Self Employed Professional Liability Insurance, Ahp Malpractive Insurance Gpla Form Pdf Hsa

Self employed professional liability insurance Indeed recently is being sought by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the post I will discuss about Self Employed Professional Liability Insurance.

- Self Employed Rekerdres Insurance

- Professional Liability Insurance Meaning Professionalliabilityinsurance Professional Indemnity Insurance Indemnity Insurance Liability Insurance

- Professional Indemnity Insurance Explained Caunce O Hara

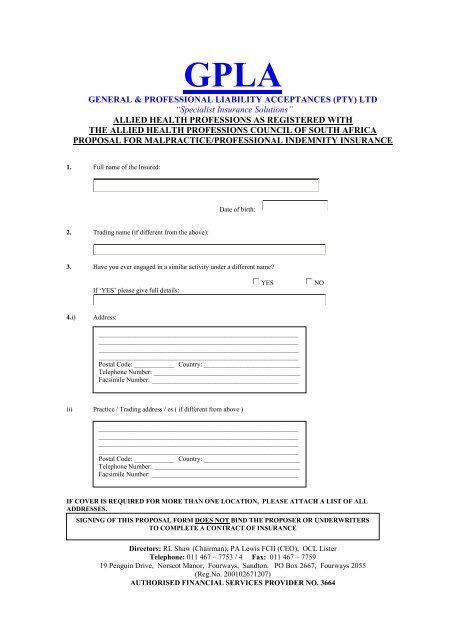

- Ahp Malpractive Insurance Gpla Form Pdf Hsa

- The Ultimate Guide To Liability Insurance For The Self Employed Socialnomics

- Https Www Aasw Asn Au Document Item 5933

Find, Read, And Discover Self Employed Professional Liability Insurance, Such Us:

- Pdf The Review And Analysis Of Compulsory Insurance

- Are You Self Employed And Work For The Oil Or Gas Industry Need Liability Or Professional Indemnity Insurance Give Us A Call On 01346510444 Or Email Louise M3w Co For A Quote With Very

- Allied Healthcare Professional And General Liability Product

- Coverwallet Review Professional Liability Insurance For Self Employed

- Website Developers Professional Indemnity Insurance With Images Professional Indemnity Insurance Liability Insurance Insurance

If you are looking for Transparent Government Of Canada Logo Png you've reached the perfect location. We ve got 100 images about transparent government of canada logo png adding pictures, photos, photographs, backgrounds, and more. In such web page, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Website Developers Professional Indemnity Insurance With Images Professional Indemnity Insurance Liability Insurance Insurance Transparent Government Of Canada Logo Png

Types Of Self Employed Business Insurance Individual Health Insurance Transparent Government Of Canada Logo Png

For example if a delivery person trips over a loose piece of carpet at your home and suffers an injury or if you accidentally spill coffee on a clients laptop public liability will cover the legal and compensation costs.

Transparent government of canada logo png. Pogo reports that many self employed people can expect to pay between 500 and 1000 per year for a liability insurance policy. But heres a little good news. Many companies offer liability insurance to the self employed.

Manual workers such as plumbers and builders generally pay more than clerical workers like graphic designers as their work is more likely to physically affect members of the public. Self employed business insurancemore and more people are turning to self employment to meet their career goals but being self employed does not protect them from the potential risks they face in their jobs risks that can open the door to liability and financial ruin. 3 working with a tax pro can help you find out what kind of tax break you can get and how to take advantage of those savings.

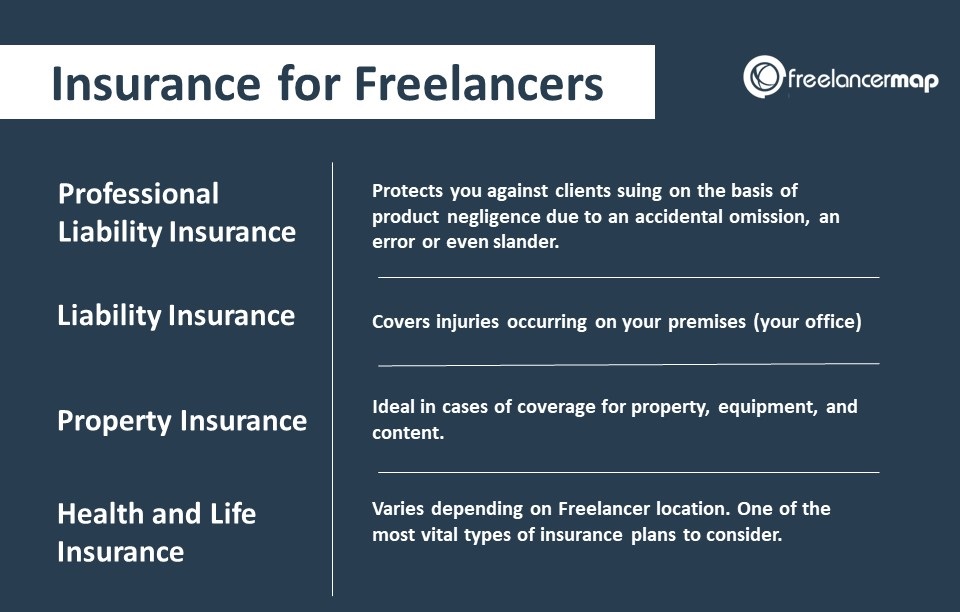

If youre a plumber or and electrician youll need liability insurance in order to work as a sub contractor for larger firms to bid on government contracts and as a part of state licensing requirements in some states. For example construction work involves hazardous trade processes so personal injuries and property damage are more likely to occur. Professional liability insurance and general liability insurance for the self employed and freelancers.

Self employed people often claim that they are cash constrained and cannot afford business insurance but the truth is that not carrying insurance can cost a lot more indeed much more than an annual premium. Theres a tax deduction on health insurance premiums for self employed professionals which can help soften the blow by lowering how much you owe in taxes to uncle sam. Insureon reports that the median annual cost for its professional.

Public liability insurance for self employed workers covers you if a member of the public is injured or their property is damaged because of your business activities. Self employed business insurance policy information. According to the insurance information institute about 40 percent of solopreneurs and small business owners have no insurance at all.

More From Transparent Government Of Canada Logo Png

- Self Employed Mortgage Broker

- Self Employed What Can I Claim For Working From Home

- Will Self Employed Furlough Scheme Be Extended

- Government Medical Universities In Lahore

- Federal Government Forms Canada

Incoming Search Terms:

- Difference Between Public Liability Professional Indemnity Federal Government Forms Canada,

- Insurance Professional Historians Australia Federal Government Forms Canada,

- Hanover Launches Customer Acquisition Platform For Independent Agents The Digital Insurer Federal Government Forms Canada,

- Https Www Caqh Org Sites Default Files Solutions Proview Caqh Proview Professional Liability Insurance Quick Reference Guide Pdf Federal Government Forms Canada,

- Example Comfort Letter Federal Government Forms Canada,

- Malpractice Business Owners Cyber Liability Insurance Aoa Federal Government Forms Canada,