Self Employed Quarterly Tax Due Dates, The Ultimate Self Employment Guide To Filing Estimated Taxes

Self employed quarterly tax due dates Indeed lately has been hunted by users around us, perhaps one of you. People are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this post I will talk about about Self Employed Quarterly Tax Due Dates.

- What Are Estimated Tax Payments A Guide For Small Business Owners

- Guide To Adjusting Your Self Employed Estimated Tax Payments Taxact Blog

- Do You Owe Estimated Tax Payments To The Irs Or Ohio Department Of Taxation Gudorf Tax Group Llc

- The Next Estimated Tax Deadline Is September 16 Do You Have To Make A Payment Watson Cpa

- Taxseasonhub Instagram Posts Photos And Videos Picuki Com

- Arizona And Federal Tax Filing Dates Estimated Tax Payments Wallace Plese Dreher

Find, Read, And Discover Self Employed Quarterly Tax Due Dates, Such Us:

- How To File Quarterly Taxes Your Faqs Asked And Answered Inc Com

- Entrepreneurship And Small Business Management Cash Flow And Taxes Ppt Download

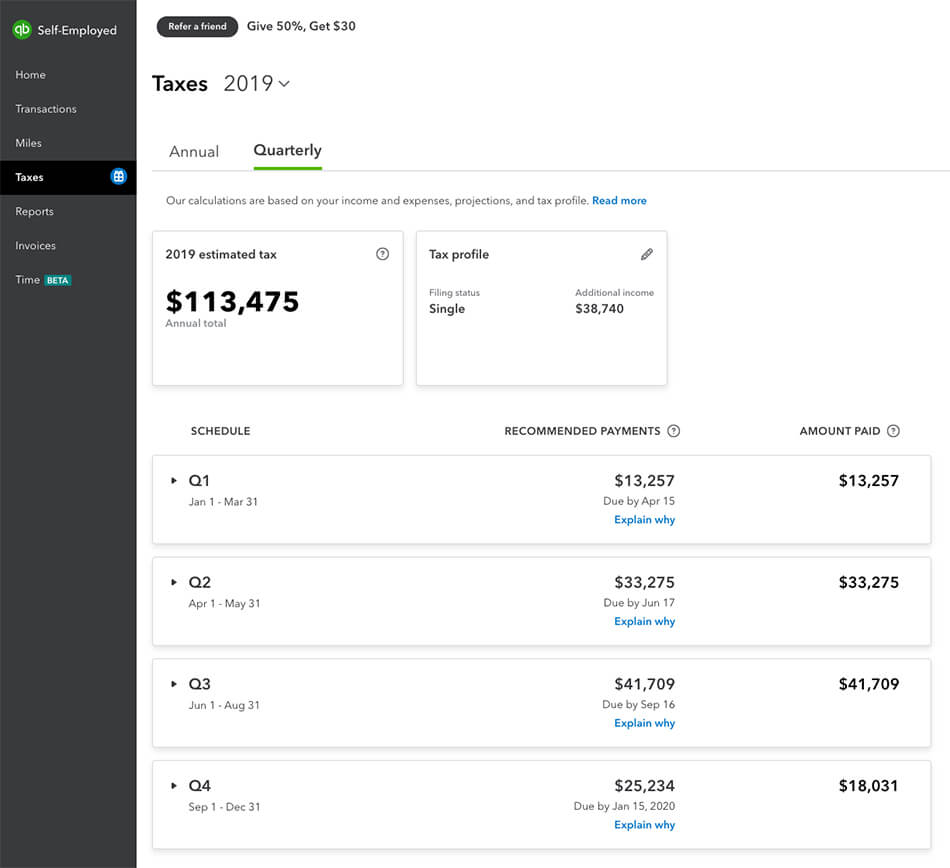

- Easiest Way To Pay Self Employment Estimated Taxes Accounting For Jewelers

- How To Prevent That Big Tax Bill When You Re Self Employed

- Https Www Marylandtaxes Gov Forms Personal Tax Tips Tip54 Pdf

If you are looking for Government Nursing College Guntur Andhra Pradesh you've reached the perfect place. We have 103 images about government nursing college guntur andhra pradesh adding pictures, photos, photographs, wallpapers, and much more. In such web page, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Guide To Adjusting Your Self Employed Estimated Tax Payments Taxact Blog Government Nursing College Guntur Andhra Pradesh

Quickbooks Self Employed In 2020 Reviews Features Pricing Comparison Pat Research B2b Reviews Buying Guides Best Practices Government Nursing College Guntur Andhra Pradesh

Irs notice 2020 18 this news should come as a relief to the millions of self employed who dont have taxes withheld from their pay and often owe money to the irs.

Government nursing college guntur andhra pradesh. It comes a full month before the typical income tax due. If you timely deposited all taxes when due you have 10 additional calendar days to file the return. Washington the internal revenue service today reminded the self employed investors retirees and others with income not subject to withholding that third quarter estimated tax payments for 2020 are due september 15.

Typically the due date is the 15th for each of the months in which payments must be made. January 1 to march 31. Visit this page on your smartphone or tablet so you can view the online calendar on your mobile device.

View the tax calendar online en espanol. Payment date for 2019 tax year. June 15 2020 unchanged.

Estimated tax payments english ir 2020 205 september 9 2020. September 30 2020 further extended as of july 27. April 1 to may 31.

When income earned in 2020. June 1 to august 31. Here is the irs quarterly estimated tax timeline.

The irs has established four due dates for paying estimated taxes throughout the year. In general you must deposit federal income tax withheld and both the employer and employee social security and medicare taxes. Income tax is generally what we think of when we think of taxes.

File form 941 employers quarterly federal tax return. Tax due date for s corporations and corporations. Filing date for 2019 tax year.

If the 15th falls on a weekend or a federal holiday however the due date is moved to the following business day. If youre self employed work as an independent contractor or run a business you may have to make estimated tax paymentsnormally theyre due in april june september and january and paying. The cra is seeking t1 returns by june 15 2020 for sole proprietors in order to ensure accurate federal and provincial benefits payments.

Due to deteriorating economic conditions the irs has delayed the deadline to file and pay 2019 income taxes and pay 2020 estimated taxes. You can see all events or filter them by monthly depositor semiweekly depositor excise or general event types. If youre self employed or dont have taxes withheld from other sources of taxable income its up to you to periodically pay the irs by making estimated tax payments.

View due dates and actions for each month.

Quarterly Tax Guide For Freelancers And The Self Employed Government Nursing College Guntur Andhra Pradesh

More From Government Nursing College Guntur Andhra Pradesh

- Government Jobs Meme

- Self Assessment Self Employed Form

- Federal Government Icon Government Building Clipart

- Self Employed Furlough Mortgage

- Government Exams After 12th Commerce 2019

Incoming Search Terms:

- How Much Does A Small Business Pay In Taxes Government Exams After 12th Commerce 2019,

- New To Self Employment Don T Forget Uncle Sam S Cut Bacon And Gendreau Government Exams After 12th Commerce 2019,

- Pin On Entrepreneur Government Exams After 12th Commerce 2019,

- Avoid Falling Behind On Estimated Tax Payments Government Exams After 12th Commerce 2019,

- Arizona And Federal Tax Filing Dates Estimated Tax Payments Wallace Plese Dreher Government Exams After 12th Commerce 2019,

- How To Calculate And Pay Quarterly Estimated Taxes Government Exams After 12th Commerce 2019,

20)