Self Employed Tax Rate Texas, 10 Down Self Employed Mortgage Lenders Using Bs

Self employed tax rate texas Indeed lately is being hunted by consumers around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of this post I will discuss about Self Employed Tax Rate Texas.

- 1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcszmgspgsrsbhodyom Tugqvqfizic Hjqoqyhhacfxy8ly7qhu Usqp Cau

- The Independent Contractor Tax Rate Breaking It Down Benzinga

- Income Tax Calculator Calculate Taxes Online Fy 2019 20

- How To Get A Tax Id Number Or Ein For A Small Business Business Insider

- Create Pay Stubs Instantly Generate Check Stubs Form Pros

Find, Read, And Discover Self Employed Tax Rate Texas, Such Us:

- What Is A Pass Through Business How Is It Taxed Tax Foundation

- E J Mcmahon On Twitter With Federal Salt Deduction All But Gone For Top Earners Effective Marginal State Local Income Tax Rate In Nyc Is Already At An All Time High Chart From Https T Co Eirccs8hn5 Https T Co Go8rrzqbwa

- Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

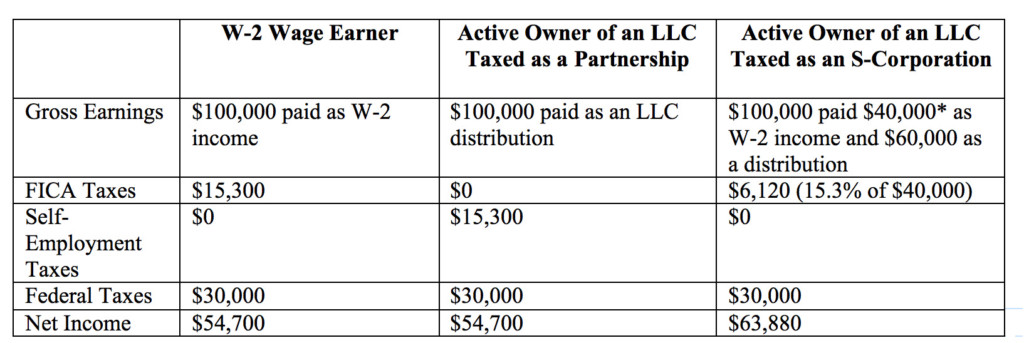

- Small Business Tax Rates For 2020 S Corp C Corp Llc

- Create Pay Stubs Instantly Generate Check Stubs Form Pros

If you are looking for Government Holidays 2019 Pdf you've reached the right location. We ve got 104 graphics about government holidays 2019 pdf including images, pictures, photos, backgrounds, and more. In such webpage, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Texas economic development department of licensing and regulation.

Government holidays 2019 pdf. Texas comptroller of public accounts texas taxes. You pay unemployment tax on the first 9000 that each employee earns during the calendar year. Texas workforce unemployment claim management and appeals new hire registry.

The tax rates for self employment taxes are 124 for the social security tax and 29 for the medicare tax however only a portion of the net earnings from se lf employment are subject to these taxes. If you are self employed you need to make these tax payments yourself since you dont have an employer to send it in for you. The rate consists of two parts.

If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. How to calculate your 2019 self employment tax rate. The self employment tax rate for 2019 and 2020 as noted the self employment tax rate is 153 of net earnings.

Brackets are assigned based on taxable income and applied at each bracket. 124 for social security old age survivors and disability insurance and 29 for medicare hospital insurance. Section 1402a12 of the code permits a self employed person a deduction in net earnings from self employment.

Your taxable wages are the sum of the wages you pay up to 9000 per employee per year. For 2020 employees pay 765 percent of their income in social security and medicare taxes with their employers making an additional payment of 765 percent. Maximum tax rate for 2020 is 631 percent.

The self employment tax rate is 153. Minimum tax rate for 2020 is 031 percent. And the self employment tax rate is 124 for social security on the first 132900 of net income or earnings anything above that amount is not taxed plus an additional 29 on the net earnings.

Ultimately for the self employment tax 2019 youll have to pay both portions of employer and employee social security and medicare which breaks down as follows. The irs states that the self employment tax 2019 rate is 153 percent on the first 132900 of net income plus 29 percent on the net income in excess of 132900. Small business administration texas txsmartbuy state and local bid opportunities administrative code city codes.

Your adjusted gross income will include income from all sources including from your job self employed income side hustles and any passive sources dividends interest and capital gains. Income tax rates range anywhere from 10 to 37 depending on which tax bracket youre in.

More From Government Holidays 2019 Pdf

- Australian Government Budget 2020 21 Immigration

- Government Furlough Scheme Shielding

- Government Exams After 12th Science Biology

- Self Employed Furlough Grant November

- Self Employed Simple Free Blank Profit And Loss Statement Pdf

Incoming Search Terms:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqofqr5qg98o7d26wwcm88rnlprgaaj9zixcs7d1klrwejfc3vy Usqp Cau Self Employed Simple Free Blank Profit And Loss Statement Pdf,

- How Much Should I Set Aside For Taxes 1099 Self Employed Simple Free Blank Profit And Loss Statement Pdf,

- Small Business Tax Rate 2020 Guide For Business Owners Self Employed Simple Free Blank Profit And Loss Statement Pdf,

- Royalty Income Taxes For 2020 With Filling Procedures Taxhub Self Employed Simple Free Blank Profit And Loss Statement Pdf,

- Small Business Tax Rates For 2020 S Corp C Corp Llc Self Employed Simple Free Blank Profit And Loss Statement Pdf,

- Texas Sales Tax Guide For Businesses Self Employed Simple Free Blank Profit And Loss Statement Pdf,

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)