Local Government Taxes Philippines, Foreword Bureau Of Local Government Finance

Local government taxes philippines Indeed lately is being sought by users around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the name of the post I will discuss about Local Government Taxes Philippines.

- Local Government Election Law And Administrative Law Law Firm In Metro Manila Philippines Corporate Family Ip Law And Litigation Lawyers

- Https Dilg Gov Ph Pdf File Issuances Legal Opinions Dilg Legalopinions 2018926 101028c30f Pdf

- Tax In The Philippines Business Tips Philippines

- Definition And Types Of Taxation Docsity

- Http Www Peza Gov Ph Issuances Others Moa Pasig Pdf

- Fiscal Policy Of The Philippines Wikipedia

Find, Read, And Discover Local Government Taxes Philippines, Such Us:

- Organizational Chart Dof Bureau Of Local Government Finance

- Local Government Taxation In The Philippines

- Local Taxation Taxes Payments

- 2

- 2

If you are looking for List Of Government Universities In Lahore you've come to the perfect location. We ve got 100 graphics about list of government universities in lahore adding pictures, photos, photographs, wallpapers, and more. In such web page, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Natad masterand slideshare uses cookies to improve functionality and performance and to provide you with relevant advertising.

List of government universities in lahore. The residence tax and residence certificate were renamed into the current community tax and community tax certificate. 9 the philippine tax system national tax law 10 the 1987 philippine constitution sets limitations on the exercise of. The same provisions from the local tax code were later subsumed into the local government code of 1991.

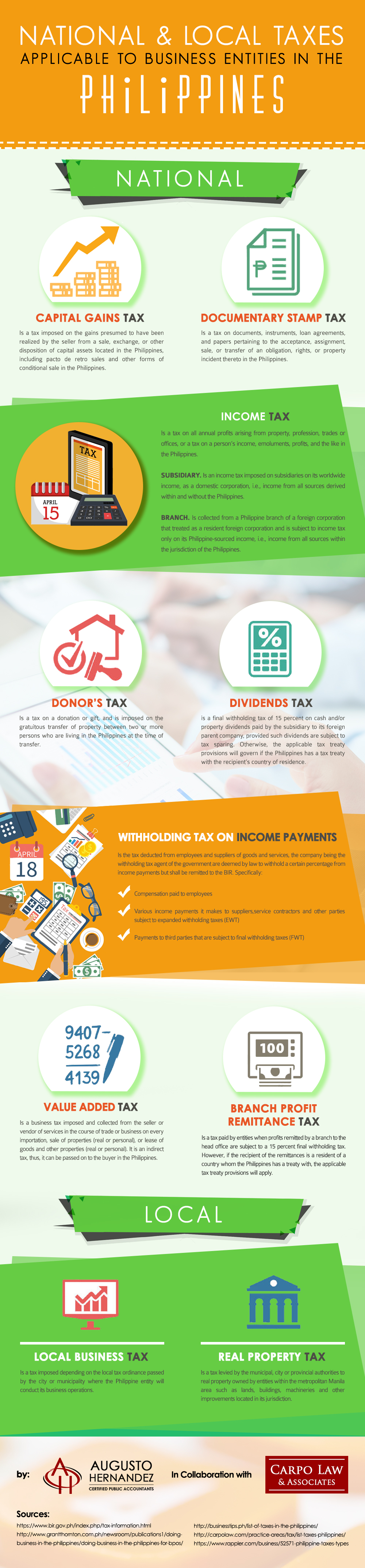

Chapter 4 countries tax revenue and of gdp by level of government and main taxes chapter 3 table 315 tax revenues of subsectors of general government as of total tax revenue chapter 3 table 32 total tax revenue in us dollars at market exchange rate. Scope the provision herein shall govern the exercise by provinces cities municipalities and barangays of their taxing and other revenue raising powers. Philippine taxes cover national and local taxes.

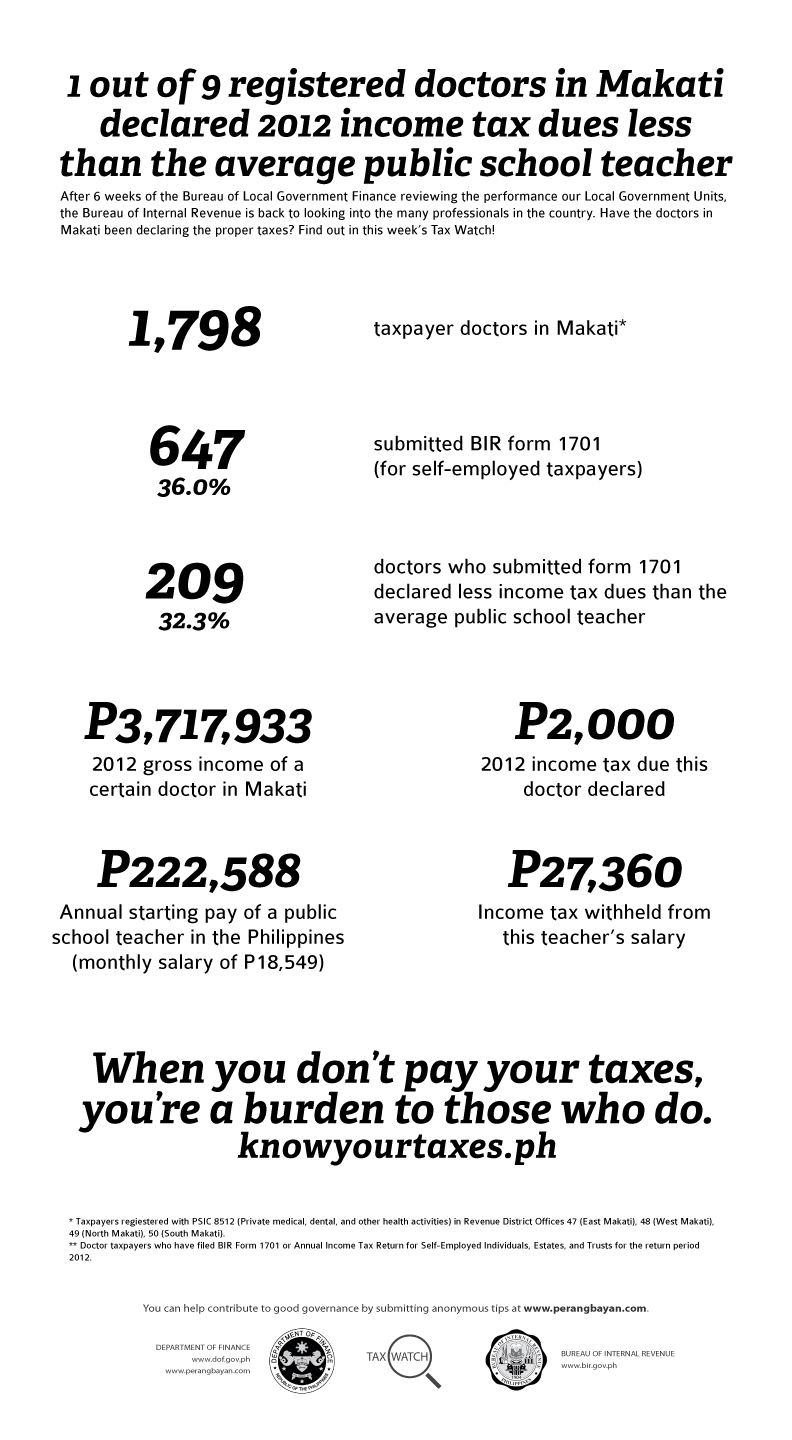

The seminars main objective is to explain the concept of local and real property taxes the taxes imposed under the local government code of 1991 as well as the remedies that may be taken by the tax. Local government taxation in the philippines by johny s. The local government code of the philippines authorizes lgus to collect taxes from printing or publication businesses that produce books cards posters tarpaulins pamphlets leaflets and other similar materials.

When your local business is already in operational status this means that you have to pay your taxes and other dues to the government. Edward gialogo local government taxes. Local government taxation chapter 1.

Most of the taxes that apply to your business are administered by the national government which are as follows. Local government tax law. The local government code of the philippines book ii local taxation and fiscal matters title one.

General provisions section 128. Local government taxation in the philippines is based on the constitutional grant of the power to tax to the local governments. Local taxes are those that are imposed by local government units such as provinces cities municipalities and barangays in contrast to national internal revenue taxes that are those imposed by.

National taxes are imposed and collected by the national government through the bureau of internal revenue bir while local taxes are collected by local government units. The maximum rate for this local tax is 50 of 1 of the gross annual receipts for the previous calendar year.

More From List Of Government Universities In Lahore

- Furlough Scheme Uk Latest News

- What Is Furlough Mean In English

- Furlough Rules Back To Work

- Government Transfer Payments Not Included In Gdp

- Government Holidays 2021

Incoming Search Terms:

- Office Of The Sangguniang Panlalawigan Local Government Taxes Government Holidays 2021,

- Fiscal Policy Of The Philippines Wikipedia Government Holidays 2021,

- Local Government Taxation In The Philippines Government Holidays 2021,

- Withholding Tax In Ph Are You Aware Of Your Obligations Cloudcfo Government Holidays 2021,

- Lll Speaks At Maccii Webinar Sgv Co Philippines Government Holidays 2021,

- Local Taxation Taxes Payments Government Holidays 2021,