Self Employed Limited Company Benefits, How Much Limited Company Tax Do I Have To Pay Company Bug

Self employed limited company benefits Indeed recently has been sought by consumers around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the post I will discuss about Self Employed Limited Company Benefits.

- 1

- Types Of Employee Benefits And Perks

- Public Limited Company Advantages And Disadvantages Rs Blogs

- Self Employed Vs Limited Company Which Way Is Best For My Business

- Hashtag Benefits For Business Contractor News

- A Guide To Getting Your Business Registered With Companies House

Find, Read, And Discover Self Employed Limited Company Benefits, Such Us:

- Freelancers Self Employed Workers Now Eligible For Unemployment Benefits In Virginia 13newsnow Com

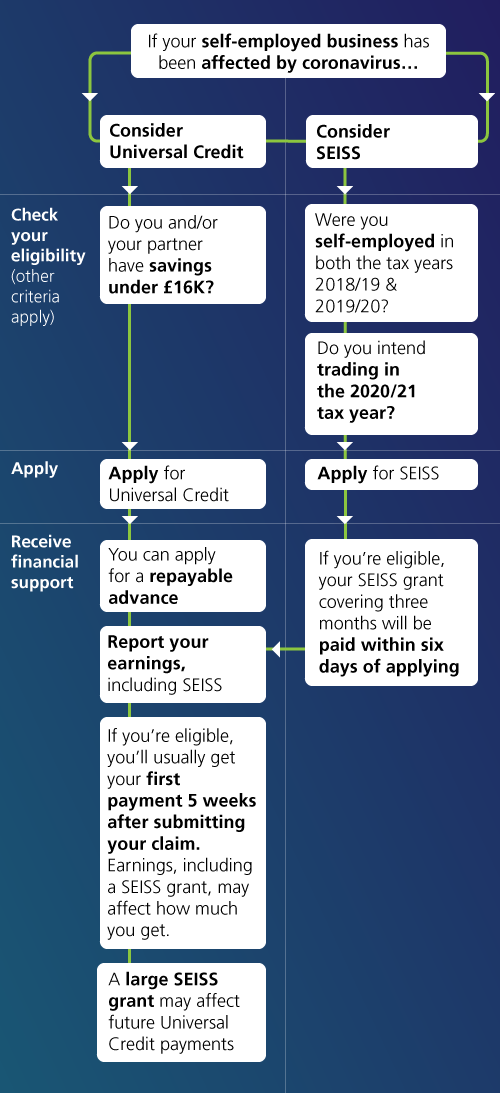

- Coronavirus Support For Small Businesses The Self Employed

- Hashtag Benefits For Business Contractor News

- Top Benefits Of Becoming Self Employed In 2019 Brookson One

- Self Employed To Limited Company Sjd Accountancy

If you are looking for Government Job Vacancies you've come to the ideal location. We have 104 images about government job vacancies including images, pictures, photos, backgrounds, and more. In these page, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

This is because limited company profits are subject to a lower corporation tax rate currently 19 per cent than income tax 20 per cent at basic rate.

Government job vacancies. Although hmrc require you to pay it back within nine months of your companys year end. Limited company profits are subject to uk corporation tax which is currently set at 19. Self employed workers pay class 2 and class 4 nics whereas limited companies and their employees pay class 1 nics.

However as a limited company you enjoy limited liability which protects your personal assets. The limited company structure means any withdrawals from the company must be distributed within strict frameworks like dividends or benefits etc. The government small business bounce back loans can be used to support your income including for those with no other support eg newly self employed limited company directors.

The limited part of a limited company means that the companys liability to any creditor is limited to the assets cash cars equipment etc that are in the company. Theyre interest free and payment free in the first year so pay it off then and its no cost and at a very low 25 annual interest after that. Treating you completely separate to that of your business.

Reduced personal liability you are likely to pay less tax if you take a small salary from your limited company. What are the other advantages of being a limited company. If youre self employed you must pay 305 per week class 2 nics 202021 unless you have very low earnings.

One of the biggest advantages for many is that running your business as a limited company can enable you to legitimately pay less personal tax than a sole trader. This will mean that each person can take the tax free salary of 12500 as of the tax year 202021. Class 4 nics apply to your annual profits and are payable at self assessment time.

But the self employed business owner has more freedom. What this means is that should you get into financial difficulty with the company your personal assets your house is usually the main one will be safe. They can withdraw money with greater freedom as and when required without organisational hindrance.

Another benefit of running a limited company is being able to take a directors loan from your business. A limited company will allow you to maximise tax free income by having your husbandwifepartner and children shareholders.

Supporting People And Companies To Deal With The Covid 19 Virus Options For An Immediate Employment And Social Policy Response Government Job Vacancies

More From Government Job Vacancies

- Government Issued Id Card With Photograph And Information

- New Self Employed Grant

- Self Employed Unemployment Benefits Texas

- Indonesia Government Logo

- Government Bond Yields Today

Incoming Search Terms:

- Types Of Employee Benefits And Perks Government Bond Yields Today,

- 1 Government Bond Yields Today,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcszw7 Xxw45pblvst9twvluqz3 Subaupjkrc 3nqm6ja Uosuq Usqp Cau Government Bond Yields Today,

- What S A Limited Company Statement Of Financial Position Balance Sheet Crunch Government Bond Yields Today,

- Kym Scott Rightfromthestart On Twitter Some Info I Was Sent Around Furloughing As Part Of The Coronavirus Job Retention Scheme For Any Freelancers Who Like Me Are A Limited Company Rather Than Government Bond Yields Today,

- Contributing To A Pension From Your Limited Company Government Bond Yields Today,