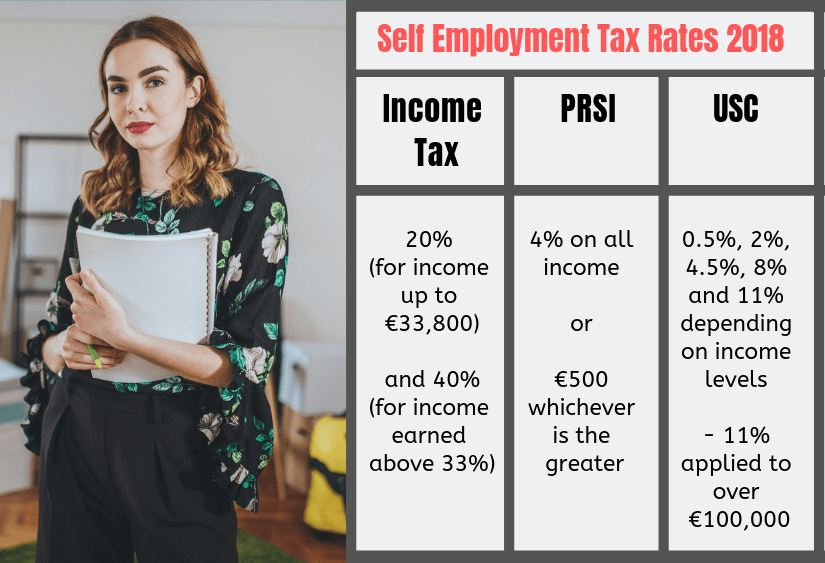

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

Find, Read, And Discover Self Employed Tax Rate, Such Us:

- Estimation Of Net Of Tax Rate Taxable Income Elasticity For Download Table

- Presented By Xtrategy Ltd Ppt Download

- Filing 8 Income Tax T Ask Ation

- Employed Self Employed And Rental Income Jf Financial

- Freelance Target Income Calculator By Paul Millerd Reimagine Work Medium

If you are searching for Government Veterinary Hospital Near Me Phone Number you've reached the right place. We have 104 images about government veterinary hospital near me phone number adding pictures, photos, pictures, wallpapers, and more. In these web page, we additionally have number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

124 for social security old age survivors and disability insurance and 29 for medicare hospital insurance.

Government veterinary hospital near me phone number. That rate is the sum of a 124 social security tax and a 29 medicare tax on net. You can use our 2020 21 income tax calculator to find out how much youll pay. The self employment tax rate for 2019 and 2020.

The self employed persons fica tax rate for 2020 january 1 through december 31 2020 is 153 on the first 137700 of net income plus 29 on the net income in excess of 137700. What are the self employed income tax rates for 2020 21. In the 2020 21 tax year self employed and employees pay.

Value added tax vat. For 2019 the first 132900 of your combined wages tips and net earnings is subject to any combination of the social security part of self employment tax. As noted the self employment tax rate is 153 of net earnings.

The usc does not apply to social welfare or similar payments. The irs states that the self employment tax 2019 rate is 153 percent on the first 132900 of net income plus 29 percent on the net income in excess of 132900. The rate consists of two parts.

145 that would typically get withheld from. You pay your usc with your preliminary tax payment. The self employment tax is calculated on 9235 of your total income.

This rate is derived from the fact that self employed taxpayers can deduct the employers portion of the tax which is 765. 62 that would typically get withheld from employee pay for social security. Ultimately for the self employment tax 2019 youll have to pay both portions of employer and employee social security and medicare which breaks down as follows.

The total self employment tax rate of 153 consists of the following. When it comes to paying income tax there arent any differences in the tax rates you pay compared to employees. In other words the self employed persons fica tax rate for 2020 includes all of the following.

Whereas employees only pay the employee share of payroll taxes for social security and medicare self employed workers have to pay the employer half as well boosting the maximum tax rate to 153. This means that self employed people pay a total of 11 usc on any income over 100000. And the self employment tax rate is 124 for social security on the first 132900 of net income or earnings anything above that amount is not taxed plus an additional 29 on the net earnings.

The tax rate is currently 153 of your income with 124 going to social security and 29 going to medicare.

More From Government Veterinary Hospital Near Me Phone Number

- Furlough Extended Unemployment

- Self Employed Driving Jobs Bradford

- Government Expenditure Multiplier Diagram

- Government Gateway Login Pension

- Furlough Rules Nyc

Incoming Search Terms:

- Billing Software Business Management Software In 2020 Billing Software Business Management Business Management Quotes Furlough Rules Nyc,

- Trump S Tax System Could Spark The Wave Of Self Employment Furlough Rules Nyc,

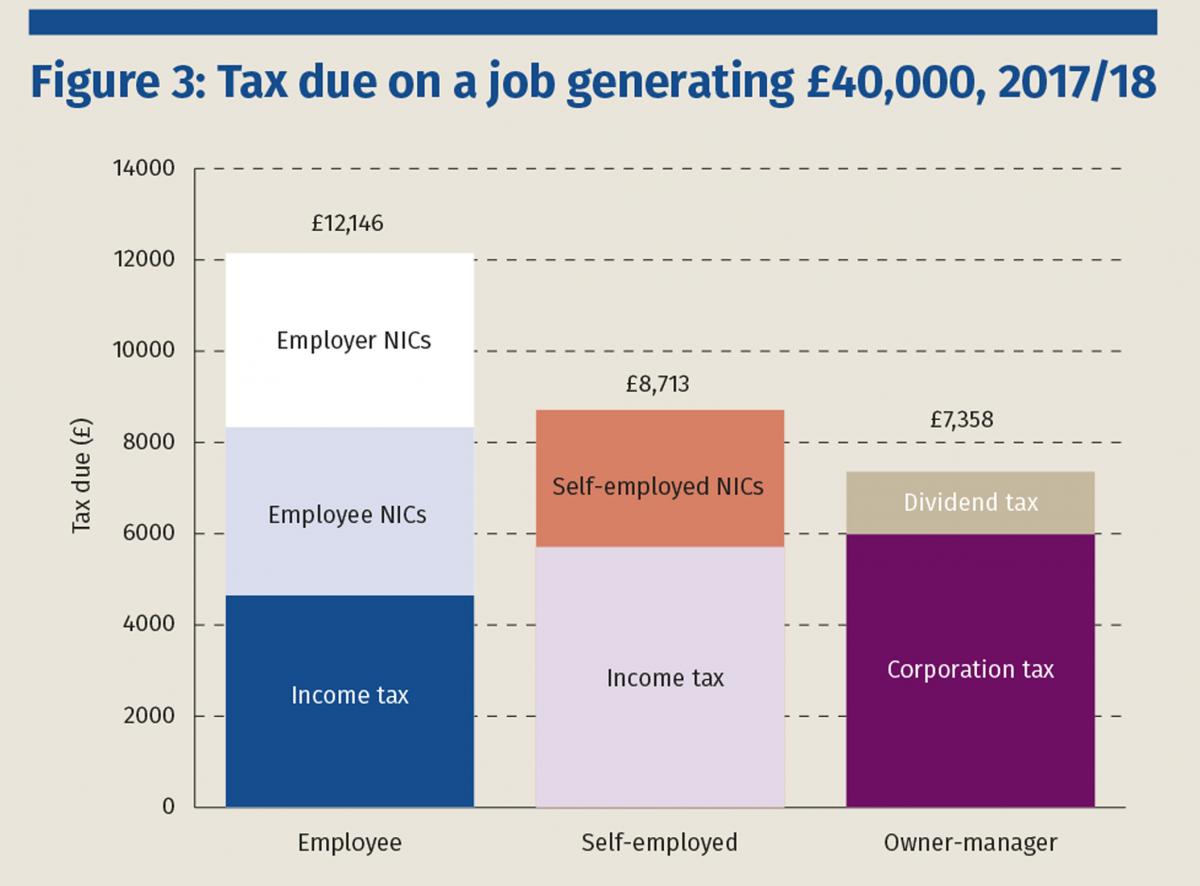

- Tax In A Changing World Of Work Furlough Rules Nyc,

- Image Is Everything Guernsey Registered Image Rights Uk Taxation Of Prize Money And Sponsorship Income Earned During The 2012 London Olympic Games Pdf Free Download Furlough Rules Nyc,

- Self Employment Tax Rates 2020 Step By Step Instructions Furlough Rules Nyc,

- Upsmart Strategy Consulting Inc On Twitter Take Note Self Employed Professionals Are Provided The Option To Pay 8 Preferential Tax Rate In Lieu Of The Tabular Tax Table Percentage Tax Remains The Same Furlough Rules Nyc,